How to Check PAN Card Application Status on Protean And UTIITSL Portal

Checking your PAN Card status is a simple process. Whether you have applied for a PAN Card online or offline, you can easily track your PAN application status online using the 15-digit acknowledgment number. Simply visit the official Protean (NSDL) PAN portal or the UTIITSL website to check your PAN or UTI PAN status.

Here are the various ways you can easily check your PAN Card Status.

How to Check Your PAN Card Status on the UTIITSL Website

Below are the steps to check the UTI PAN Card Status

Step 1 - Visit the UTIITSL website.

Step 2 - Click the ‘Track PAN Card’.

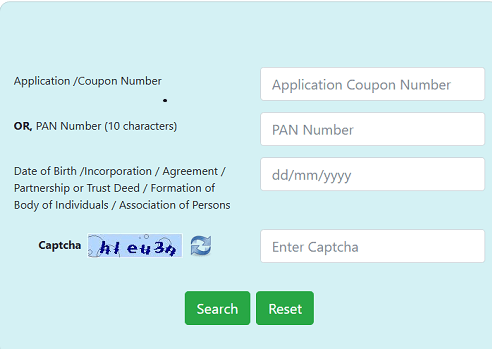

Step 3 - Enter your 'PAN number' or 'application coupon number' and date of birth

Step 4 - Enter the 'captcha code'.

Step 5 - Click on the 'Submit' button.

Step 6 - The status of the PAN application is displayed on the corresponding screen.

Check PAN Card Status Using PAN or Coupon Number

To check UTI PAN Card application status , applicants need to follow the instructions mentioned below:

Step 1 - Visit UTIITSL

Step 2 - Enter 'PAN number' or 'application coupon number'.

Step 3 - Enter 'date of birth'.

Step 4 - Enter the 'captcha code'.

Step 5 - Click on the 'Submit' button.

Step 6 - The status of the PAN application is displayed on the corresponding screen.

How to Check PAN Card Status on the Protean Website(formerly NSDL)?

The process to follow the PAN Card status on the official website of Protean is mentioned below

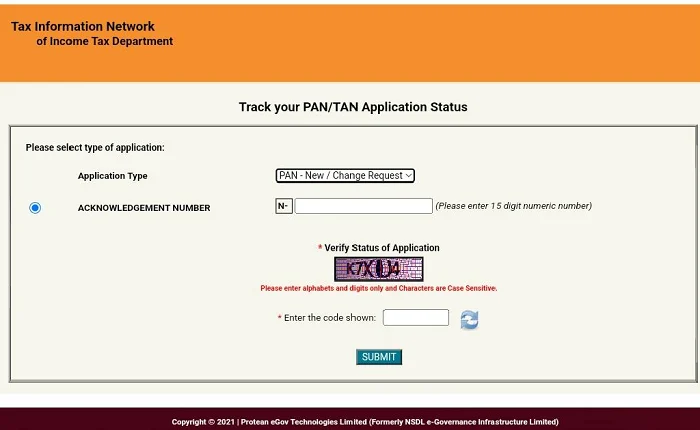

Step 1 - Visit Protean website

Step 2 - Select your 'Application Type' and click on 'PAN- New/Change Request'.

Step 3 - Enter your 15-digit acknowledgement number.

Step 4 - To verify the status, please enter the code.

Step 5 - Click on the 'Submit' Button.

Note: Online Tracking of a PAN Card application can be carried out by an individual only after 24 hours of filing the application.

Steps to Check PAN Card Status without an Acknowledgement Number

To check the status of your PAN Card without the acknowledgement number, you can follow these simple steps:

Step 1 - Visit the official website of Protean

Step 2 - Click on ‘Track your PAN or TAN Application Status’ option.

Step 3 - From the ‘Application Type’ section, select ‘PAN-New or Change Request’ option.

Step 4 - Enter the captcha code, to verify status of PAN Card application.

Step 5 - To view your NSDL PAN Card Status on your screen, click on ‘Submit’ option.

Steps to Know PAN Card Status with an Acknowledgement Number

When you apply for a PAN Card on the Protean website, you can check the application status using the acknowledgment number by selecting the application type. Similarly, if you applied on the UTIITSL website, you can check the PAN Card application status on their website using the acknowledgment number.

Check PAN Card Status by Name and DOB

The process to check the PAN Card status by using the name and date of birth is given below:

Step 1 - Visit Official Link.

Step 2 - Choose the 'Application Type' as 'PAN - New/Change Request'.

Step 3 - Select 'Name'.

Step 4 - Enter your first surname, first name, and middle.

Step 5 - Enter the date of birth.

Step 6 - Click on 'Submit' to check the status of the PAN.

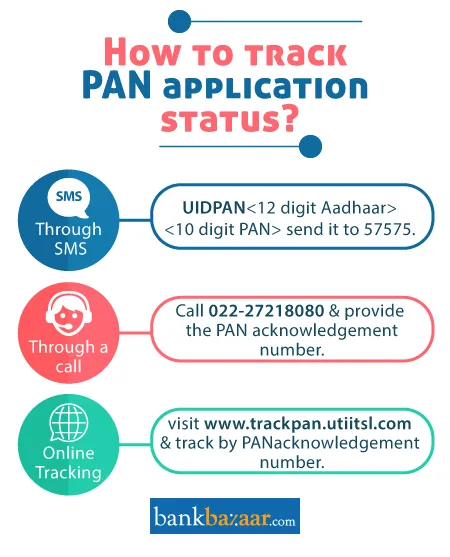

Other Ways to Track PAN Card Application Status

The applicant can track the status of his or her PAN application using the number. Apart from visiting the official website of Protean e-Gov Technologies Limited and UTIITSL and tracking the status of the PAN application, applicants can also do so by using the modes mentioned below:

- Telephone call

- SMS facility

Track PAN Card Status Through a Telephone Call

This is the First way to check the status of your pan card via call

Step 1 - Dial 020-27218080.

Step 2 - Enter the 15-digit Acknowledgement Number.

Step 3 - You will be able to know the status of your PAN.

Track PAN Card Status Through SMS

This is the second way to check the status of your pan card by sms service.

- You can check the status of your PAN Card Application three days after the submission of the PAN Card application form.

- You can check the status by sending an SMS 'NSDLPAN 15-digit acknowledgement number' to 57575.

The process to check the PAN Card status via WhatsApp is given below

- Sent a ‘Hi’ message to 8096078080 on WhatsApp.

- Next, choose ‘Yes’ to provide consent to receive SMS or emails from Protean.

- Choose ‘Services’.

- Choose ‘Status of Application’.

- Next, select ‘PAN Application’.

- Enter the acknowledgement number. The status will be displayed.

How to Check e-PAN Card Status Using Aadhaar Number?

Please follow these steps

Step 1 - Visit the official website of Income Tax e-filing.

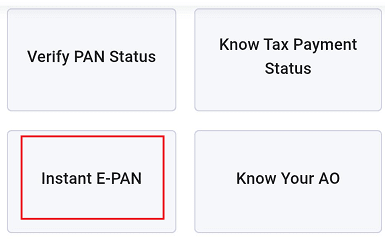

Step 2 - Click on 'Quick Links' Section and Select ‘Instant E-PAN' option.

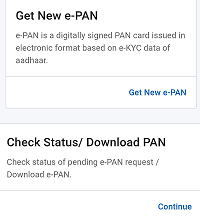

Step 3 - Click on the ‘Continue’ button, under the ‘Check Status or Download PAN’ option.

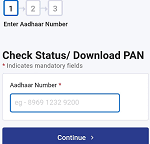

Step 4 - Click on ‘Continue’, after entering the 12-digit Aadhar number.

Step 5 - Click on ‘Continue’, after entering the OTP on your registered number.

Step 6 - The e -filling PAN Card status will be displayed on the screen.

Read More - Instant e PAN status through aadhaar number

Note:

Digital PAN can be availed through the Income Tax website without paying any charges.

Mobile must be registered with an Aadhar card for verification through OTP (One Time Password).

Check PAN Card Payment Status

Apart from knowing the status of the PAN Card application, applicants can also know the PAN transaction status.

Applicants who apply with the applicable fees for availing a PAN through internet banking, credit card or debit card, can track the status of the transaction by following the procedure listed below:

Step 1 - Visit Protean Website.

Step 2 - Select 'PAN' under the 'Services' tab. and Click 'Apply Now'.

Step 3 - Click on 'Know Status of your application transaction online.

Step 4 - Next, provide the transaction number that is displayed on the 'Payment through Credit card/Debit card/Net banking' screens or the 15-digit acknowledgment number.

Step 5 - Enter the name of the applicant.

Step 6 - Provide the Date of Birth/ Date of Incorporation/Date of Agreement/Date of Partnership or Trust Deed/Date of Formation of Body of Individuals/Date of Association of Persons depending on the kind of applicant.

Step 7 - Click on 'Show Status'.

Step 8 - On doing the above-mentioned steps, the transaction status is displayed on the corresponding screen.

What Documents Do I Need to Track My PAN Card Status?

The following is the list of documents required to check your PAN status:

- An acknowledgement number is required for checking status through Protean website.

- An application number is required for checking status through e-Mudra portal.

- An application Coupon number is required for checking status through UTIITSL.

FAQs on PAN Card Status

- How do I know my PAN Card status through UTI if I have lost the acknowledgement code?

If you have lost the acknowledgement code ,the best thing that can be done is to get in touch with the officials of UTIITSL. Applicants can also write to utiitsl.gsd@utiitsl.com.

- What will happen if I apply for a PAN both through Protean e-Gov Technologies Limited and UTIITSL?

In case, you apply for a PAN through both Protean e-Gov Technologies Limited and UTIITSL, only the first acted application will result in the applicant getting the PAN. The second application will be rejected stating that a PAN already exists for the applicant. It needs to be mentioned that the amount paid for the application that was rejected would not be refunded.

- When I check the status of my PAN Card application, it shows no matching record found. What should I do?

If the above mentioned message is seen when checking the status of the PAN application, there is a high possibility that the application was not received by the issuing authority.

- How can I check my PAN Card application status without an acknowledgement number on Protean eGov Technologies Limited?

If the 15-digit acknowledgement number is lost or misplaced, there is no way to check the status of the PAN Card application.

- How to check my PAN Card status using the SMS facility?

To track the status of the PAN Card through SMS, the applicant needs to send an SMS to 57575 typing NSDLPAN followed by the 15-digit acknowledgement number. For example, 'NSDLPAN 012345678900000' and send it to 57575.

- My PAN card application status is showing as 'deleted'. What should I do?

If such a message is being displayed when checking the status of the PAN Card application, it is better to get in touch with the officials of the department as soon as possible.

- PAN Card status is showing 'Application is inwarded'. What is the meaning of this status?

The message indicates that the application has been received by the department and is being processed.

- After how many days can I track my PAN Card status?

Usually, you can track the status of the PAN Card after 24 hours of submitting the application. However, the number of days can vary due to certain unforeseen circumstances.

- My PAN Card status is showing that my application is being withheld from processing due to incomplete details/documentary proof. What should I do now?

The best thing to do is to get in touch with the officials at the earliest. This will help in getting the issue resolved within the specified time period and save you from having to apply for the PAN Card all over again.

- In how many days will I get my PAN Card if the status reads 'PAN Card is under printing'?

It is tough to answer this. This is because many issues are to be taken into consideration like when the card is dispatched by the department, couriered etc. Usually, it takes 21 days for an individual to get his/her PAN Card after the application is submitted.

- How to check the status of my PAN Card application by calling the TIN call centre?

To check the status of the PAN Card application using the call facility, the applicant needs to call on 020-27218080 and provide the call centre executive with the 15-digit acknowledgement number provided to him/her after the application was successfully submitted.

- How can I check my PAN application status on UTIITSL?

To check the PAN application status on UTIITSL, the applicant first needs to visit the official website of UTIITSL. Next, the applicant needs to go to the PAN Card page and enter the application coupon number along with the captcha code and click 'Submit'. The status of the application will be displayed on the corresponding screen.

News on PAN Card Status

Free PAN card and Aadhaar linking is available until 31 December 2025

The Income Tax Department has announced that the PAN card can be linked to Aadhaar without paying a late fee if the Aadhaar application was submitted before 1 October 2024. The deadline for completing the connecting process is 31 December 2025. According to a circular issued by the Central Board of Direct Taxes (CBDT) on 3 April, individuals who were assigned a PAN based on the registration ID provided on their Aadhaar application form until 1 October 2024, are required to notify the income tax authorities of their Aadhaar number.

If the PAN and Aadhaar card are linked after 31 December 2025, there would be a penalty of Rs.1000. This will address circumstances where Aadhaar IDs and PANs exist but are not linked. The possibility of a PAN getting out of service exists for those who have not linked their PAN to Aadhaar.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.