All About AO Codes for PAN - Types, Elements, How to Find Them

The abbreviation AO stands for Assessing Officer. AO Code consists of four elements Area Code, AO Type, Range Code, and AO Number. AO Code is meant to identify the tax jurisdiction that the applicant will fall under.

When someone applies for a new PAN Card, one part of the application asks them to enter an AO Code. It is asked for right at the top of the PAN application form.

The importance of an AO Code and determining the jurisdiction is directly linked to taxation, since these codes tell the appropriate authorities what tax laws apply to a person.

If the person is a resident of this country, they might have to pay taxes as per one set of rules, but if they happen to be a company then the tax slabs and rules may be different. Such differences can exist between citizens too since the AO Code for those serving in the Army or the Air Force will be different. Thus, the right area Code is essential to ensure that individuals and companies are taxed according to the appropriate rules.

Elements of an AO Code for PAN

There are officers assigned to each area to assess the taxation of the people in that areas. It is these officers who are identified by AO Codes. A look at the table for the AO code, on Form 49A for new PAN Card, will show that it is formed through the combination of multiple elements. There are 4 elements that make up an AO Code. They are:

- Area Code: For the purpose of identifying the geographic location of the individual or company, their area is assigned a code which is represented using 3 letters.

- AO Type: The type helps the tax department identify the type of PAN Card holder as an individual or company or even a service personnel or a person who is not a resident of India.

- Range Type: Based on the actual address of the PAN Card hold, they are assigned a Range Type which helps identify the ward or circle that they live in.

- AO Number: The AO number is a numerical value that is also published by Protean e-Gov Technologies Limited and is the last part of the AO Code.

Types of AO Codes

There are four main types of AO Codes and they are meant to identify the individual/company and the associate them with the appropriate tax laws. Here's a brief look at them:

- International Taxation- This is for people and companies applying for a PAN Card who are not residents of India or incorporated in India.

- Non International Taxation (Outside Mumbai)- These are AO Codes meant for people and companies that are residing in or registered in Mumbai.

- Non International Taxation (Mumbai)-This is a list of AO Codes that apply to individuals/companies that are based in India but are outside Mumbai.

- Defence Personnel-These AO Codes are meant to identify an individual as a member of the Indian Army or the Air Force. It has only two types of codes, one meant for the Army and the other meant for the Air Force.

Knowing your AO Code is not mandatory, but nevertheless, it is good to know it. We hope that we have been able to educate you everything you need to know about these codes.

Selection Criteria of AO Code

The selection criteria of the AO Code for a PAN Card are as follows:

- For Individuals: Anyone applying for a PAN Card with an income source from a business or salary, then the AO Code will be their residential address or business address.

- For non-individuals: The AO Code for identities such as trusts, Government bodies, companies, LLPs, HUFs, etc. will be their business address.

How to Find Your AO Code for PAN Online?

The following are the three methods which help you in finding your AO Code for PAN online:

Find AO Code Through NSDL Website

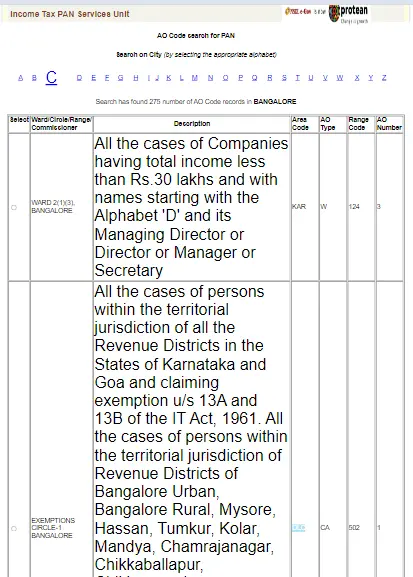

Let us have a look at the steps to know the AO Code through the NSDL website:

Step 1 - Firstly, you need to visit the PAN Portal of NSDL to search AO Code

Step 2 - Choose your residence city.

Step 3 - Once you have clicked on your residence city, a list of AO Codes present in your city will be displayed in the portal.

Step 4 - Choose the preferred AO Code based on the details mentioned.

Step 5 - Finally, click on the ‘Submit’ button.

Find AO Code Through UTIITSL Website

The following are the steps to find the AO Code through the UTIITSL website:

Step 1 - First, go to the UTIITSL website.

Step 2 - Under the ‘PAN Card Services’, click on ‘Search for AO Code Details’.

Step 3 - Choose the appropriate AO code type and then click on ‘View Details’.

Step 4 - Next, choose the city name by selecting the suitable alphabet.

Step 5 - Finally, select from the AO Codes list and other information provided.

Find AO Code Through Income Tax e-Filing Website

The following are the steps to find the AO Code through the Income Tax e-Filing website:

Step 1 - Visit the Income Tax India e-filing website

Step 2 - Click on the ‘Profile Settings’ and go to ‘My Profile.

Step 3 - Finally, click on ‘PAN Card’ to check details such as the Area Code, AO Type, AO Number, Range Code, and Jurisdiction.

AO Codes for Major Indian Cities

How to Migrate PAN Card AO Code?

In order to migrate your AO Code, you must perform the following steps:

Step 1 - Search your AO Code in the jurisdiction of your area.

Step 2 - Find the AO Code of your jurisdiction by visiting the Income Tax Department website.

Step 3 - Click on the ‘Field Offices’ option.

Step 4 - Make an application to shift your AO Code.

Step 5 - After submitting your request, the source AO officer will approve it.

Step 6 - Go to the ‘know your jurisdiction AO’ section on the Income Tax Department website to track the jurisdiction's current status.

How is Your AO Code Determined for PAN Card?

Your AO Code is determined based on your address and what type of taxpayer you are. These criteria are divided into two: Individual and Non-individuals. Here are the conditions:

- If you are an individual taxpayer getting income mainly from salary or from a combination of salary and business earnings, then your AO Code will depend on your official address.

- If you are an individual with sources of income other than salary, then your AO Code will be as per your home address.

- If you are an HUF (Hindu Undivided Family), Company, Partnership Firm, LLP (Limited Liability Partnership), Association of Persons, Body of Individuals, Trust, Artificial Juridical Person, Local Authority, or Government Body, then your office address will decide your AO Code.

- If you are an Army Personnel, then your code will be:

Description | ITO WARD 4(3), GHQ, PNE |

Area Code | PNE |

AO Type | W |

Range Code | 55 |

AO No. | 3 |

- If you are an Air Force Personnel, then your code will be:

Description | ITO WARD 42(2) |

Area Code | DEL |

AO Type | W |

Range Code | 72 |

AO No. | 2 |

Now that you know the important things about AO Codes, here are some other points you might like to know.

FAQs on AO Codes for PAN

- What is the AO Code for students?

There is no AO Code for students.

- What is the AO Code for a non-employed person on a PAN Card?

No specific AO Code is assigned to a non-employed person on a PAN Card. However, the applicant will have an option to choose a salary below a certain amount.

- What is the default AO Code?

The highlighted record in each city is the default AO Code for that city. Depending on the PIN code, the type of assessee, the region, etc., some cities may have multiple default AO Codes for new assessees. The default AO Code of the city in which the applicant files or intends to file the TDS return may be mentioned by an applicant who is unaware of their Ward, Circle, Range, or Commissioner details.

- How can I get my AO Code changed?

In case you change your residential address, then you will be required to change your AO code as well. You will have to submit an application for change in your AO Code.

- How can I find my area code for PAN?

You can find your area code by visiting the Protean eGov Technologies Limited portal or by getting in touch with the tax department. You will have to provide the details of your PAN to find your area code.

- What is W and C in AO Code?

In AO Code, W stands for ward, and C stands for circle.

- Is AO code mandatory for PAN Card?

Yes, AO Code is mandatory for PAN Card application process.

- Can I leave my AO Code blank?

Individuals who are not employed, can choose a salary below a certain amount and leave the AO section blank.

- What is an AO Code for Student?

An AO Code for a student is a code given by the Income Tax Department that shows the office where the student’s PAN application is processed. Students need it while applying for a PAN card, usually based on their city or area.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.