Yes Bank Personal Loan Status

Yes Bank offers personal loans to all eligible salaried individuals at attractive interest rates. The advantage of getting the loan from Yes Bank is the speedy approval process and quick disbursal of the loan amount.

Table of Contents

- What Details Are Required to Check Yes Bank Personal Loan Status?

- How to Check Yes Bank Personal Loan Status Offline

- How to Check Yes Bank Personal Loan Status Online

- Check Yes Bank Personal Loan Status via BankBazaar Portal

- YES Bank Personal Loan Application Status Check via SMS

- YES Bank Personal Loan Status Check via Customer Care Support

- The lender also offers doorstep banking where a representative from the bank will carry out the documentation process on the person's behalf. Also, one can apply for the loan online by following a few simple steps.

- If you have applied for a personal loan with Yes Bank already and need to know the status of your loan application, read further to learn the many tracking options.

What Details Are Required to Check Yes Bank Personal Loan Status?

In order to learn your loan application status, you might have to provide the following details:

- Application form number

- Identity details

- Mobile number

How to Check Yes Bank Personal Loan Status Offline

Yes Bank promises to get back to the loan applicant within 5 days from the day they receive the loan application form. However, if you would like to know the status at the earliest or if there has been a delay, you can always use the following methods to track your Yes Bank Personal Loan status:

- Call the customer care department: You can call the toll-free number 1800 1200 and the executives will help you find out the status of your loan application.

- Send an SMS: Alternatively, you can SMS 'HELP' followed by your customer ID to 92233 90909. You can follow the automatic responses to solve your query regarding the loan application.

- Visit Branch: You can always visit the Yes Bank branch and find out the status. To know the nearest branch, you can use the branch locator available on the official website of the bank.

Different Modes to Check Your Personal Loan Application Status

- Offline mode: To know the status of your loan application, you can always call the Yes Bank customer care department or visit the nearest branch.

- Online mode: If you prefer the online mode, you can always drop an e-mail to the bank so that they can revert with the status of your application.

How to Check Yes Bank Personal Loan Status Online

If you find it more convenient to check the status through an online platform, you can send an e-mail to yestouch@yesbank.in. Make sure you mention all the relevant details such as the application number and your identity details so that they can respond with an update regarding your loan application.

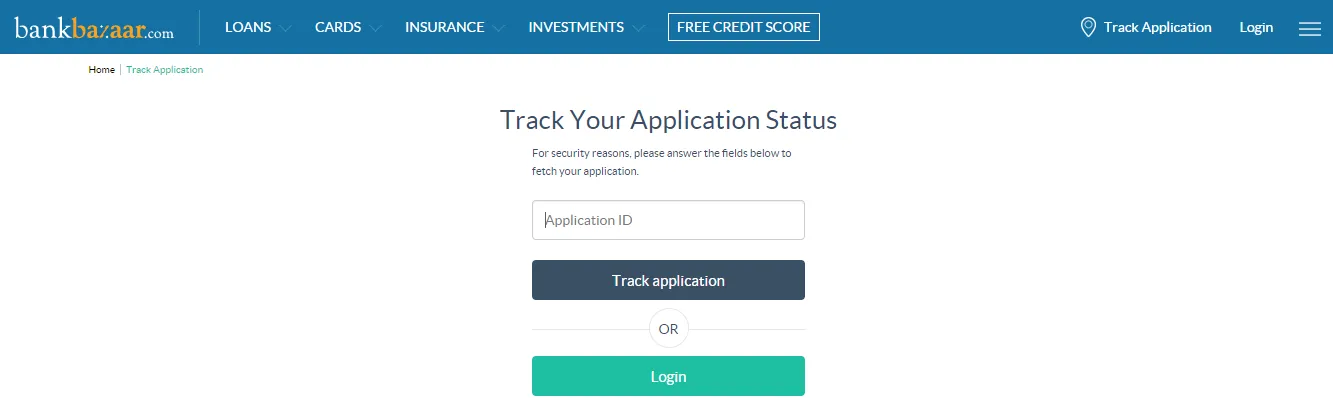

Check Yes Bank Personal Loan Status via BankBazaar Portal

Tracking your loan application status through BankBazaar is very simple. Those who prefer the online mode can also use this method to know whether the application is still under review or if it has been approved.

Follow the steps given below to check your Yes Bank Personal Loan status on BankBazaar:

- Go to the homepage of the website

- Click on the "Track Application" link that you can see on the top right corner of the page.

- On the redirected page, enter your application ID and mobile number, or login to your BankBazaar account.

- You can then view the status of your loan application in the next step.

YES Bank Personal Loan Application Status Check via SMS

Another way to check your personal loan status is by sending an SMS to the authorities.

- Visit the bank's official website.

- Click and open the 'Contact Us' tab and find the 'SMS' section.

- Send the message 'HELP' space to +91 92233 90909 from your registered mobile number.

- You will instantly receive a reverted message from the bank guiding you about the next step.

- Follow the instructions step by step to check your personal loan application status.

- Once you provide all the details asked for, you will receive a message stating your application status.

- For any further query or confusion regarding this, talk to the bank executives on the helpline numbers given below.

YES Bank Personal Loan Status Check via Customer Care Support

To know the status of your personal loan application you can also get in touch with a YES Bank customer care representative by dialling its customer care numbers. The process is fast and you will be instantly connected to an amicable customer support representative who will answer all your status related queries and clarify whatever doubts you are having. Follow these steps to contact the customer support team:

- Log into the registered website of YES Bank.

- Go to the 'Contact Us' section present on the right of the main page.

- Dial the following helpline numbers given on this page to talk to the executives who are readily available to help you anytime.

- Toll-free Number- 1800 2000

- Non-Toll-Free number- 91 22 6121 9000

- Once your call is picked up, enquire about the current status of your YES Bank personal loan application status. Feel free to ask them if you have any other related queries.

- If the update provided by the executives doesn't meet your expectation, you can contact the 'Grievance Redressal Officer' about your grievance. You will get the number, address and mailing details in the 'Nodal Officer' tab under 'Support' section at the bottom of the main page.

Either write to them at head.grievanceredressal@YESbank.in or you can call them on 022-39489373.

The process of checking YES Bank personal loan application is very easy and convenient. You just need to have a good internet connection or a mobile phone along with you to know the status from wherever you are. There is no need to visit the bank and stand for hours in the long queues to know the current status of your loan. Instead, you can know that in a jiffy by following any of the above mentioned ways.

FAQs on Yes Bank Personal Loan Status

- What is the rate of interest for Yes Bank Personal Loan?

The interest rate for personal loans depends on a number of factors. The interest rates offered by Yes Bank start as low as 10.75%.

- What is the loan amount range that can be availed from the bank?

Yes Bank offers loans ranging from Rs.1 lakh to Rs.4 lakh. However, the bank will decide the maximum amount based on the applicant’s profile.

- Do I need to pledge anything to get a personal loan from Yes Bank?

No, the bank does not require any collateral to provide a personal loan.

- Can I repay the loan in advance?

Yes, you can repay the loan before the loan tenure ends. Foreclosure of the loan, however, will be charged by the bank.

Personal Loans by Bank

- SBI Personal Loan

- HDFC Personal Loan

- IDFC First Personal Loan

- Kotak Personal Loan

- Axis Personal Loan

- Yes Bank Personal Loan

- IDBI Personal Loan

- Indusind Personal Loan

- Standard Chartered Personal Loan

- Citibank Personal Loan

- RBL Personal Loan

- Indian Bank Personal Loan

- Canara Bank Personal Loan

- Bank of Baroda Personal Loan

- Bank of India Personal Loan

- Central Bank of India Personal Loan

- Punjab National Bank Personal Loan

- Union Bank Personal Loan

- IOB Personal Loan

- Bank of Maharashtra Personal loan

- UCO Bank Personal Loan

- Punjab and Sind Bank Personal Loan

- Jammu Kashmir Bank Personal Loan

- Indiabulls Dhani Personal Loan

- Shriram Finance Personal Loan

- Aditya Birla Finance Personal Loan

Personal Loan Eligibility by Banks

- SBI Personal Loan Eligibility

- HDFC Personal Loan Eligibility

- Kotak Personal Loan Eligibility

- Axis Bank Personal Loan Eligibility

- SCB Personal Loan Eligibility

- Tata Capital Personal Loan Eligibility

- IDBI Bank Personal Loan Eligibility

- Indusind Personal Loan Eligibility

- RBL Personal Loan Eligibility

- Yes Bank Personal Loan Eligibility

- Canara Bank Personal Loan Eligibility

- Bank of Baroda Personal Loan Eligibility

- PNB Personal Loan Eligibility

- IOB Personal Loan Eligibility

- Union Bank Personal Loan Eligibility

- Central Bank of India Personal Loan Eligibility

- UCO Bank Personal Loan Eligibility

- Bank of India Personal Loan Eligibility

- Bank of Maharashtra Personal Loan Eligibility

- City Union Bank Personal Loan Eligibility

- Corporation Bank Personal Loan Eligibility

- Dhanalakshmi Bank Personal Loan Eligibility

- Karnataka Bank Personal Loan Eligibility

- Karur Vysya Personal Loan Eligibility

Personal Loan Interest Rates by Bank

- HDFC Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

- SCB Personal Loan Interest rates

- Tata Capital Personal Loan Interest rates

- RBL Bank Personal Loan Interest rates

- YES Bank Personal Loan Interest rates

- Canara Bank Personal Loan Interest Rates

- Bank of Baroda Personal Loan Interest Rates

- Punjab National Bank Personal Loan Interest rates

- Central Bank of India Personal Loan Interest rates

- Bank of India Personal Loan Interest rates

- UCO Bank Personal Loan Interest rates

- Corporation Bank Personal Loan Interest rates

- TMB Personal Loan Interest rates

Personal Loan EMI Calculator by Bank

- HDFC Personal Loan EMI Calculator

- AXIS Bank Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- SCB Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- TATA Capital Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- PNB Personal Loan EMI Calculator

- Canara Bank Personal Loan EMI Calculator

- IOB Personal Loan EMI Calculator

- UCO Bank Personal Loan EMI Calculator

- KVB Personal Loan EMI Calculator

Personal Loan Customer Care by Bank

- SBI Personal Loan Customer Care

- HDFC Personal Loan Customer Care

- IDFC First Personal Loan Customer Care

- Kotak Personal Loan Customer Care

- Axis Bank Personal Loan Customer Care

- TATA Capital Personal Loan Customer Care

- Shriram Finance Personal Loan Customer Care

- Indusind Personal Loan Customer Care

- Indiabulls Personal Loan Customer Care

- BOB Personal Loan Customer Care

- IIFL Bank Personal Loan Customer Care

- Yes Bank Personal Loan Customer Care

- RBL Personal Loan Customer Care

- Punjab National Personal Loan Customer Care

- Canara Personal Loan Customer Care

- UCO Bank Personal Loan Customer Care

- Union Bank Personal Loan Customer Care

- Bank of India Personal Loan Customer Care

- Standard Chartered Personal Loan Customer Care

Personal Loan Status Track by Bank

- HDFC Bank Personal Loan Status

- IDFC First Personal Loan Status

- Yes Bank Personal Loan Status

- Tata Capital Personal Loan Status

- Axis Bank Personal Loan Status

- KOTAK Bank Personal Loan Status

- IndusInd Personal Loan Status

- SBI Bank Personal Loan Status

- PNB Bank Personal Loan Status

- Canara Bank Personal Loan Status

- Mahindra Finance Personal Loan Status

- Shriram Finance Personal Loan Status

- CITIBANK Bank Personal Loan Status

- IIFL Bank Personal Loan Status

- SCB Personal Loan Status

- RBL Personal Loan Status

- BOB Personal Loan Status

- Central Bank of India Personal Loan Status

- BOI Personal Loan Status

Personal Loan Articles

- Top Personal loan Finance Companies

- Personal Loan without Documents

- Personal Loan Verification Process

- Personal Loan Disbursal Process

- Personal Loan Preclosure Procedure

- Personal Loan for NRI

- Personal Loan Prepayment

- Pre Approved Personal Loan

- Personal Loan for Non Listed Companies

- Personal Loans by Private Sector Banks

- Microfinance Institutions

- Financial Inclusion Schemes in India

- Process of Bank Guarantee

- Promissory Notes

- Credit Appraisal

- Project Financing

- Statutory Liquidity Ratio

- Marginal Standing Facility

- Personal Loan Preclosure Calculator

- HDFC Bank Personal Loan Preclosure

Other Loans

- Mudra Loan

- Mortgage Loan

- MSME Loan

- Buy Now Pay Later

- Instant Loan

- SBI Mudra Loan

- NABARD

- SIDBI

- SKS Microfinance

- Agriculture Loan

- Business Start up Loan

- Marksheet Loan

- Loans For Unemployed

- Personal Loan for Low Salary

- Personal Loans by NBFCs

- Personal Loan for Govt Employees

- Personal Loan on Aadhar Card

- Personal Loan Insurance Plans

- Personal Loan Top Up

- Personal Loan for Salaried Employees

- Personal Loan for Self Employed

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.