FedBook Selfie Zero Balance Account

What is FedBook Selfie Zero Balance Account ?

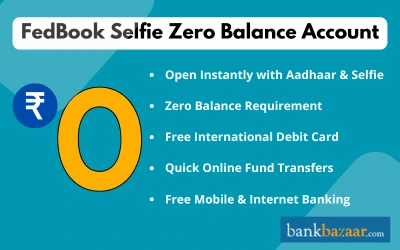

FedBook Selfie Zero Balance Account is a digital savings account from Federal Bank that can be opened easily through the FedBook app using a selfie and Aadhaar card. It requires no minimum balance and offers basic banking services.

Overview of FedBook Selfie Zero Balance Account

In the digital age, when everything can be accessed at the touch of a few buttons, Federal Bank brings a new offering. For the tech savvy generation of the country which relies on smartphones on a daily basis for all their needs, Federal Bank presents the FedBook Selfie Zero Balance Account.

Two unique features of this account are that, firstly this account can be easily opened via the FedBook app, and secondly, this is a Zero Balance Account. This implies that customers need not maintain any minimum balance in this account to ensure its continued activation.

Selfie is a savings bank account opening facility which will allow customers to open Federal Bank savings bank account on their own. Customers can submit their documents like Aadhar and PAN Card and a photograph via the highly secure FedBook app which also provides for online validation of KYC documents.

Upon completing the steps, customers will be immediately issued a real time account number which will be fully valid. Currently, the facility of the FedBook Selfie Account is offered to resident individuals who use Android or Apple smart phones.

Bank | Federal Bank |

Category | FedBook Selfie Zero Balance Account |

Minimum Balance Requirement | This is Zero Minimum Balance Account i.e. no minimum balance needs to be maintained to ensure continued account operation. |

Interest | Interest at the rate of 4% will be provided on this account which is calculated n a daily basis |

ATM/Debit Card | Visa EMV International Gold Debit Card. Issued Free of charge. |

Features of FedBook Selfie Zero Balance Account:

Account Statement | Customers will be provided with a monthly account statement via email, free of charge. |

Cheque book facility | Customers will be provided with a cheque book of 10 cheque leaves per year, free of charge. |

Electronic Fund Transfer | Customers can carry out quick electronic fund transfers via NEFT or RTGS. 4 fund transfers below Rs 50,000 in value are allowed each month. |

Internet Banking Facility | Customers can avail internet banking facility free of charge, for anytime access to their account and carrying out transactions. |

Fedmobile | Facility provided free of charge. |

FedBook | App can be downloaded free of charge. |

AWB Cash Deposit | Facility provided |

AWB Clearing / Collection / Transfer | Facility provided |

Collection of Outstation Cheques | Facility provided |

Initial Remittance | Customers can remit up to Rs 10,000 as one time initial remittance via NEFT / RTGS before account is activated. |

Email Alerts | Timely email alerts for all account transactions for ease of keeping track. |

Mobile Alerts | Customers will receive mobile alerts on their registered mobile number or all account transactions. |

Fees & Charges Associated With FedBook Selfie Account:

Charges for Non-maintenance of minimum balance | No charges levied |

ATM / Debit Card Issuance Charges | Federal Bank Debit cards do not carry any Issuance Fee |

Transaction Charges | Zero Transaction Charges |

ATM/Debit Card Annual Charges | Rs 300 + Tax applicable. |

RTGS / NEFT Charges | All charges levied towards NEFT / RTGS transactions up to the free limit which have been carried out via digital channels will be reversed. |

AWB Cash Deposit | Charges to be levied as per the service charge structure |

AWB Clearing / Collection Transfer | Charges to be levied as per the service charge structure |

Collection of Outstation Cheques | Charges to be levied as per the service charge structure |

Mobile Alerts | A charge of Rs 0.50 per SMS is chargeable. |

Documents Required To Open FedBook Selfie Zero Balance Account:

To open a FedBook Selfie Zero Balance Account, you will be required to download the FedBook app from the Google Playstore. Once the app is downloaded, you must select the branch which is most convenient for you. Further, you must scan your Aadhaar Card, PAN Card, take a photograph of yourself and submit all of these via the app.

Savings Account Pages

- Indian Holiday

- Internet Banking

- How to Activate SBI SMS/Mobile Banking for the First Time

- SBI Quick - Missed Call Banking

- Steps to Open Punjab National Bank Savings Account

- Documents Required to Open Bank of Baroda Savings Account

- Steps to Open HDFC Bank Savings Account

- Best Zero-Balance Savings Account For Indian Citizens

- Converting Salary Account to Savings Account

- SBI Salary Account

- SBI Savings Account For Minors

- BOB Immediate Payment Service (IMPS)

- SBI Basic Savings Bank Account

- Generating MPIN for Indian Overseas Bank Mobile Banking

- What is Inactive or Dormant Bank Account?

- Kotak 811

- HDFC Bank Salary Account

- Steps to Link Aadhaar card to Bank of Baroda Savings Account

- Union Bank of India Regular Savings Bank Account

- IRCTC eWallet

- Steps to Link Aadhaar Card to Bank of India Savings Account

- India's Top 5 Mobile Banking Apps

- PNB SMS Banking Services

- Steps to Link Aadhaar card to Central Bank of India Savings Account

- Steps to Open Axis Bank Savings Account

- Axis Bank Salary Accounts

- FedBook Selfie Zero Balance Account

Related Debit Card Pages

- Steps to Check Central Bank of India Account Balance

- Steps to change SBI registered mobile number

- MyDesign Image Debit Card

- Debit Cards For Fuel

- How to Activate Axis Bank ATM Debit Card PIN

- Steps to Block PNB Debit Card

- Debit Cards For Online Shopping

- Steps to Check Indian Bank Account Balance

- Kotak Mahindra Platinum Debit Card

- Debit Cards For Movie Tickets

- Steps to Block Central Bank of India ATM Debit Card

- HDFC Bank Rewards Debit Card

- Steps to Apply for a Canara Bank ATM Debit Card

- Central Bank of India Platinum Debit Card

- Priority Platinum Debit Card - Axis Bank

- SbiINTOUCH Tap & Go Debit Card

GST of 18% is applicable on all banking products and services from July 1, 2017 onwards.

FAQs on FedBook Selfie Zero Balance Account

- What is the age limit to open a FedBook Selfie Zero Balance Account?

In order to open a FedBook Selfie Zero Balance Account, the age limit must be 18 to 70 years.

- What documents are needed to open a FedBook Selfie Zero Balance Account?

To open the account, you need your PAN card, and Aadhaar card inked with your mobile number.

- Is it possible to open a FedBook Selfie Zero Balance Account without a PAN card?

Yes, you can open your account without a PAN card, but you need to submit Form 60 as a declaration in place of the PAN card.

- Can I do free NEFT/RTGS transactions from the FedBook Selfie Account?

Yes, you can do up to four free transactions (below Rs.50,000) per month.

- Is there a charge for using the FedBook app?

No, there is no charge for downloading or using the FedBook app.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.