Mudra Loan - Pradhan Mantri Mudra Yojana (PMMY) Online

MUDRA (Micro Units Development & Refinance Agency Ltd.) is a government initiative announced in Union Budget 2016, which is launched to support and refinance micro and small enterprises through the Pradhan Mantri Mudra Yojana (PMMY). It offers collateral-free business loans ranging from Rs.50,000 to Rs.10 lakh, categorized as Shishu, Kishor, and Tarun. These loans are provided via banks, NBFCs, and MFIs to help boost entrepreneurship in the non-corporate small business sector across India.

What is Pradhan Mantri Mudra Yojana?

MUDRA loans under the Pradhan Mantri MUDRA Yojana (PMMY) were launched on 8 April 2015. The scheme aims to financially empower micro enterprises involved in manufacturing, trading, and services. Offered through banks, NBFCs (Non-Banking Financial Institutions), MFIs (Microfinance Institutions), and other recognized financial institutions, these loans provide funding up to Rs.20 lakh without the need for collateral.

The loans are structured into four categories based on the stage and funding needs of the business: Shishu (up to Rs.50,000), Kishore (Rs.50,001 to Rs.5 lakh), Tarun (Rs.5,00,001 to Rs.10 lakh), and Tarun Plus (Rs.10,00,001 to Rs.20 lakh). Even overdrafts of Rs.10,000 under PMJDY are classified as MUDRA loans, expanding financial inclusion for small entrepreneurs.

Mudra Loan Interest Rates 2026

The Mudra loan interest rate depends on the profile of the applicant. There are several banks in the public sector as well as the private sector offering MUDRA loans. All the lenders have certain set guidelines are the final rate of interest at which the loan is provided to an applicant is decided by the lender itself. This is done after scrutinizing the business requirements of the applicant as well.

Top Banks | Interest rates | Tenure |

State Bank of India (SBI) | Linked to MCLR | 1-5 years |

Linked to Bank's Base Rate and Rating | 1-5 years | |

As per bank guidelines | At the discretion of the bank | |

As per bank guidelines | At the discretion of the bank | |

At the discretion of the bank | At the discretion of the bank | |

At the discretion of the bank | 1-3 years |

Key Objectives of Mudra Loans

Tenure & Interest Rates | Depends on the bank’s policy decisions |

Loan Facility | Cash Credit, Overdraft & Term Loan |

Loan Amount | Up to Rs 10 lakhs (Up to Rs 20 lakhs proposed in Budget 2024) |

Processing Fees | For Shishu category (loans up to Rs 50,000) – No processing fee |

For Kishore & Tarun category – depends on the financial institution |

MLIs that meet the eligibility requirements can provide loans under the Pradhan Mantri Mudra Yojana. These MLIs include:

- Government-run Cooperative Banks

- Banks in Rural Regions

- Finance Companies That Are Not Banks (NBFCs)

- Banks with Small Finance (SFBs)

- More financial intermediaries that Mudra Ltd. has authorised to operate as member financial institutions.

Pradhan Mantri Mudra Yojana (PMMY) Categories

Name of Scheme | Loan Amount |

Shishu | For micro-enterprises - Loans up to Rs. 50,000. |

Kishor | For enterprises - Loans ranging from Rs.50,001 to Rs. 5 lakh. |

Tarun | For more established businesses - Loans ranging from Rs.5,00,001 to Rs.10 lakh. |

Tarun Plus | Entrepreneurs who have repaid their Tarun Loans can avail loans under Tarun Plus. Loans ranging up to Rs.20 lakh |

Mudra Loan Eligibility

- Eligible Borrowers: Individuals, sole proprietors, partnerships, Pvt./Public Ltd. companies, other legal entities

- Age Criteria: 18 to 65 years

- Loan Purpose: For service, trading, manufacturing, or small business setup — up to ₹10 lakh

- Units Covered: New and existing businesses

- Credit Profile: No defaults; satisfactory credit history

- Skill Requirement: Applicant should possess required skills/experience; education criteria based on project type

- Security: No collateral or third-party guarantee required

- Lending Institutions: Public & private banks, RRBs, SFBs, MFIs

Documents Required to Apply for MUDRA Loan

The documents required for MUDRA Loan can be listed as follows:

Particulars | Type of Document |

Application Form | Duly filled up application form on the basis of the loan category |

Proof of Identity | Aadhaar card, Voter's ID card, driving license, passport, etc. |

Proof of Address | Utility bills (electricity bill, telephone bill, and so on), Aadhaar card, Voter's ID card, passport, etc. In the case of joint loans, the bank account statement of all applicants is required. |

Photographs | 2 passport-sized photographs of the applicant |

Caste Certificate | If applicable |

Other documents | Quotation of the commodity or items which are to be bought and used for the business |

Latest benefits offered under Mudra Shishu Category as per Atmanirbhar Abhiyan

The Indian Government under the Atmanirbhar Abhiyan recently announced certain benefits the Mudra Shishu category will be eligible to receive. The benefits are:

- A relief of up to Rs.1,500 crore will be provided to borrowers under the Mudra Shishu category.

- Interest subsidy worth Rs.1,500 crore will be provided to Mudra Shishu borrowers.

- Fast recipients will get a discount of 2% on their interest rate for a period of one year by the Government of India.

Step-by-Step Guide to Applying for a Mudra Loan

Online Process

- Visit UdyamMitra Portal or Mudra Website

- Click “Apply Now” and choose your borrower type

- Fill in personal, business, and loan details (Shishu, Kishore, or Tarun)

- Upload required documents (ID, address, photo, signature, business proof)

- Submit and save your Application Number for tracking

Offline Process

- Visit any MUDRA-authorized bank or NBFC

- Request and fill out the loan form

- Attach documents and submit

- Bank verifies and disburses on approval

Benefits of Availing a MUDRA Loan

Here are the key features and benefits of Mudra loan:

1. Financial Inclusion: They give individuals who were previously left out of the formal banking system a chance to get credit.

2. No Collateral Requirement: Mudra Loans are collateral-free, eliminating the need for borrowers to pledge assets to secure the loan.

3. Interest Rate Subsidy: The government provides interest rate subsidies to keep the cost of borrowing affordable.

4. Entrepreneurship Promotion: By providing support to small businesses, Mudra Loans promote entrepreneurship and help individuals realize their business goals.

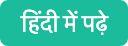

PMMY Achievements in FY 2024-25: Loans Disbursed & Impact

Financial Year | 2024-2025 |

No. Of PMMY Loans Sanctioned | 54661648 as of 31 March 2025 |

Total Sanctioned Amount | Rs.552801.78 crore |

Total Disbursed Amount | Rs.541802.58 crore |

Activities Covered under Mudra Loan

- Transport: Autos, taxis, goods carriers, tractors, e-rickshaws, two-wheelers

- Personal Services: Salons, gyms, tailoring, dry cleaning, boutiques, repair shops

- Food: Catering, pickles, sweets, food stalls, bakery, cold storage

- Textiles & Handicrafts: Khadi, embroidery, handloom, dyeing, printing

- Agri-Allied: Dairy, poultry, fisheries, beekeeping, agro-processing

How to Obtain a Mudra Loan

Getting a Mudra Loan is a straightforward process. Here are the general steps:

1. Business Plan: Start by creating a comprehensive business plan that outlines your business model, funding requirements, and expected outcomes.

2. Eligibility: Ensure you meet the eligibility criteria for Mudra Loans, which typically require your business to fall under the micro and small enterprise category.

3. Loan Application: Approach participating financial institutions such as banks, NBFCs, or microfinance institutions, and fill out the Mudra Loan application form. Be prepared to provide details about your business, the loan amount needed, and your repayment plan.

4. Loan Approval: The financial institution will evaluate your application and creditworthiness. Mudra Loans are usually collateral-free, making it accessible to a wide range of entrepreneurs.

5. Loan Disbursement: Once your application is approved, the loan amount is disbursed to your account, and you can start using it to grow or kickstart your business.

Purpose of Assistance of MUDRA Loan

MUDRA Loans offer term loans, overdraft (OD) limits, or composite loans based on the borrower's business needs.

- Eligible Uses: Funds can be used to acquire capital assets, working capital, or for marketing-related expenses.

- Purpose: Specifically meant for small income-generating businesses in manufacturing, processing, services, or trade, and not for personal or consumption needs.

- Loan Amount: Determined by the business plan and proposed investment.

- MUDRA Card: A RuPay debit card designed for working capital needs, allowing easy and flexible access to credit.

What is a MUDRA Card?

When you apply for a Mudra Loan, you are issued a Mudra Card which is a debit card. After you successfully apply for the loan, you will be required to open an account along with which the card is issued. You can use the Mudra Card to withdraw the loan amount which will be disbursed to your Mudra account after you successfully apply for the loan.

Government of India launches Tarun Plus Scheme

The Department of Financial Services (DFS) under the Finance Ministry has introduced a new ‘Tarun Plus’ category within the Mudra Scheme to boost entrepreneurship in India. The announcement of the scheme was made by the Finance Minister Nirmala Sitharaman during the recently concluded Union Budget 2024 Session.

Key highlights include:

New Loan Category: Entrepreneurs who have successfully repaid their existing Tarun loans can now avail of loans ranging from Rs.10 lakh to Rs.20 lakh under the Tarun Plus category.

Increased Loan Limit: As announced in the Union Budget by Finance Minister Nirmala Sitharaman, the overall loan limit under the Mudra Scheme has been raised from ₹10 lakh to Rs.20 lakh.

Guarantee Coverage: Loans up to Rs.20 lakh under the Pradhan Mantri Mudra Yojana (PMMY) are now covered by the Credit Guarantee Fund for Micro Units (CGFMU).

Collateral-Free Assistance: Mudra loans continue to provide collateral-free and third-party guarantee-free financing of up to Rs.20 lakh, offering significant support to micro and small enterprises.

Mudra Loan Customer Care Numbers

- Toll-Free Numbers: 1800 180 1111 / 1800 11 0001

- Email: help@mudra.org.in

- Website: www.mudra.org.in

- Postal Complaints: Swavalamban Bhawan, C-11, G-Block, BKC (E), Mumbai–400051, 022 6722 1465

- In-Person Complaints: Visit the Customer Service Cell at MUDRA’s corporate office during business hours

- Public Grievances Portal: www.pgportal.gov.in

- Nodal Officers: Contact via SIDBI offices (details on Mudra website)

FAQs on Mudra Loan

- What are the eligibility rules for a Mudra loan?

The projected investment and the business strategy are used to determine the project's cost. MUDRA loans are not intended for personal use or consumption.

- Can I take Mudra loan two times?

Yes, you can use the Pradhan Mantri MUDRA Yojana (PMMY) to apply for a second loan. An existing MUDRA unit may be upgraded or expanded with the second loan.

- What is the new limit of MUDRA?

On October 24, 2024, the Pradhan Mantri Mudra Yojana (PMMY) loan cap was raised to ₹20 lakh. On July 23, 2024, the finance minister made this announcement in the Union Budget 2024-25.

- Do we need to pay back Mudra loan?

Indeed, a Mudra loan must be repaid over a predetermined length of time in Equated Monthly Instalments (EMIs). The type of loan and the bank that offers it determine the interest rates and payback schedule.

- Who is not eligible to borrow from MUDRA bank?

A Mudra loan could not be available to people with a bad credit history or who have a history of loan defaults.

- How much subsidy is in a mudra loan?

Loans made under the Pradhan Mantri Mudra Yojana (PMMY) are not eligible for any subsidies. The program does, however, provide loans with interest rates that are lower than the going rate.

- What is Mudra Loan limit from banks?

The maximum loan amount that can be availed from banks is up to Rs.10 lakh.

- What type of loan is Mudra Loan?

Mudra Loan can be considered as a type of term loan where a group or an individual can avail a loan for expansion of business, purchasing of inventory, etc.

- Is ITR Compulsory for Mudra Loan?

Yes, you will have to produce your income tax returns (ITR) for the past two years if you are looking to apply for a Mudra Loan.

- Does Cibil score affect Mudra Loan?

No, your Cibil Score will not be taken into consideration if you are looking to apply for a Mudra Loan.

- What kind of clients does MUDRA loan target?

MUDRA loans are targeted at the Non-Corporate Small Business Segment which consists of millions of partnership firms and proprietorships that operate as service sector units, small industries, small manufacturing units, vegetable or fruit vendors, repair shops, etc. In urban as well as rural regions.

- Are there any subsidies under the Pradhan Mantri MUDRA Yojana?

No. There are no subsidies under the Pradhan Mantri MUDRA Yojana.

- Can I avail a MUDRA loan if I have recently graduated from college?

Yes. College graduates who wish to start their own businesses can apply for MUDRA loans. Based on the kind of business you wish to start and the requirements of the project, MUDRA can help you get your business up and running.

- I am a woman entrepreneur and wish to start my own boutique. Can MUDRA help?

Yes. Women entrepreneurs can make the most of a special refinance scheme offered to women entrepreneurs. The Mahila Uddyami Scheme as it is called, offers an interest rebate of 0.25% when you avail a MUDRA loan from an NBFC or a micro finance institution.

- Do I need to have a PAN card if I want to avail a MUDRA loan?

PAN cards are not mandatory for those who wish to avail MUDRA loans, but you will have to meet the other KYC requirements set forth by the financing institution.

- Is PMMY Loan Eligible for Khadi Activity?

Indeed. MUDRA loans can be used for any kind of activity that generates revenue. Since Khadi is one of the textile industry's approved activities, it can be covered if MUDRA loans are taken out to generate income.

- How long does it take to process a loan proposal under PMMY-Shishu loans?

Loan applications for credit limits up to Rs.5 lakh should be processed within two weeks, in accordance with the Banking Codes and Standard Board of India (BCSBI), which were established by the RBI.

- Is It Possible to Purchase A CNG Tempo or Taxi with a MUDRA Loan?

If the applicant plans to use the CNG Tempo/Taxi for business activities, MUDRA loans may be available for the purchase of the vehicle.

News about Mudra Loan

Union Budget 2025: MUDRA loans extended to homestays

Under the Union Budget 2025, the Finance Minister announced that MUDRA loans, under the Pradhan Mantri MUDRA Yojana (PMMY), would now be extended to homestay properties in order to promote the tourism sector.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.