Link PAN Card with Aadhaar Card - Deadline Process and Penalty (2026)

It has become a mandatory process to link your PAN with Aadhaar. This is an important process because it will allow your income tax returns to be processed. Linking of your PAN with Aadhaar is also required if you are carrying out banking transactions for an amount of ₹ 50,000 and above.

If you missed the deadline linking PAN with Aadhar, you can Reactivate your PAN: Reactivate your Inoperative PAN

Deadline | What changed | What happens if not |

30 June 2023 | The general deadline for all PAN Card holders to link their PAN with Aadhaar is without further delay. | If PAN is not linked it will become inoperative from 1st July 2023 |

31 May 2024 | Government extended deadline for certain PAN Card holders to link their PAN with Aadhaar without penalty. | If not linked PAN will be inoperative; linking my require penalty |

31 December 2025 | New final deadline for those whose PAN was issued using an Aadhaar enrolment ID on or before 1 October 2024.the final deadline to provide their actual Aadhaar number. | If they are unable to link their PAN card to Aadhar by this date , PAN will become inoperative from 1st January 2026. |

Important Note: Aadhaar authentication is mandatory for all new PAN applications from July 2025 onwards.

How to Link PAN Card with Aadhaar Card?

There are three methods available to link your PAN with Aadhaar. These are:

- Submitting online or offline link request for PAN and Aadhaar

- Process to Pay the Penalty for Linking PAN Card with Aadhaar

- Linking PAN with Aadhaar by send SMS

1. Submitting Online or Offline Linking Request for PAN and Aadhar

Here are the two steps to submit the link request of PAN and Aadhar:

1. Without Logging into the Account

2. Logging into your Account

Method 1 - Linking PAN Aadhaar Without Logging into Your Account

Here are the following steps to linking PAN Aadhaar without logging into the account:

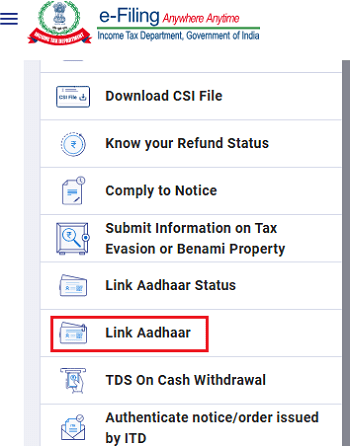

Step 1 - Visit the official website of Income Tax e-filling portal ,Under "Quick Link" section Click on "Link Aadhaar".

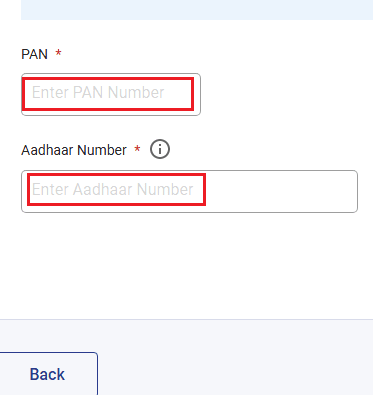

Step 2 - Enter the PAN and Aadhar number

Step 3 - After Click on Validate.

Step 4 - The PAN–Aadhaar linking request will be forwarded to UIDAI for verification.

If the Payment Not Verified on E-Portal

After click on validate Pop Up message displayed "Payments details not found." Payment must be made in advance to submit the PAN Aadhar link request. Once the payment has been made on the E- Portal site, the link request must be submitted within 4 to 5 working days.

Method 1- Linking PAN Aadhaar by Logging into Your Account

Here are the steps to submit linking PAN Aadhaar by logging into your account:

Step 1 - If not a registered user, visit the e-filling portal of Income Tax to register yourself. Already register then login

Step 2 - Login using your User ID

Step 3 - Enter the password and confirm the secure access message

Step 4 - Click on ‘Continue’

Step 5 - Click on ‘Link Aadhaar’ or select ‘Link Aadhaar’ from ‘My Profile’ under ‘Personal Details’ option

Step 6 - Enter the required details, such as name, gender, date of birth

Step 7 - Verify the details on the screen and click on the ‘I agree to validate my Aadhaar details’ check box

Step 8 - In case only year of birth is mentioned, select ‘I have only year of birth in Aadhaar card’

Step 9 - Click on ‘Link Aadhar’

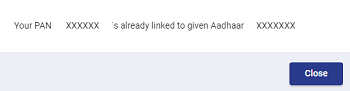

Step10 - After completion of the process, the pop-up message will be displayed informing the PAN and Aadhar are linked.

2. Process to Pay the Penalty for Linking PAN with Aadhaar

The procedure to link PAN with Aadhaar with a penalty is as below:

Step 1 - Visit the official website of the Income Tax Department

Step 2 - Under the 'Quick Links' category, select 'e-Pay Tax'

Step 3 - Enter PAN Number, TAN Number and Mobile Number and Continue

Step 4 - After OTP Verification you will be redirected to e -tax page.

Step 5 - Click on the 'Continue' button

Step 6- Click on Proceed Button

Step 7- Select Year 25-26

Step 8 - Make payment using debit card, credit card, net banking, or any authorized bank HDFC Bank, Axis, PNB, Bank of India, SBI, etc.

Step 9 - After making the payment proceed to link your PAN Card with Aadhaar Card immediately.

3. Link PAN with Aadhaar by Sending an SMS

To link PAN with Aadhaar by sending an SMS. You need to follow the steps below:

Step 1- PAN Aadhar can be linked via SMS as per the Income Tax department.

Step 2 - Send SMS from the registered mobile number to 567678 or 56161 in the format- UIDPAN<Space><12-digit Aadhaar><Space><10-digit PAN>

How to Check PAN Aadhaar Link Status Online?

Given below are the steps to check PAN Aadhaar link status :

Step 1 - Visit the Income Tax Department’s official website and go to Link Aadhaar Status.

Step 2 - Enter your Aadhaar and PAN number.

Step 3 - Click on ‘View Link Aadhaar Status’.

If your Aadhaar has been successfully linked with PAN then you will be able to see the message ‘Aadhaar (Aadhaar number) is already associated with PAN..in ITD database. Thank you for using our services’.

Also Know : How to Link PAN Card to DigiLocker App

Importance of Linking PAN Card with Aadhaar Card

Both the PAN Card as well as the Aadhaar card are unique identification cards that serve as proof of identity that are necessary for registration and verification purposes.

The government has urged all entities to link their PAN Cards with their Aadhaar cards. This is being done for the following purposes:

- Prevent Tax Evasion

By linking the Aadhaar and PAN Cards, the government will be able to keep tabs on the taxable transactions of a particular individual or entity, your identity and address will be verified by his Aadhaar card. This will effectively mean that every taxable transaction or activity will be recorded by the government.

As a result, the government will already have a detailed record of all the financial transactions that would attract tax for each entity, making tax evasion a thing of the past.

- Multiple PAN Cards

Another reason for link PAN with Aadhaar is to reduce the occurrence of individuals or entities applying for multiple PAN Cards in an effort to defraud the government and avoid paying taxes.

By applying for more than one PAN Card, an entity can use one of the cards for a certain set of financial transactions and pay taxes applicable for those. Meanwhile, the other PAN Card can be used for accounts or transactions that the entity wishes to conceal from the Income Tax department, thereby avoiding paying tax on them.

By linking the PAN and Aadhaar card, the government will be able to link the identity of an entity via his/her Aadhaar card, and subsequently have details of all financial transactions made through the linked PAN Card. If there are multiple PAN Cards registered under the same name, the government will be able to identify the same and take corrective action.

How to Link PAN Card with Aadhaar Card in Case of Name Mismatch

It is important that the name on both the Aadhaar Card and PAN Card is the same. In case of any mismatch, below-mentioned procedure can be used to link the PAN Card and Aadhaar Card:

Complete Name Mismatch Between Aadhaar and PAN

If the name is completely different in the Aadhaar Card when compared to the PAN Card, the correction will have to be made on the PAN database or Aadhaar database.

Partial Name Mismatch Between Aadhaar and PAN

If there is some minor mismatch in case of your name in your Aadhaar card and PAN Card, the same can be resolved in the following way:

- If the name mismatch is minor, a One Time Password (OTP) will be sent to the user who has registered the same with Aadhaar

- The OTP can thus be used for the verification purpose in case of a name mismatch

- However, it is a must for taxpayers to make sure that the date of birth and gender details are the same.

Who Is Exempt from PAN Aadhaar Linking?

Individuals in the following categories are exempt from linking PAN with Aadhaar:

- Residents of Jammu and Kashmir, Assam, and Meghalaya.

- Non-resident taxable persons as per the Income-tax Act, 1961.

- Individuals over 80 years old (Super Senior Citizens).

- Non-citizens of India.

How to Check if Your PAN Card is linked with Your Aadhaar Card?

You can follow the steps given below to check if your PAN Card is linked to your Aadhaar card:

Step 1- You need to visit the Income Tax e-filing portal.

Step 2 - Fill in all the required details like Aadhaar number and PAN number.

Step 3 - Click on the ‘Aadhaar Link Status’.

Step 4 - You will be able to see if your Aadhaar card is linked to your PAN Card. In case, your PAN Card is not linked to your Aadhaar card, a pop-up will appear on the screen stating the same.

Fees to Link Aadhaar Card and PAN Card

If you have not linked your PAN Card to Aadhaar card, you will have to pay a penalty of ₹1,000 on the Income Tax portal. Your Aadhaar will be linked to your PAN only after you have paid the penalty.

In case you are a citizen who received their PAN Cards after 1st October 2024, the deadline for you to link your Aadhaar card and PAN Card is 31st December 2025. You will not have to pay any penalty until then.

Video Guide - How to Link Aadhaar Card with PAN Card?

More Resources on Linking PAN Card

Related Articles on PAN and Aadhar Card

FAQs on Linking PAN With Aadhaar Card

- What should I do if my details as per my PAN Card do not match with the ones mentioned on my Aadhaar Card?

If the details on your PAN Card, such as spelling of name, date of birth, or gender, do not match the ones on your Aadhaar Card, you will have to submit an application with valid proof and get the details corrected. After this, you may apply to link your Aadhaar with your PAN Card.

- What are the fees for Aadhaar PAN link for senior citizens?

A fee of ₹ 1000 is charged for Aadhaar PAN link for senior citizens.

- If PAN and Aadhaar are not connected, what is the TDS rate?

According to Section 206AA and Rule 114AAA(3), the deductor must deduct TDS at a higher rate of 20% if a deductee's PAN is not connected with Aadhaar after 1 April 2023 (iii). To prevent greater TDS deductions, deductees must link their PAN with Aadhaar.

- How to link PAN Card with Aadhar card without fees?

You can link your PAN Card with Aadhaar for free through the Income Tax e-filing portal https://www.incometax.gov.in.

- Is it mandatory to link PAN and Aadhaar for all?

Yes, it is mandatory for all to link PAN and Aadhar under Income Tax Act, 1961, except for those who fall under the exempted category.

- Is senior citizens' Aadhaar PAN linking required?

Everyone must link their PAN (Permanent Account Number) to their Aadhaar, as mandated by the Indian government; however, there are some exclusions for NRIs, non-citizens, those over 80, and residents of specific districts.

- My banking transactions are worth more than ₹ 50,000. Do I need to link my PAN with Aadhaar?

Yes, it will be mandatory for you to link your PAN with Aadhaar if your banking transactions are worth ₹ 50,000 or more.

- If I don’t fall into the taxable bracket, do I still have to get an Aadhaar card or have it linked to my PAN?

Yes, it is advisable that you apply for an Aadhaar card and have it linked with your PAN. Aadhar is now necessary to avail most government benefits and so it is advisable to apply for it and also get it linked with PAN to ensure that your PAN is valid.

- Do I have to submit any documentary proof to link my PAN and Aadhaar Card?

No, you are not required to submit any documents when linking your Aadhaar to your PAN Card. You have to check if the PAN information mentioned on the website matches your Aadhaar card and then apply for them to be linked.

- Is it necessary to link PAN with Aadhaar for an NRI?

No, it is not necessary for an NRI to link their PAN with Aadhaar. However, if an NRI has a PAN Card and an Aadhaar card, then it is recommended they get each other linked.

- Failed to Link your PAN with Aadhaar. What to do?

In case you fail to link your PAN with Aadhaar, you will have to submit a signed Aadhaar seeding form by visiting the nearest PAN Centre. You must note that along with the Aadhaar seeding form you must carry all the relevant documents such as PAN and Aadhaar.

- In what number of days will Aadhaar and PAN be linked?

Linking Aadhaar and PAN can take up to 7 days.

- If Aadhaar PAN is not connected, what is the penalty?

The PAN Card stops working if Aadhaar and PAN are not connected by the deadline. As a result,: There will be no reimbursements applied to such PANs. The rates of TDS (Tax Deduction at Source) and TCS (Tax Collection at Source) will be increased.

- Is it mandatory to link PAN with Aadhaar for housewife?

Yes, Every Indian people who has Aadhaar and PAN Card needs to link ,including housewife also.

News on PAN Link with Aadhaar

PAN-Aadhaar Linking Deadline 2025

The government has announced that PAN cards that are not linked to Aadhaar by 31 December 2025 will be deactivated. Linking PAN cards to Aadhaar has been made mandatory, and failing to do so may result in the denial of access to many important financial transactions.

If a PAN card becomes inactive, the cardholders will not be able to file income tax returns, receive tax refunds, open bank accounts, apply for loans, or get credit/debit cards. It will also be impossible to deposit or withdraw amounts over Rs.50,000. Not linking PAN to Aadhaar by the deadline can also lead to paying 20% higher TDS on fixed deposits.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.