Steps to Open Axis Bank Savings Account

For customers looking to open a savings account, opting for the variety of savings account options offered by Axis Bank could be the best way forward. The Axis Bank Savings Account comes with the benefit of relatively low average monthly balance, reward points for every transaction and the possibility of customising the account to suit one's financial needs.

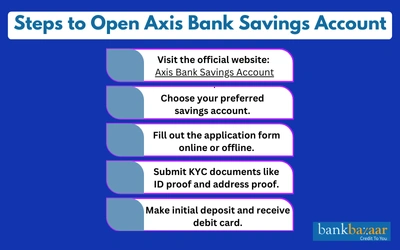

How to Open an Axis Bank Savings Account?

Online Process:

- Visit the Axis Bank website and go to the Savings Account section.

- Choose the suitable account type and click on “Apply Now.”

- Fill in personal details and upload the required documents.

- Submit the form for verification.

- Once approved, the account is activated and details are sent to your registered contact.

Offline Process:

- Visit your nearest Axis Bank branch and collect the account opening form.

- Fill in the form and attach KYC documents (ID proof, address proof, PAN, photos).

- Submit the form and make the initial deposit (if required).

- After verification, your account is activated. You'll receive a welcome kit with a debit card and cheque book.

Eligibility to Open Axis Bank Savings Account

Customers will have to meet certain criteria to be eligible for the savings account offered by Axis Bank.

- The individual applying for this savings account should be a citizen of India.

- The applicant should be 18 years and above to be eligible, except in cases of a minor savings account.

- The applicant will be required to submit valid KYC documents provings his/her identity and address along with the account opening form.

- Hindu undivided families are eligible.

- When opening the account, the applicant will have to make an initial deposit - depending on the minimum balance requirement of that particular savings account.

Features and Benefits of Axis Bank Savings Account

- Customers can choose between a number of savings accounts and choose one that suits their financial needs and goals.

- The average monthly balance requirement depends on the location the account is held in - urban, semi-urban or rural areas.

- Customers can also opt for a zero-balance savings account.

- On opening the account, customers are eligible for a free cheque book and passbook.

- Customers holding a savings account with Axis Bank can make withdrawals at any ATM across the country.

- Account holders can enjoy the convenience of free net banking and mobile banking and phone banking facilities.

- To keep a track of their finances, customers will receive free monthly e-statements.

- Interest is compounded quarterly.

- Through the net banking facility, account holders can carry out transactions anywhere in the world.

- Customers can carry out fund transfers through the NEFT and RTGS facilities.

Documents Required for Axis Bank Savings Account:

To be eligible to open any savings account with Axis Bank, customers will be required to submit the following documents.

For individuals:

- Two latest passport size photographs

- Proof of identity - Passport, Driving license, Voter's ID card, etc.

- Proof of address - Passport, Driving license, Voter's ID card, etc. If temporary address and permanent address are different, then both addresses will have to submitted.

- PAN card

- Form 16 (only if PAN card is not available)

For Hindu undivided families:

- Copy of PAN card

- Form 16 (only if PAN card is not available)

- Declaration form from Karta

- Proof of identification and address of Karta document

- Prescribed joint Hindu family letter that has been signed by the heads of the family

For joint applicants:

- Identity and address proof of both parties

- In case of a married couple, only the address of the primary account holder will be required

Savings Account Pages

- Savings Account vs Current Account

- How to Activate SBI SMS/Mobile Banking for the First Time

- SBI Quick - Missed Call Banking

- Steps to Open Punjab National Bank Savings Account

- Documents Required to Open Bank of Baroda Savings Account

- Steps to Open HDFC Bank Savings Account

- Best Zero-Balance Savings Account For Indian Citizens

- Converting Salary Account to Savings Account

- SBI Salary Account

- SBI Savings Account For Minors

- BOB Immediate Payment Service (IMPS)

- SBI Basic Savings Bank Account

- Generating MPIN for Indian Overseas Bank Mobile Banking

- What is Inactive or Dormant Bank Account?

- Kotak 811

- HDFC Bank Salary Account

- Steps to Link Aadhaar card to Bank of Baroda Savings Account

- Union Bank of India Regular Savings Bank Account

- IRCTC eWallet

- Steps to Link Aadhaar Card to Bank of India Savings Account

- India's Top 5 Mobile Banking Apps

- PNB SMS Banking Services

- Steps to Link Aadhaar card to Central Bank of India Savings Account

- Steps to Open Axis Bank Savings Account

- Axis Bank Salary Accounts

- FedBook Selfie Zero Balance Account

FAQs on Steps to Open Axis Bank Savings Account

- What is the minimum age to open an Axis Bank Savings Account?

You must be 18 years or above, except for minor accounts.

- Can I open an Axis Bank Savings Account online?

Yes, through the Axis Bank website by filling the form and uploading KYC documents.

- What documents are required?

ID proof, address proof, photos, PAN card, and Form 16 (if PAN is not available).

- Does Axis Bank offer zero-balance savings accounts?

Yes, along with other types that require a minimum balance.

- How long does account activation take?

After verification and deposit, the account is activated quickly with a welcome kit.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.