Personal Loan EMI Calculator - Check EMI, Interest & Tenure

Use the BankBazaar Personal Loan EMI Calculator to calculate your personal loan EMI. You just need to enter your preferred loan amount and tenure, interest rate, processing fee (if applicable), and click "Calculate" to see your equated monthly instalments.

The Personal Loan EMI Calculator helps you instantly estimate monthly EMIs based on loan amount, interest rate, and tenure. It provides an accurate repayment schedule, total interest payable, and quick comparisons across lenders. This tool simplifies planning, improves affordability checks, and supports faster, informed borrowing decisions.

How to Use a Personal Loan EMI Calculator Effectively

BankBazaar EMI Calculator – Calculate Your Personal Loan EMI Instantly

BankBazaar personal loan EMI Calculator is extremely easy to use and user-friendly. Put your preferred loan amount, interest rate, processing fee and tenure into the form. Click Calculate to see your estimated monthly payment. You can also view the details of your payment plan through an amortization chart.

The monthly payment for your personal loan depends on various factors, such as the loan amount, interest rates, and tenure. Calculate your monthly instalments beforehand so that you can budget your finances in a better manner.

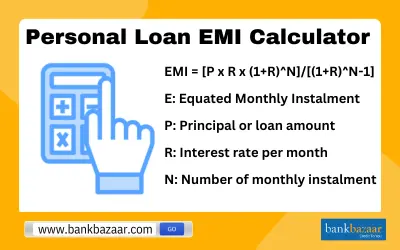

Formula Used for Personal Loan EMI Calculation

The mathematical formula for calculating EMIs is EMI = [P x R x (1+R)^N]/[(1+R)^N-1] where E: Equated Monthly Instalment,

P: Principal or loan amount,

R: Interest rate per month (the annual interest rate is divided by 12 to get the monthly interest rate), and

N: Number of monthly instalments or loan tenure in months.

Example:

Suppose Mr. X takes out a loan of Rs.15 lakh for a term of 5 years at an annual interest rate of 12%. To calculate the EMI, he would apply the above formula. While the calculation is somewhat complex, an online EMI calculator can provide the answer quickly.

In this case, Mr. X's monthly EMI would be Rs.33,367.

Benefits of using a Personal Loan EMI Calculator

Here’s some of the benefits of using a personal loan EMI calculator.

- Compare loans: Enter a fixed loan amount and tenure and vary the interest rate and processing fee depending on the rates fixed by the concerned bank. That’ll give you a holistic idea regarding total cost of your loan and based on that you can choose your personal loan product.

- Saves time: Calculating EMI takes less than a minute when you are using a calculator. Also, EMI calculators are extremely easy-to-use and 100% accurate.

- Choose your preferred loan tenure: Vary loan tenures and compare your EMI to see which one is better suited for your financial health. If you are okay with paying higher EMI and would like to close your loan early, go for a shorter tenure. Otherwise you can always opt for a longer tenure.

- Check your repayment schedule: BankBazaar’s personal loan EMI calculator also gives you a complete break-up of your repayment schedule. That way you will get an idea how much you’ll have to pay as interest and how much will be your principal outstanding.

- Verify EMI information: You can validate your repayment schedule as offered by the bank by using an EMI calculator. Other than that, with a calculator you can also calculate the processing fee that you have to pay upfront (usually deducted from the sanctioned amount).

Features of Personal Loan EMI Calculator

- Graphical Representation: Learn how much will be the principal amount and interest will be paid in each EMI. This information will be presented to you in the form of a pie chart.

- Repayment Table: The repayment table, illustrates details with regard to your loan repayment. It helps you understand how much you will have to shell out each month so that you can plan the rest of your expenditures accordingly.

EMI Calculation Results Explained

- EMI: Your monthly EMI which you have to pay to the lender to pay off your personal loan. Based on your loan EMI output you can check your personal loan eligibility in real time at BankBazaar.com.

- Break-up of your total amount payable: The EMI Calculator tool gives you the total personal loan amount payable to the lender. Your total loan amount payable is the sum of your loan amount (Principal), interest payable and processing fees. You can view this in the form of an amortization table that’s designed to give you a holistic view of your monthly/yearly repayment obligations.

What Factors Can Affect Your Personal Loan EMI?

- Loan Amount: The higher the loan amount, the higher the EMI payable. The maximum loan amount you can avail is decided by the lender based on your repayment capacity, relationship with the bank, and other factors.

- Rate of Interest: In this case, too, the rate of interest is directly proportional to the EMI. The higher the rate of interest, the higher the EMI. The bank will determine your loan’s interest rate based on a number of factors such as your Income, your credit history, repayment capacity, etc.

- Loan Tenure: The loan tenure you choose is inversely proportional to the EMI. The longer the tenure, the lower the EMI. However, with longer tenure you may end up paying more as interest. The loan tenure options usually range between 12 months and 84 months.

Understanding Monthly Interest Rates for Personal Loan EMI

When you approach a financial institution in order to take a personal loan, the main piece of information you are looking for is the interest rate that is being offered.

Once you know it, and before you start using it to calculate the EMI, you need to convert the rate into a monthly one since the interest rate is always presented as an annual rate. To do so, the following formula is used.

Monthly Interest Rate = Interest Rate/12

For Example, if the interest rate offered to you for your personal loan is 18% p.a., then your monthly interest rate will be calculated as follow:18/12 = 1.5

This means that the monthly rate of interest will be 1.5%.

How Personal Loan Restructuring Impacts EMI

In a new directive announced by the Reserve Bank of India (RBI), it was announced that banks can help restructure the personal loans of those borrowers who are finding difficult to repay the EMI on time due to the financial crunch caused by Covid19.

The bank can restructure the personal loan by lowering the rate of interest, rescheduling the payment of EMI, or allow the individual to avail a limited loan repayment holiday.

The restructuring window will be available till 31st December 2020. This will help the borrower gain more time to repay their loan. The loan account will not be deemed as a non-performing asset (NPA) and the credit score of the borrower will not have any negative impact.

However, borrowers who have been paying their EMIs regularly and were not overdue by more than 30 days as of 1st March, 2020 are eligible to avail the personal loan restructuring facility.

FAQs on Personal Loan EMI Calculator

- What does EMI mean?

EMI stands for Equated Monthly Installment. It is a fixed monthly payment made by a borrower to a lender on a set date each month.

- How to Calculate the Lowest EMI on Your Personal Loan?

In order to calculate lowest EMI, you need to consider your preferred loan amount, the lowest rate offered by the concerned bank, and the maximum tenure. Enter these details while calculating and you will get the lowest EMI applicable on your loan.

- Can I pay my EMI in one go?

If you are referring to prepayment or foreclosure, yes you can do that. However, different banks have different conditions for personal loan prepayment. For instance, HDFC allows you to prepay only if you have completed 12 EMIs.

- What Happens If You Fail to Pay Your EMI?

It’s always advised to pay your EMIs on time. Most banks charge a penalty fee of 2% on your EMI if you fail to make repayments. Also, any missed payment will hurt your credit score and may jeopardise your chances of getting a loan in the future. Use a personal loan EMI calculator and calculate your EMI beforehand to avoid any financial stress.

- What is the formula for EMI in Excel?

You can check the EMI in Excel by using the formula PMT. For example, if you avail a loan of Rs.5 lakh at an interest rate of 12% for a tenure of 48 months, then the formula will be (500000x48x0.01). Here 0.01 will be the rate of interest will be 12% divided by 12 which will yield 0.01%. On using the formula, the result yielded will be the EMI payable.

- What is the EMI for a ₹3 lakh personal loan?

The EMI payable will depend on factors such as the tenure and interest rate charged, hence the EMI for a loan amount will differ from bank to bank. For example, if you avail a loan of Rs.3 lakh for a tenure of 1 year where the rate of interest rate charged is 10%, then the EMI payable will be Rs.26,375.

- How much EMI can I get for ₹5 lakh?

The EMI payable for a loan of Rs.5 lakh will differ from bank to bank and will depend on the tenure and interest rate charged. For example, if you avail a loan of Rs.5 lakh for a tenure of 1 year with an interest rate of 10% being charged, then the EMI payable will be Rs.43,958.

- What is the EMI a ₹20 lakh personal loan?

For example, if you avail a loan of Rs.20 lakh for a tenure of 5 years where the interest rate charged is around 10%, then the EMI will be Rs.42,494. However, you must understand that the EMI payable will depend from bank to bank and hence you must properly compare the various personal loan schemes to know the one most suitable for you.

- Is collateral necessary for personal loans?

No, personal loans are unsecured, meaning that no collateral is required.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.