Duplicate PAN Card - How to Apply Online/Offline

What is a Duplicate PAN Card?

A duplicate PAN Card is an official document issued by the Income Tax Department to a PAN holder in case the original card is lost, misplaced, or damaged.

People often accidentally put their important documents at risk, which can make them worry about how to get them back. The Income Tax Department has made it easy to get a duplicate PAN Card. Let’s understand the process.

How to Apply for a Duplicate PAN Card Online?

Obtaining a duplicate PAN Card is a very easy and simple process. Visit the official website of NSDL or UTIITSL or apply it in paper form. The process involves filling out an online application for a duplicate PAN Card, saving lots of time.

Through the NSDL (Protean) Website

Following are the steps to apply for duplicate PAN Card online.

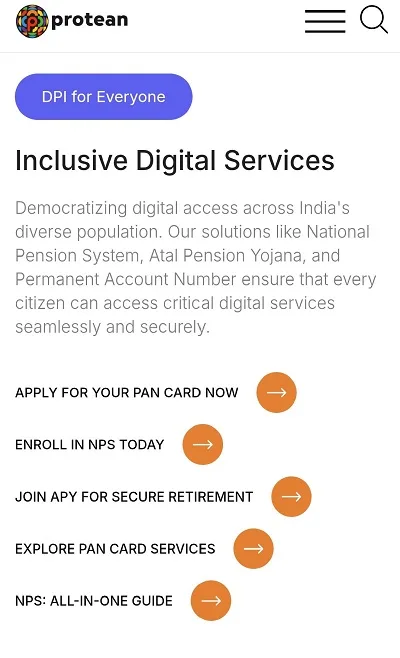

Step 1 - Visit Official Website of NSDL (Protean) .

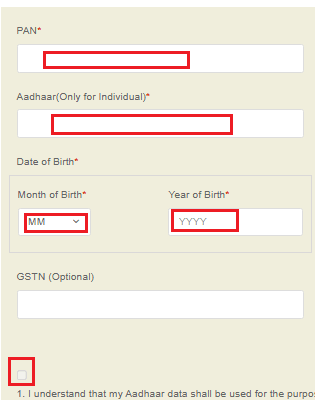

Step 2 - Enter your PAN Number, Aadhar number and Date of birth. Optionally GSTIN number.

Step 3 - Carefully read the declaration and Check the box to proceed.

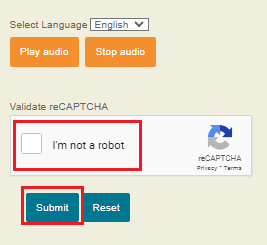

Step 4 - Enter the mentioned Captcha Code for verification.

Step 5 - Click on the 'Submit' button.

Step 6 - A new page will display your PAN Card details.

Step 7 - Scroll down and choose the options to receive an OTP on Email ID, Mobile Number, or both.

Step 8 - Click on 'Generate OTP.'

Step 9 - Enter the OTP received and click on the 'Validate' button.

Step 10 - Your request to reprint the PAN Card will be submitted to the NSDL (now Protean) department.

Through UTIITSL Website

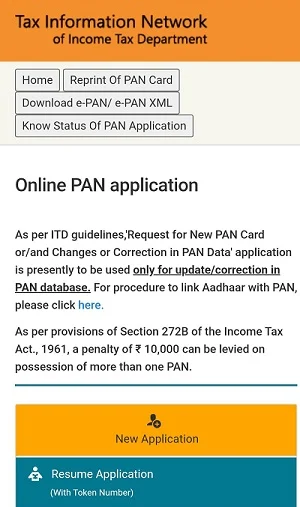

Step 1 : Go to the official website of UTIITSL.

Step 2 : Click on “Reprint of PAN”.

Step 3 : Enter your PAN Card number, Aadhaar number, date of birth, and other required details, then submit the form.

Step 4 : Verify the details and click on the option ’Get OTP’.

Step 5 : Fill in the OTP and complete the payment online.

Step 6 : Once you make the payment, you can download the receipt for future reference.

How to Apply for a Duplicate PAN Card Offline?

Follow the steps reprint PAN Card physically

Step 1 - Download and print the 'Request for new PAN Card or/and changes or Correction in PAN Data' form.

Step 2 - Use Black ink and write in BLOCK letters while filling out the application for a PAN Card.

Step 3 - Provide your 10-digit PAN for reference.

Step 4 - If you are an individual applicant, attach two passport-sized photographs and cross-sign them carefully. Ensure that your face is not covered while signing.

Step 5 - Fill in all the required details in the form and sign the relevant boxes.

Step 6 - Send the completed application to the nearest NSDL facilitation centre along with the payment, proof of address, proof of identity, and proof of PAN. After receiving the payment, the facilitation centre will generate a printed acknowledgement form with a 15-digit number.

Step 7 - The facilitation centre will then forward your application for further processing to the Income-tax PAN services unit.

Step 8 - You can check the status of your reprint PAN Card by using the 15-digit acknowledgement number.

Step 9 - The reprint PAN Card will be dispatched within two weeks after the concerned department receives your application.

Download Application Form for Duplicate PAN Card

Click Here to >> Download Application Form For Duplicate PAN Card

Steps to Apply for Duplicate PAN Card Without Changes

If you want to request a duplicate PAN Card, without any changes to your PAN details and without the need of documents then you can follow the steps given below:

1. Go to the official website of Protean.

2. Scroll down and click on ‘Re-print PAN Card’ under ‘PAN Services links’.

3. Fill in the details such as PAN number, Aadhaar number, date of birth and agree to the declaration.

4. Pay the required fees and an 15-digit acknowledgement number will be generated.

5. You can track the status of your duplicate PAN by using the acknowledgement number.

Documents Required For Duplicate PAN Card

Given below is the list of documents

- Self-attested identity proof such as Aadhaar, driving license, voter ID, etc.

- Self-attested address proof such as Aadhaar, bank account statements, utility bills, etc..

- Self-attested document mentioning the date of your birth such as Passport, matriculation certificate, certificate of birth, etc.

- PAN allotment letter or a self-attested copy of PAN Card.

Fees for Applying for a Duplicate PAN Card

Mode of Application Submission | Mode of Dispatch of PAN Card | Fees (Including GST) |

Offline or Online (Physical Mode) | Physical PAN Card in India | ₹107 |

Offline or Online (Physical Mode) | Physical PAN Card outside India | ₹1,017 |

Online (Paperless Mode) | Physical PAN Card in India | ₹101 |

₹1,011 | ||

Reprint of PAN Card | Physical PAN Card in India | ₹50 |

₹959 | ||

Offline or Online (Physical Mode) | e-PAN Card to the email ID | ₹72 |

Online (Paperless Mode) | e-PAN Card to the email ID | ₹66 |

When Do You Need to Apply for a Duplicate PAN Card?

You may need to apply for a reprint PAN Card in the following situations:

- ✅ Loss or Theft: Losing your PAN Card is a common occurrence, especially when your wallet or purse is stolen.

- ✅ Misplacement: There are instances where people misplace their PAN Card, leading to uncertainty about its whereabouts.

- ✅ Damage: If your existing PAN Card gets damaged, the only solution is to apply for a reprint of the card.

- ✅ Change in Information: When the information and signature on your PAN Card need updating, you must apply for a duplicate PAN Card with the revised details.

Who is Eligible for a Duplicate PAN Card?

Various types of taxpayers exist in India, including Individuals, Hindu Undivided Families (HUFs), and Companies. However, it's important to note that while individuals can file their own PAN Card application, taxpayers other than individuals, such as HUFs and Companies, must designate an authorized signatory to submit the application. The authorized signatories can include

Taxpayer Category | Authorized Signatory |

Individual | Self |

HUF | Karta of the HUF |

Company | Any Director of the company |

Firm/ Limited Liability Partnership (LLP) | Any Partner of the firm or LLP |

AOPs or Body of Individuals or Local Authority or Artificial Juridical Person | Authorised signatory as mentioned in the incorporations deed of the several taxpayers |

How to Download a Duplicate PAN Card?

Step 1- Visit the official NSDL or UTIITSL website.

Step 2 - Navigate to the "Reprint of PAN Card" section.

Step 3 - Enter required details such as PAN number and Aadhaar.

Step 4 - Verify using OTP.

Step 5 - Pay the applicable fee.

Step 6- Download e-PAN Card in PDF format.

How to Track the Status of a Duplicate PAN Card?

You can track the status of your duplicate PAN Card by following the steps given below:

- Visit the official website of the TIN-NSDL website.

- From the tab 'Application Type', select the option 'PAN-New/Change Request'

- Fill in the confirmation number and security code.

- Click on submit to check the status of your PAN Card application.

How to Surrender a Duplicate PAN Card?

It is not permissible by law to have two PAN Cards with two different PAN numbers; hence you will be needed to submit any one of them. You can surrender one of your Pan cards by following the steps given below:

Step 1 - Write a letter to your assessing officer requesting the surrender of your PAN Card. Make sure you provide the necessary details of both your PAN Cards.

Step 2 - You will have to clearly mention the PAN Card you want to submit and the one you wish to retain.

Step 3 - You will have to hand over the letter to your assessing officer who will give you an acknowledgement number in return which will be the proof that the PAN Card surrendered by you is cancelled.

Some Important Points to Remember About Duplicate PAN Card

- ✅ If your PAN Card is lost due to theft, it is necessary to file a First Information Report (FIR) at a police station that is nearest to you. Include a copy of the FIR with your duplicate PAN Card application documents.

- ✅ When sending the acknowledgement of your PAN application by registered post, make sure that you mention 'Acknowledgement No. – (*************) – Application for changes or correction in PAN data or Application for Reprint of PAN' on the front of the envelope.

- ✅ The application fee for a PAN Card is ₹1,020 for non-resident individuals and ₹110 for resident individuals.

Video Guide - Applying for a Duplicate PAN Card

Related Articles on PAN Card

1. How to Apply for Instant e PAN through Aadhar Number

2. How to Link PAN Card with Aadhar

6. What is the Penalty for Multiple PAN Card

How to Apply for Other Duplicate Documents

Fqs on Applying for a Duplicate PAN Card

- How much do I need to pay for the reprint of the PAN Card?

The amount needed to be paid for the reprint and dispatch of PAN Card within the country is₹50 including GST, while for reprint and dispatch of PAN Card outside the country the fee payable is ₹959.

- How to find the owner of a lost PAN Card?

The best thing to do if you find a lost PAN Card is to hand it over to the police station or at the nearest TIN facilitation centre. Submitting it at the TIN facilitation centre will most probably lead to it being returned to the owner as the officials can check the database and find the address of the person to which the PAN Card belongs.

- How long does it take to receive a duplicate PAN card after applying? answer in one line

An e-PAN is typically sent to your email within hours, while a physical duplicate PAN Card is usually delivered within 15-20 working days.

- If I lose my PAN Card, will I have to file an FIR at the nearest police station?

Yes, you will have to obtain a copy of the FIR stating the loss of your PAN Card. It will be proof that you have lost your PAN Card and will help you with the process of applying for a duplicate card.

- What is the process to find out my PAN Card number if I have lost my PAN Card?

To retrieve your Permanent Account Number (PAN) after losing your card, you can visit official website of Income Tax Department in 'Know Your PAN'. Then fill in the required details and click on 'Submit'. Enter the One-Time Password (OTP) sent to your mobile number and click on 'Validate'. Finally, your PAN number, name, and jurisdiction will be displayed on the screen.

- Will I have to link my Aadhaar again after getting my duplicate PAN Card?

If your PAN number has not changed, then you will not be required to link your Aadhaar with your PAN.

- I have lost my PAN Card and I also forgot my PAN number. The PAN number is of a HUF. I do not have its date of incorporation. How do I get a duplicate PAN card?

It would be better if you get in touch with the NSDL officials as they may be better suited to help you regarding the matter. You can call them on 020 - 27218080 on all days between 7:00 a.m. to 11:00 p.m.

- Can someone use my lost PAN Card?

No. However, it is better to file a complaint with the police if the card is lost. This comes in handy in case some unforeseen situations arise in the future.

- Do I need to pay if I request a reprint of my lost PAN Card?

Yes, you need to pay to request a reprint of your lost PAN Card.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.