PAN 2.0 - Features, Benefits, Updates, and Process

The PAN 2.0 Project will provide online authentication and validation services to various organizations. Financial institutions, banks, and government agencies will be able to securely access PAN data.

This will streamline processes, making data access more efficient and secure. The PAN 2.0 project was officially approved on 25 November 2024 by the Cabinet Committee on Economic Affairs (CCEA).It will go live late 2025 or early 2026.

Table of Contents

Key Update

When Applying for a New PAN Card? Aadhaar authentication is mandatory, and it is upgraded starting from July 2025. This should be stated clearly for application process clarity.

Note: Expected rollout continues in phases through 2026.

What is PAN 2.0?

PAN 2.0 is an upgraded version of the PAN system designed to modernize PAN and TAN systems, thereby improving efficiency and accessibility. It will digitize processes, align with the Digital India program, and create a universal digital identifier across government platforms.

PAN 2.0 will feature a QR code for easy data access, thus offering faster services and improved security. The upgrade is free for existing cardholders, although the official launch date is still awaited.

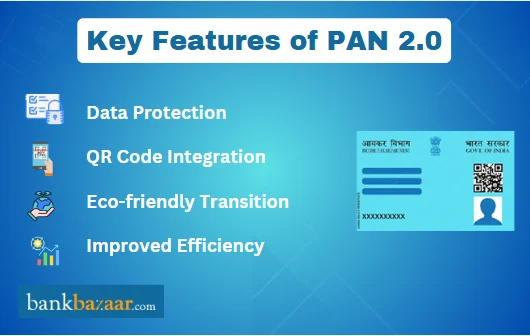

Key Features of PAN 2.0

The main features of PAN 2.0 are as follows

Data Protection: Advanced measures will safeguard taxpayer data from unauthorized access and breaches.

Duplicate Detection: Systems will identify and resolve duplicate PAN applications.

Unified Platform: All PAN-related services will be consolidated into a single digital platform for easy management.

QR Code Integration: QR codes will enable quick verification and instant access to taxpayer details.

Secure Data Storage: A PAN data vault will securely store PAN-related data.

Eco-friendly Transition: The shift to a paperless system will reduce costs and promote sustainability.

Improved Efficiency: Advanced technology will enhance the operational efficiency of the PAN system.

Changes and Upgrades from Existing PAN Card to PAN 2.0

The following are the changes made to the existing PAN Card to upgrade it to PAN 2.0:

- Streamlined taxpayer registration and verification through a secure, paperless digital system.

- Introduction of a QR code for faster data access, verification, and eco-friendly services.

- Free upgrade to PAN 2.0 for all PAN Card holders.

- Existing PAN Cards remain valid, with no need for immediate replacement.

- PAN allocation, updates, and corrections will be provided at no cost to taxpayers.

- e-PAN Card documents will be sent directly to registered email addresses for quick access.

Benefits of QR Codes in Verification

PAN 2.0 will enhance verification with dynamic QR codes, offering real-time updates on personal data. Users with older PAN Cards can request updated ones featuring QR codes. The QR code can be scanned using a dedicated reader app to access key details like name, photograph, and date of birth, streamlining the verification process and improving efficiency.

Fees and Charges for PAN 2.0

The fees and charges required for PAN Card are as follows

Type | Detail | Fees |

Physical PAN Card (Domestic) | For delivery within India | ₹ 50 (inclusive of taxes) |

Physical PAN Card (International) | For delivery outside India | ₹ 15 plus postal charges |

e-PAN up to three requests | Within 30 days of PAN issuance | Free |

e-PAN after three requests | After 30 days or after 3 free requests | ₹ 8.26 (inclusive of GST) |

Eligibility Criteria for PAN 2.0

In order to get the PAN 2.0, an individual must fulfil the given below criteria.

- Existing PAN Card holders are eligible for PAN Card 2.0 and can upgrade without reapplying.

- For new applicants some documents are required including identity proof (Aadhaar Card, Passport, Voter ID, or Driving License), address proof (Electricity Bill or Rent Agreement) and birth proof (Birth Certificate, School Leaving Certificate, or Passport).

Documents Required for PAN 2.0

Mentioned below are the supporting documents that are required to apply for PAN 2.0

Type of documents | Acceptable Documents |

Proof of Identity | Aadhaar Card, Passport, Driving License, Voter ID Card |

Proof of Address | Recent Bank Statement (within last 3 months), Rent Agreement, Recent Utility Bill, Aadhaar Card |

Proof of Date of Birth | Birth Certificate, School-Leaving Certificate, Passport |

How to Apply for PAN 2.0

You can either apply through the official Protean website or UTIITSL portal. Application process from both websites is quick and easy. You can follow the given below steps to complete the application process:

Apply PAN 2.0 via NSDL Portal

- Visit the official website of NSDL (Protan)

- Enter your PAN, Aadhaar number and date of birth.

- Verify your details and select an option, e-mail or SMS to get an OTP.

- Enter the 6-digit OTP received within ten minutes to validate your details.

- Agree to the terms and conditions.

- The e-PAN service is free for up to three requests if your PAN was issued within the last 30 days but after the three attempts, a fee of ₹ 8.26 (including GST) will be applied.

- Upon successful processing, your e-PAN will be emailed to your registered email ID within 30 minutes.

Apply PAN 2.0 via UTIITSL Portal

- Go to the official UTIITSL e-PAN portal.

- Fill in your PAN Card number, date of birth, and captcha code.

- If your email ID is registered with the Income Tax Department then you can continue to request the e-PAN.

- On the other hand, if your email ID is not registered then you need to update it under PAN 2.0 project.

- You can request a new PAN Card for free up to three times within 30 days from the date it was issued. After the third request, each additional one will cost ₹ 8.26, including GST.

- After the payment is processed, you will get your e-PAN within 30 minutes on your registered e-mail ID.

Differences Between PAN 2.0 Vs Old PAN

Aspect | Existing Setup | PAN 2.0 |

Platforms | PAN services are spread across three portals (e-Filing, UTIITSL, Protean) | A unified portal integrates all PAN/TAN services. |

Application Process | Paper-based and online applications, requiring separate steps. | Complete online, paperless workflow for all services. |

PAN Card Features | No QR code (older cards). | New PAN Cards include dynamic QR codes for enhanced security. |

Correction/Up dates | Updates can be made, but with certain fees and limitations. | Free updates for personal details, like name and address. |

Duplicate PAN Detection | Manual checks, requiring submission to the AO for resolution. | Advanced systems automatically detect and resolve duplicate PANs. |

Taxpayer Services | Spread across multiple portals, causing delays. | Simplified services on a single portal, reducing delays. |

Aadhaar-PAN Linking | Done separately, with manual intervention. | Simplified and integrated process on the unified portal. |

Verification | Manual verification, relying on physical submission. | QR code enables instant online verification. |

Delivery of New PAN | Only updated upon request, with additional fees for physical delivery. | New PAN Card delivered based on request; free e-PAN delivery. |

Processing time | Physical PAN takes longer time (up to a few weeks) | It is available within a few minutes |

PAN Card Through Different Apps

FAQs on PAN Card 2.0

- Will my PAN number change under PAN 2.0?

No, your PAN number will remain unchanged under the PAN 2.0 system. However, the new PAN Card will feature advanced security elements, including a dynamic QR code for quick verification and greater protection against fraud.

- Do I need to apply for a new PAN Card?

No, if you are an existing PAN Card holder, you do not need to apply for a new PAN Card unless you need to update your information. However, you can request an upgraded PAN Card with a QR code at no additional cost.

- What is the PAN 2.0 unified portal?

The unified portal is an integrated platform that will consolidate all PAN and TAN services, such as allocation, updates, amendments, and validation. This single portal aims to streamline processes, making it easier for users to access services and complete PAN-related tasks in one place.

- What is the Unified Portal in PAN 2.0?

The Unified Portal is a single digital platform that consolidates all PAN and TAN services, such as allocation, updates, amendments, and validation. This streamlined system aims to make PAN-related processes more efficient, accessible, and faster by eliminating the need for separate portals and reducing delays.

- What benefits does the QR code on my PAN Card offer?

The QR code will offer enhanced verification capabilities. Scanning the code will quickly display your PAN details, including personal data like your photograph and name, ensuring faster and more secure access for verification purposes.

- Can I update my personal details on the PAN Card?

Yes, under PAN 2.0, you can update your personal details like your name, address, mobile number, and date of birth free of charge. These changes can be made through the new online services available via the unified portal, making the process more accessible and efficient.

- What happens if I hold multiple PAN Cards?

Holding multiple PAN Cards is illegal. PAN 2.0 introduces a system that will detect and resolve duplicate PAN applications. If you have more than one PAN, you must inform the relevant Assessing Officer to have the extra PAN(s) deactivated or deleted.

- Will PAN 2.0 speed up processing times?

Yes, the PAN 2.0 system will digitise and automate processes, significantly reducing the time required for services such as PAN Card issuance, updates, and corrections. The shift to a paperless system will also eliminate delays associated with traditional paper-based processing.

- What is a Common Business Identifier (CBI) in PAN 2.0?

The Common Business Identifier (CBI) is a unique identifier introduced in PAN 2.0 for businesses. It will simplify the tracking and verification of business-related PAN details and ensure better integration of business data across government systems, improving overall compliance and data accessibility.

- Is there a fee for the upgraded PAN Card with a QR code?

No, there is no fee for the upgraded PAN card with a QR code. However, if you require a physical PAN Card to be delivered internationally, you will have to pay a nominal fee for delivery, which may vary based on the delivery address.

- What is the deadline for updating my PAN details?

There is no specific deadline for updating PAN details under the PAN 2.0 system. However, it is advisable to update your details ahead of the full rollout of PAN 2.0 to ensure that your information remains accurate and accessible in the new system.

News on PAN 2.0

PAN 2.0 Modernisation Project to be Rolled out in 18 Months

The Income Tax Department has announced the rollout of PAN 2.0, which aims to unify all PAN-related services across India. The project is set to be completed within 18 months, improving security and streamlining tax filing. This system upgrade will modernise the current infrastructure and provide enhanced user experience, with a focus on efficiency and reducing operational bottlenecks. LTIMindtree will be the Managed Service Provider (MSP) for the project.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.