How to Surrender a PAN Card - Know the Process

Each taxpayer is given a unique 10-digit alphanumeric number known as their PAN (Permanent Account Number). However, a person is only allowed to have one PAN in their lifetime. Having more than one PAN Card is prohibited by the government. There is a process for surrendering or cancelling the PAN Card in such situations.

Reasons for PAN Card Surrender

The process for surrendering your PAN Card depending on the reason for it is listed below.

- The individual is relocating outside of India permanently.

- An individual has been mistakenly issued two PAN Cards by the Income Tax Department

- There are issues with the person's present PAN Card.

- In case a person passes away, their surviving family members may request that the Income Tax Department remove their PAN Card.

- The approved persons may request that the PAN Card of a company, limited-access partnership, or partnership to be cancelled in the event of its dissolution.

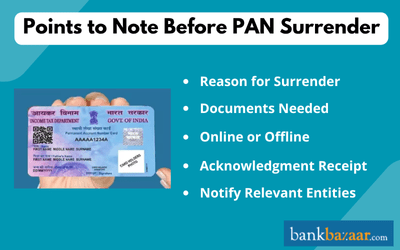

Things to Remember Before Surrendering Your PAN Card

Before surrendering your PAN Card, you must remember the steps given below

- Reason for Surrender: Give a clear explanation for your PAN Card surrender (e.g., multiple cards, cardholder death, business dissolution)

- Documents Needed: Make sure you have every necessary document, including your date of birth, proof of identity, the PAN Card that needs to be given, and any other supporting documentation.

- Online or Offline: Depending on your convenience, choose whether to process the surrender online or offline.

- Acknowledgment Receipt: When submitting offline, make sure to always obtain an acknowledgement receipt.

- Notify Relevant Entities: Notify banks and other financial institutions of the cancelation after turning in the PAN Card.

How to Surrender a PAN Card - Online?

- Step 1 - Visit the Official website of the NSDL.

- Step 2 - Choose the category and click on the Changes or Correction in existing PAN data/Reprint of PAN Card application.

- Step 3 - Complete the necessary details with correct information and submit it.

- Step 4 - A unique token number will be sent to the email address you provided on the PAN Card correction form after the form has been submitted, and a modification request has been submitted. For future use, save the token number .

- Step 5 - Select PAN Application Form and Continue.

- Step 6 - Choose the document submission method on the new page. After completing the necessary personal information, click Next .

- Step 7 - Click the Next button after selecting the check box in the left margin under the contact information in the PAN Card correction form and adding any more PANs you wish to cancel or surrender.

- Step 8 - Choose and upload your proof of identity, birthdate, place of residence, and a copy of your other PAN, then click "Submit." Verify that you wish to update these details.

- Step 9 - Complete and submit the declaration.

- Step 10 - If the PAN Card to be brought in is issued in the name of a business or partnership entity, the PAN Card form needs to be signed by an authorized signatory.

- Step 11 - The payment page will be displayed. Payment options include demand drafts, credit/debit cards, and online banking.

- Step 12 - Upon successful payment, an acknowledgement slip will be produced.

How to Surrender PAN Card - Offline?

Method -1

- Step 1 - Fill out the form titled Request for New PAN Card Or/And Changes or Correction in PAN Data from the Income Tax Department website.

- Step 2 - Mention the PAN number you wish to submit under item number 11 of the form.

- Step 3 - Fill out the application form and submit it along with supporting documents and the PAN Card that you are surrendering at the nearest PAN Card centre.

Method- 2

It is possible to surrender a PAN Card by writing a surrender letter to the Rea’s immediate assessing officer. The letter must include all relevant details regarding the PAN Card holder, such as name, address, PAN Card details, and the reason for surrendering. An acknowledgement letter will be sent to you by the Income Tax Department as proof that the PAN is cancelled.

- An acknowledgement slip will be sent to you after the form and supporting documentation have been submitted.

How to Surrender a PAN Card Due to the Death of Individual Holder?

In the event of the demise of the PAN Card holder, a letter addressed to the Income Tax Officer for that jurisdiction is to be written by the relatives of the deceased. The letter should mention the reason for the surrender (demise of the holder) as well as a copy of the deceased's death certificate. The letter should also mention the PAN details such as PAN number, name, and date of birth.

This procedure can be used to surrender a PAN Card upon the death of Indian residents, NRIs (Non-Resident Indians) as well as foreign nationals.

Surrender of PAN Card for Firm/Partnership/Company

Online Process

- Step 1 - Visit the website of the NSDL.

- Step 2 - Choose the application for Changes or Correction in existing PAN data/Reprint of PAN Card and provide the necessary information

- Step 3 - Under the Mention of any Permanent Account Numbers (PANs), if any mistakenly allotted to you, enter the information for the PAN number that must be cancelled .

- Step 4 - Fill out the form and pay the required fee.

- Step 5 - Print the acknowledgement and send it to the Income Tax PAN Services Unit in Pune, together with all of the necessary documents, the dissolution deed, a copy of the PAN Card that needs to be turned in, and a cover letter.

Offline Process

- Draft a letter to the income tax officer that the business or firm was reporting taxes under.

- Mention in the letter that the PAN Card must be turned in since the corporation or firm is dissolved.

- Cover the necessary documents, including the dissolution deed and a copy of the PAN Card that needs to be given with the letter.

- Submit the income tax officer with the letter and supporting documentation, then get an acknowledgement.

Consequences of Not Surrendering PAN Card

If you have not surrendered your PAN Card, you must face the following consequences:

- Penalties: According to Section 272B of the Income Tax Act, a ₹10,000 penalty for possessing multiple PAN Cards is provided

- Tax Confusion: Having several PAN Cards may cause confusion for the tax authorities and result in incorrect tax returns.

- Fraud Risk: If a PAN Card is not returned, it may be used illegally to open bank accounts or apply for loans in someone else's name.

Related Contents on PAN Card

FAQs on PAN Card Surrender

- Is it possible to surrender my PAN Card online?

Yes, by completing the Changes or corrections in existing PAN data/Reprint of PAN Card application on the NSDL website, you can turn in your PAN Card online.

- How long would it take for the PAN Card to be deactivated?

The PAN Card cancellation process may take ten to fifteen days to complete after the form is submitted. The person will get a confirmation message once the PAN cancellation form is accepted.

- Is it required to turn in your PAN Card when you pass away?

Note that there is no law or regulation requiring the PAN Card of the deceased to be cancelled or deactivated. To avoid the PAN from being exploited, the IT Department advises giving up a deceased person's identity, though.

- Can I receive a PAN refund?

You are eligible for a complete refund for your PAN Card application if the demographic authenticity verification process is unsuccessful. Demographic authentication functions similarly to an Aadhaar fact-check.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.