PAN Card for NRI 2026

While a PAN is mandatory for resident Indian taxpayers, NRIs who wish to participate in stocks or receive rent in the country are expected to have a PAN, integrating them into the folds of our society.

PAN Card is a vital document mandatory for Indian citizens which is mandatory for taxpayers. The card consists of a unique identification code, which is required mandatorily for opening bank accounts, filing tax returns, investing in mutual funds, selling or buying properties, and other purposes.

Indian citizens residing outside the country also require a PAN Card to make various financial transactions and for other purposes. Here is all that you need to know about PAN Cards for NRIs.

Why Does an NRI Need a PAN Card?

Here are the reasons why NRI needs a PAN Card:

- PAN Card is mandatory for those NRI individuals who derive their income source from India in the form of

- Capital gain from selling property

- Dividend from stock

- Rent,

- Or other investments from India

- Mandatory for filing tax for NRIs who derive income from India

- PAN not required for NRIs who owns agricultural land, as tax is exempted for income generated from agricultural land

- PAN is key identification document which is required during investment in India for NRIs

- Transactions exceeding ₹10 lakh in India required PAN Card mandatorily

- PAN also required opening an NRE or NRO account in India, which are specialised accounts for NRIs to manage foreign currency or Indian rupees

Documents Required for NRI PAN Card

NRI applicants are required to submit the following documents when applying for a PAN Card

- 2 recent passport-sized photographs

- Copy of passport

- Overseas address proof- copy of overseas bank statement a residential permit issued by the Foreigner's Registration Officer in India or the State Police Authorities

- If applicable, copy of your Person of Indian Origin (PIO) card or Overseas Citizen of India (OCI) card

- NRE bank account statement showing at least two transactions in the last six months which is duly attested by the Indian Embassy, Consulate, High Commission, Apostille, or the bank manager where the account is held

Additional documents required for applying with an Indian office address

- Address certificate issued by your Indian employer

- PAN details of employer

- Copy of appointment letter by the concerned company with an address in India

Process for NRI PAN Card Application

The following are the process for NRI PAN Card application

Step 1 - Visit the UTIITSL or NSDL websites.

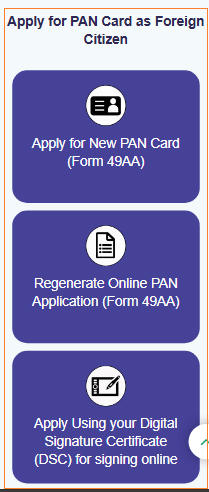

Step 2 - Select the ‘PAN Card for Foreign Citizens

Step 3 - After Selecting PAN Card for Foreign Citizen , in this three options are there, you have to select Apply for New PAN Card( , (Form 49AA)’ option.

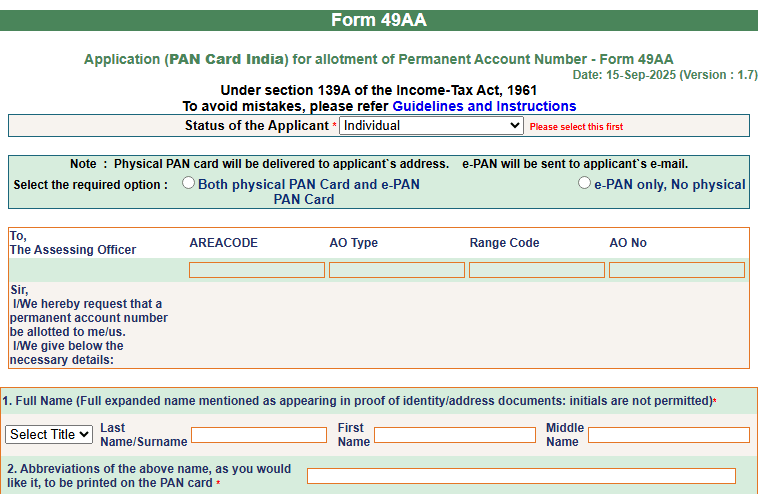

Step 4 - After click on apply for new PAN Card Form 49AA opened .Fill the application form with required details, such as

- Name

- Birth date

- Address

- Contact number

- Email ID

Step 5 - Select applicant’s category and status as ‘Individual’ and ‘Non-Resident India’, respectively.

Step 6 - Upload the required documents

Step 7 - Pay the application fee through either of the following modes:

- Credit Card

- Debit Card

- UPI

- Net Banking

Step 8 - Not the acknowledgement number after submitting the application form

Step 9 - Take a print of the acknowledgement receipt

Step 10 - Paste two passport-size photographs on the form and sign it

Step 11 - Send the signed acknowledgement receipt and the original documents (or copies authenticated by an Indian embassy or consulate) to the UTIITSL or Protean office within 15 days from your e-application submission.

Step 12 - On the envelope write: ‘Application for PAN- Acknowledgement Number’

Fees for NRI PAN Card

The following are the fee details for NRI PAN Card

- Physical PAN Card delivered to foreign address: ₹994 or ₹1,017that includes dispatch charges + application fees

- Physical PAN Card delivered to Indian address: ₹107 including GST

Check More About - PAN Card Fees

Note:

- The fees depend on whether the applicant is applying for physical or e-PAN

- The PAN fee also depends on whether it will be delivered to foreign address or Indian address

- The physical PAN delivered to foreign address is s is accessible to a specific list of 105 countries, which you can find on the official NSDL website

Contact Details of PAN Card Office

Given below are the contact details of PAN office

Protean eGov Technologies Limited TIN Head Office

Times Tower, 1st Floor, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel, Mumbai, Maharashtra, PIN - 400013.

PAN/TDS Call Centre of Tax Information Network (TIN) managed by Protean eGov Technologies Limited

4th Floor, Mantri Sterling, Plot No. 341, Survey No. 997 /8, Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

Phone number - 02027218080

Email ID - tininfo@nsdl.co.in

Do's and Don'ts of Filling a PAN Application Form for NRI

Do's

- Make sure fill your details in the application form in Block letters using only Black ink.

- Signature should be within the box and not run through the face of the applicant.

- Provide correct AO Code.

- Provide correct proof of address and proof of identity.

- You must ensure that the details on your proof of identity match the details on your proof of address, most important being your name.

- If the applicant is a minor, then the proof of identity and proof of address will have to be provided a legal representative of the applicant.

Don'ts

- Do not overwrite or make corrections in the application form. Be careful while providing your details.

- Stick your photograph to the form using a proper adhesive. Avoid stapling or pinning the photograph to the application form.

- Do not write date or place underneath your signatures.

- Do not state the name of your husband in the 'Name of the Father' column.

- If you already have a PAN Card, do not apply for one.

Benefits of PAN to NRIs

A PAN is a critical identifier in the country, serving a number of useful purposes, as mentioned below.

- A PAN simplifies the tax paying procedure, with it being mandatory for all taxpayers.

- NRIs cannot invest in securities or mutual funds without a PAN.

- Purchase of property or vehicles in India requires PAN.

- Depositing amounts over a certain limit requires PAN.

- Owning a PAN simplifies the KYC procedure in most banks.

How Long Does It Takes for an NRI to Receive a PAN Card?

It could take a NRI about 15-20 days to receive the PAN after he/she NRI has successfully paid the fee and submitted all documents. The PAN will be delivered to the communication address mentioned in the application.

Other Types of PAN Card

List of PAN Card Offices in India

FAQs On PAN Card for NRI

- Is linking Aadhar with PAN mandatory for NRIs?

Yes, NRIs must link their Aadhar with PAN mandatorily. But the NRI is not residing in India and has not applied for Aadhar then they are exempted from linking process.

- What is a PAN and why do NRIs need it?

A Permanent Account Number (PAN) is a vital document required for NRIs for tax purposes in India, for performing financial transactions and investment activities.

- How can an NRI apply for a PAN in India?

NRIs can apply for PAN online via the UTIITSL or NSDL websites, through authorized agents, or by visiting PAN service center, ensuring compliance with Indian tax regulations.

- Are there any specific documents required for NRIs to obtain a PAN?

Yes, there are specific documents required for NRIs to obtain PAN essential for identity verification, such as passport copies, overseas address proofs, and a valid visa.

- What is the processing time for PAN application for NRIs?

It takes about 15-20 days to process a PAN application for NRIs, provided the documents submitted and information given in the application form are accurate.

- Can NRIs apply for a PAN from abroad?

Yes, NRIs can apply for PAN from abroad using online platforms or through postal services.

- Is physical presence in India required for NRIs to get a PAN?

No, physical presence in India is not required for NRIs to obtain a PAN and the process of PAN application and other related activities can be completed online or via postal communication.

- How do NRIs check the status of their PAN application?

NRIs can track their PAN application status online by visiting the NSDL or UTIITSL website using the 15-digit acknowledgement number.

- Are there any fees involved in applying for a PAN as an NRI?

Yes, there is a nominal fee required for PAN application for NRIs which varies if the communication address is within India or overseas.

- What should NRIs do if they lose their PAN Card?

In case any NRI individual loses their PAN card, they should immediately apply for a duplicate PAN card online or through a PAN service center by providing necessary documentation.

- Can a minor NRI apply for a PAN?

Yes, minor NRIs can apply for a PAN and either their parents or guardians must represent them and provide their own PAN details in the application.

- How important is a PAN for NRIs for banking purposes?

A PAN is vital for all NRIs who wish to make a financial transaction in India or has income source in the country. The PAN is needed for opening bank accounts in India, investing in financial instruments, and conducting substantial financial transactions.

- Can NRIs hold more than one PAN?

No, NRIs cannot hold more than one PAN as holding multiple PAN cards is illegal. If they have more, they should surrender the additional ones.

- How does a PAN help NRIs in tax management?

For NRI PAN is crucial document for tax management, as it is required for filing income tax returns in India for those NRIs who have income source in the country and avoiding higher tax deductions at source (TDS).

- What are the consequences of not having a PAN for NRIs?

There are various consequences of not having PAN some of which are, NRIs face challenges in financial transactions in India, higher TDS rates, and difficulties in income tax filings.

- How can NRIs update or correct details in their PAN?

NRIs can update or correct PAN details online by visiting the NSDL/UTIITSL website or by contacting the nearest PAN service center.

- Is PAN mandatory for all NRIs irrespective of their income in India?

PAN is mandatory for NRIs engaging in financial transactions in India, making investments, or having taxable income in India irrespective of the income amount.

- Can foreign address for PAN registration be used for NRIs?

Yes, foreign address can be used for PAN registration by the NRIs, provided their PAN Card is delivered to their current overseas address.

- What is the role of a PAN in property transactions for NRIs?

A PAN is considered as a vital document for NRIs in property transactions in India, as it is required for registration, tax payments, and legal documentation.

- How to link PAN with Aadhaar for NRIs?

NRIs can link their PAN with Aadhar through online mode but they are exempted from linking if they do not invest in Indian market or do not have any income source from India.

- Can PAN for investments in the Indian stock market be used by the NRIs?

Yes, PAN can be used by the NRIs for investing in any of the financial instruments in the Indian market, such as Indian stock market, mutual funds, and others.

- Can I get my existing PAN online if I am an NRI?

Yes, you can retrieve your existing PAN card only if you are an NRI through online mode via DigiLocker app, provided the applicant must have their Aadhar card.

- Can I opt for only e-PAN card if I am an NRI?

Yes, you can opt for only e-PAN if you are NRI. You just need to mention the same while filing out the PAN Card application form.

- Is there any distinguishing factor to detect if a PAN card is for NRIs or resident Indians?

No, there is no distinguishing factor to detect whether the PAN card is for NRIs or resident Indians.

- How NRIs check the status of their PAN Card application?

To check the PAN card application status for NRIs, the applicant needs to visit the NSDL or UTIITSL portal using the acknowledgement number.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.