Apply for a PAN Card Online

Key Highlights -

- For New PAN Card application Aadhar is mandate.

- Also, for the Instant E-PAN facility, no documentation is required; only Aadhar authentication and OTP verification are required.

PAN or Permanent Account Number is an important document that is required to carry out certain tasks. Given this, it is necessary to have a card that contains a unique 10-digit alphanumeric code, which is issued by the Income Tax Department.

How to Apply for a PAN Card Online?

Applying for a PAN Card online is a very simple process facilitated by the (NSDL) website or the (UTIITSL) website. Both platforms have received explicit authorization from the Government of India to issue PAN Cards and handle necessary changes or corrections on behalf of the Income Tax Department.

How to Apply for a PAN Card Online via the NSDL Website?

Follow the steps mentioned below, fill in the necessary details, and upload the required documents on the NSDL website.

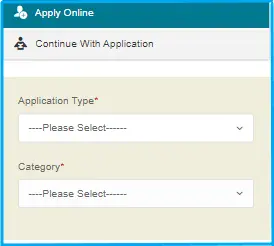

Step1 - Visit the NSDL website then Click on Apply Online section.

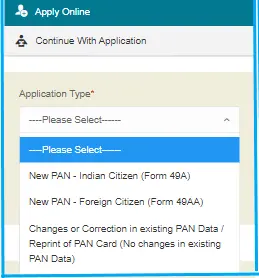

Step 2 - Select your application type: Indian Citizens, Foreign Citizens, or Changes or Correction in PAN/ in existing PAN Data .

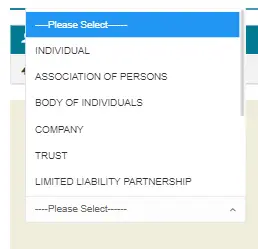

Step 3 - Select your Category. The options are: Individual, Association of Persons, Body of Individuals, Trust, Limited Liability Partnerships, Firm, Government, Hindu Undivided Family, Artificial Judicial Person, and Local Authority.

Step 4 - Fill in the Title, Last name/surname, First name, Middle Name, Date of Birth/Incorporation/Formation in DD/MM/YYYY format, email ID, mobile number, and Captcha code. Submit the form.

Step 5 - On the next page you will receive an acknowledgement with a token number on your email ID. Click on 'Continue with PAN Application Form' on this page.

Step 6 - You will be redirected to the next page where you have to submit your digital-KYC.

Step 7 - Select how you want to submit the documents. You can: a) Forward application documents physically; b) Submit digitally through digital signature; c) Submit digitally through e-sign.

Step 8 - On the same page, indicate what documents you are submitting as proof of identity, address, and date of birth. Confirm the declaration, place and date of application. Review and submit the form. Make sure you make no mistakes.

Step 9 - Click on 'Proceed' and you will be taken to the payment options. You can use debit/credit card, net banking or demand draft

Step 10 - You will receive an acknowledgment receipt and payment receipt. Print the acknowledgment receipt. You can check your application status using this receipt.

NOTE: Do not staple or clip the photos. Ensure that you sign across the photo that you attach on the left side of the receipt. Do not sign the photo on the right. Ensure that your signature is within the box provided. If you use your left thumb impression, ensure that it is attested by a gazetted officer or a notary.

How to Apply for a PAN Card Online via UTIITSL Website?

The steps to apply PAN Card online on the UTIITSL website are as follows:

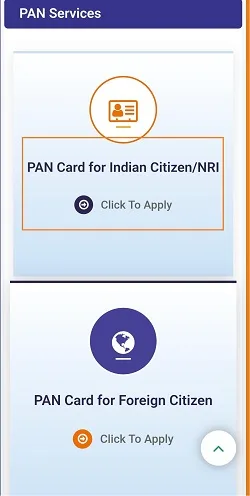

Step 1 - Visit the official website of UTIITSL.

Step 2 - Click on the PAN Card for Indian citizen/NRI.

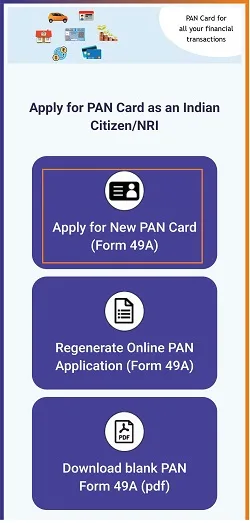

Step 3 - Select the Apply for new ‘PAN Card Form 49A ’, regardless of whether you are an Indian citizen, NRE/NRI, or OCI.

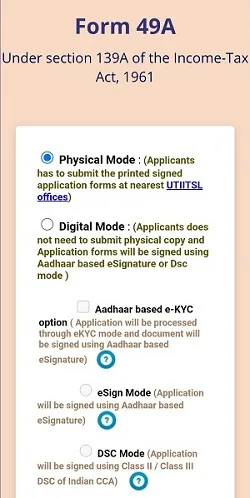

Step 4 - In Form 49A you have two options Digital mode and physical mode.

Step 5- After Selecting the Digital Mode , Fill the all information, such as, personal details, contact details, documents etc.

Step 6 - Pay the required fee using debit/credit card, net banking or via a demand draft.

Step 7 - An acknowledgement slip will be displayed on the screen and send to your registered email Id.

Important Note : If you select the Physical Mode option, just print the PAN Card form, attach your photo, signature, and required documents, and send them to the UTIITSL office.

PAN PDC Incharge - Mumbai region,

UTI Infrastructure Technology And Services Limited,

Plot No. 3, Sector 11, CBD Belapur,

Navi Mumbai - 400614

How to Apply for a PAN Card Through Income-Tax Portal

Individuals can apply for PAN Card Online through the Income Tax Portal (Instant-E PAN) . To check step by step procedure Click Here

Fees to Apply for a PAN Card Online

Apart from applying for a PAN Card, you can also make corrections, changes, or request a PAN Card reprint online. You can visit the official website of UTIITSL or Protean e-Gov Technologies Limited (formerly NSDL).

The fee for PAN application through physical mode of document submission is ₹107. Application submitted online through paperless mode costs₹101.

Documents Required to Apply for a PAN Card

Proof of Date of Birth

One of the below-mentioned documents may be submitted as proof of date of birth:

- An affidavit sworn before a magistrate stating the date of birth.

- The marriage certificate that has been issued by the Registrar of Marriages.

- Pension payment order.

- Any photo identity card that has been issued by the State Government or Central Government.

- Bank certificate with an attested photograph of the applicant with the account number.

- Any photo identity card that has been issued by a State Public Sector Undertaking or Central Public Sector Undertaking.

- Birth certificate that has been issued by the municipal authority.

- Mark sheet or Matriculation certificate that has been provided by a recognized board.

- Passport.

- Driving License.

- Elector’s photo identity card.

- The Aadhaar Card that has been issued by the UIDAI.

Proof of Address

Photo copy of any one of these documents | Elector’s photo identity card, Aadhaar card, Passport, Driving licence |

Photo copy of these documents (not over three months) | Landline bill, Electricity bill, Gas connection card, Water bill, Depository account statement |

Original documents | Certificate of address |

Proof of Identity

Photo copy of any one document | Aadhaar card, Passport, Voter Id, Driving licence, Ration card |

Originals | Certificate of identity |

Read More About

- How to apply Instant e PAN Card Through Aadhaar

- PAN 2.0 - Features, Benefits, and Updates

- Download E-PAN Card Online

- How to Link PAN Card with Aadhaar Card?

- Duplicate PAN Card

- How to Link PAN Card with Bank Account

- How to Activate a Deactivated PAN Card After Missing Deadline

- PAN Card Application Status through NSDL& UTIITSL

- Simple Process to an Download E-PAN Card Online

- Apply for child PAN Card

- What is the Penalty for Multiple PANs

- PAN Card for HRA ExemptionPan for HRA Exemption

- How to Change Photo and Signature on your PAN Card

- How to Activate a Deactivated PAN Card?

FAQs on How to Apply for PAN Card Online

- What are the documents required for the online application of PAN Card?

To apply for a PAN Card online, you will need identity proof (Aadhaar card, Voter ID, passport, ration card, etc.) address proof (Aadhaar card, post office passbook, passport, etc.) and proof of date of birth.

- Can I apply for PAN offline?

Yes, you can apply for PAN offline by download Form 49A from either NSDL/UTIITL website or requesting for one from an official from UTIITSL. Fill in the form and submit it along with all the necessary documents at your nearest UTIITSL or NSDL office and pay the application fee.

- Can I Download a PAN Card Online?

Yes, you can download PAN Card online by visiting the official website of e-filling -portal, NSDL and UTIITSL.

- How to check PAN Card Online?

You can check for a PAN Card online through the NSDL e-Gov or UTIITSL website by filling out the form, uploading documents, and making the payment.

- Is online PAN Card valid?

Yes, an e-PAN Card is valid.

- How long will it take for me to get my PAN Card after submitting my application?

Nowadays, it only takes 2 days after the submission of the application to get your PAN Card .If you are applying through the Income Tax Department’s instant PAN facility.

- Can I apply for my PAN Card online through my mobile?

Yes, you can apply for your PAN Card online through your mobile.

- Can I have more than one PAN Card?

You cannot have more than one PAN Card as it is against the law. In case you have more than one PAN Card, you will have to get in touch with the concerned authorities and get any one of the accounts closed.

- Are there any charges I will be required to pay while applying for a PAN Card?

Yes, you will have to make a payment of ₹107 while applying for a PAN Card if you are a resident of India. If your PAN Card is to be dispatched outside India then you will have to make a payment of ₹1017.

- I do not have an Aadhaar card. Can I still apply for a PAN Card online?

No, without an Aadhaar card, you cannot apply for a PAN card. An Aadhaar card is mandatory to get a PAN Card.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.