Challan 280 Income Tax Payment Online

Challan 280 is a form available on the official website of Income Tax India. This challan can be used to make online payment of income tax. The challan can be filed online or can be submitted offline as well to pay the tax.

What is Challan 280?

Challan 280 is a form that can be used by a person to make an income tax payment of self-assessment tax, tax on distributed income and profit, regular assessment tax, advance tax, and surtax.

Another name for the form is "ITNS 280." Whether you pay your taxes online or offline, you must use Challan 280 for the transaction.

If you've opted for the offline method, you must take the form to a specified bank branch, where you must also make the payment. However, if you've chosen to pay online, you can finish the transaction by going to the TIN NSDL website.

How to Pay Income Tax Online through Challan 280

Tax Payers must follow the simple steps to pay your Income Tax Online via Challan 280 and process as follows:

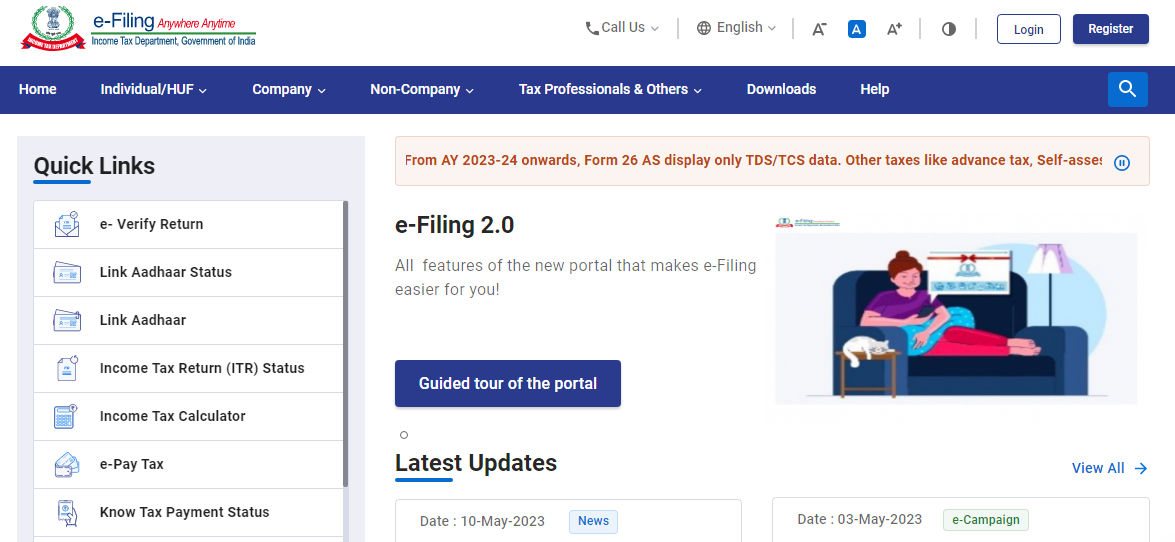

Step 1: Visit the official website of Income Tax at https://www.incometax.gov.in/iec/foportal/ and Click on the ‘e-pay Tax’ under Quick Links as shown in the image below.

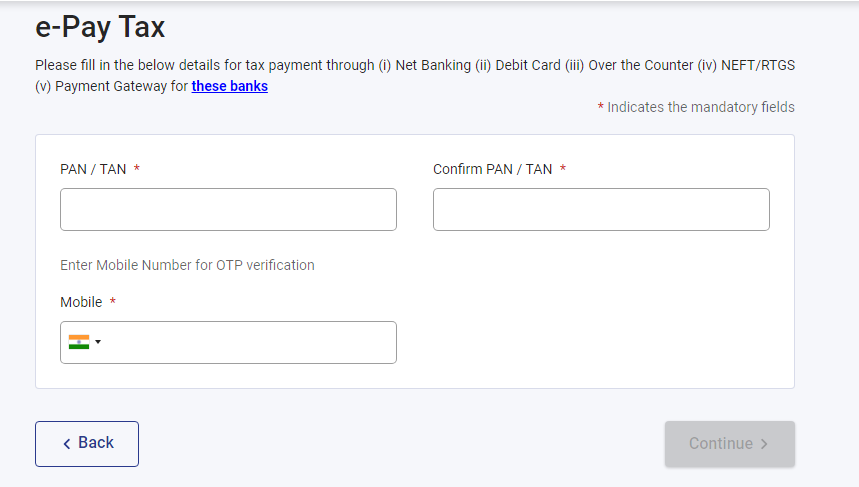

Step 2: Once you click on e-pay tax, you will be re-directed to a new page. Now, Fill all the required details like PAN / TAN, Mobile Number. Now, click on ‘Continue’

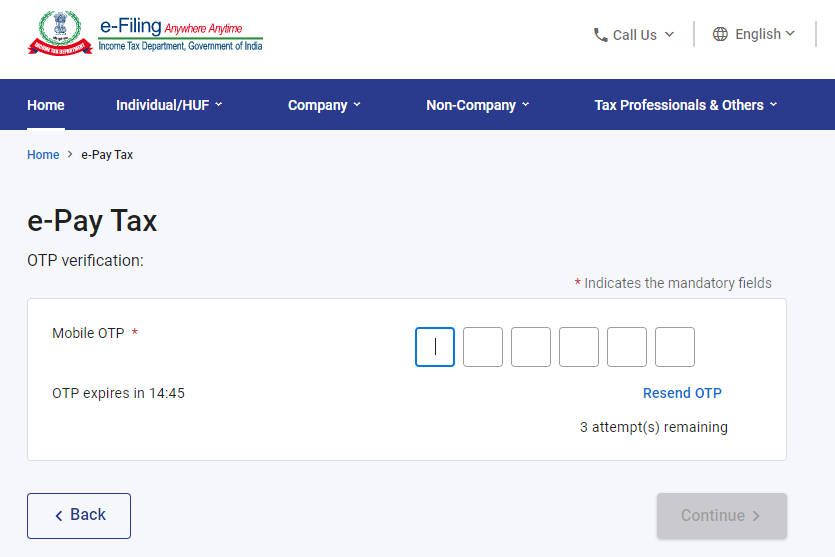

Step 3: Enter the ‘OTP’ received on your Mobile and Click on Continue button.

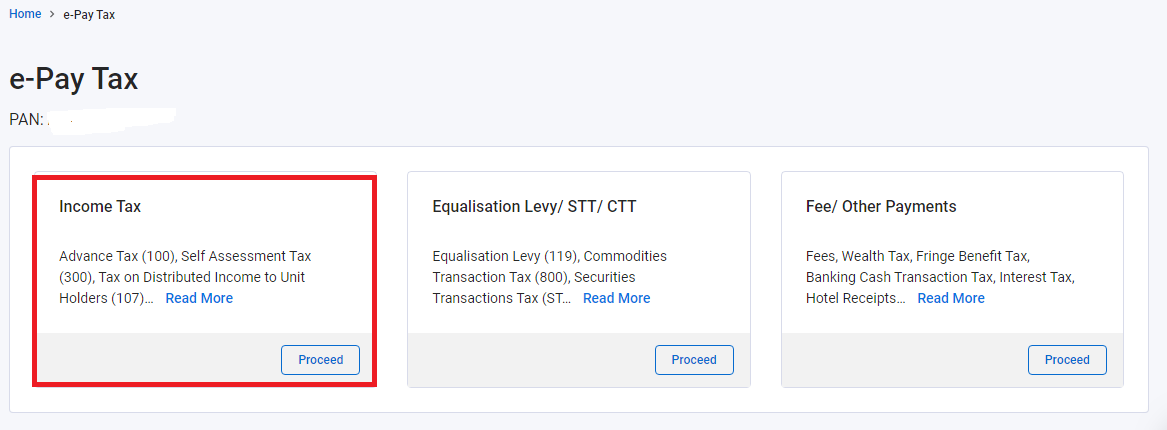

Step 4: You have successfully verified through mobile OTP; it will take you to new page where you have to select ‘Income Tax’ Option and ‘Proceed’

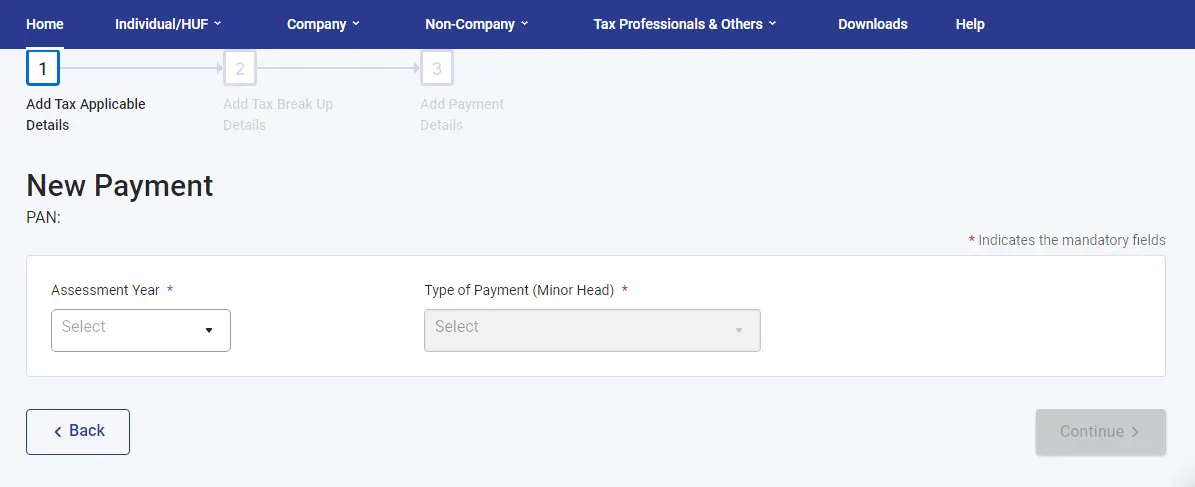

Step 5: Now, you will be redirected to the payment page where you have to fill the required fields like Assessment Year (AY) and Next, select the correct 'Type of Payment' from the given options including - (100) Advance Tax, (102) Surtax, (106) Tax on Distributed Profit, (107) Tax on Distributed Income., (300) Self-Assessment Tax, and (400) Tax on Regular Assessment.

If you have any any dues on Income Tax Return, then select ‘Self-Assessment Tax'

Step 6: Then, Fill the amount under Tax Head and Proceed to click on ‘Continue’ button

Step 7: Then, choose the mode of payment. The payment can either be made using 'Net Banking' or through 'Debit Card'. Once you select the convenient option, click the bank name from the drop-down menu next to the selected option.

Step 8: Once the online payment of Income Tax is successful, a challan counterfoil will display. It serves as proof of payment made. Make a copy for PDF for future reference.

Download Challan 280 (Offline)

The Challan 280 can be downloaded from the internet by following the steps which are mentioned below:

Step - 1: Visit the official website of Income Tax India at www.incometaxindia.gov.in

Step - 2: On the home page, click on the 'Forms/Downloads' option from the top menu.

Step - 3: Click on the 'Challans' option under the 'Forms/Downloads' menu.

Step - 4: You will be redirected to a new webpage with a list of all the downloadable Challans.

Step - 5: From this list click on the 'ITNS-280' which is located at the top of the list.

Step - 6: The Challan 280 and all other Challans are available in 2 different formats - a PDF format and a Fillable Form. Click on the feasible option and download the form.

Different Types of Challan for Tax Payments

The different types of challans mentioned below provide the taxpayers with convenient options to make their income tax payments online. It is essential to select the correct challan based on the type of tax liability to ensure accurate and timely payment:

- Challan 280: This is the most commonly used challan for income tax payment. It is used for the payment of income tax, surcharge, and education cess. Individuals and non-corporate taxpayers can use this challan to pay their income tax liabilities.

- Challan 281: This challan is used for the payment of tax deducted at source (TDS) or tax collected at source (TCS). It is used by taxpayers who are required to deduct or collect tax at source on behalf of the government.

- Challan 282: This challan is used for the payment of advance tax, self-assessment tax, and regular assessment tax. Individuals and non-corporate taxpayers who are not required to deduct or collect tax at source can use this challan for their tax payments.

- Challan 283: This challan is used for the payment of wealth tax. However, it is important to note that wealth tax has been abolished from the assessment year 2016-17 onwards.

- Challan 284: This Challan is used by the collectors to deposit TCS on the sale of specified goods such as scrap, minerals etc.

- Challan 285: The Income Declaration Scheme (IDS) Challan is used to pay the IDS tax. The IDS Challan was valid for a certain period of time and allowed taxpayers to report undisclosed income and pay tax on it.

Proof of Payment of Tax

After the remittance of the tax amount, a counterfoil of the challan is generated. This counterfoil contains certain details such as the Challan Identification Number or CIN, the date of payment of tax, the amount of tax paid, and so on. The CIN is generated in the form of an acknowledgment for the tax amount that has been paid. The CIN should be saved for future references, especially when filing Income Tax Returns . An individual can also get in touch with his/her bank in case he/she wants to get the challan counterfoil regenerated.

The following information is furnished on the CIN:

- Serial number of the Challan

- 7-digit BSR code of the branch of the bank where the tax has been deposited

- Date on which the remittance is made

Verification of Challan Tax Payment

The Income Tax Department (ITD) offers the facility of verifying the status of the challans that are generated for an assessee. Verifying the challan also confirms the status of the same. An assessee can also log in to the NSDL website and verify the status of the payment that he/she has made. The status of the challan can be verified in one of the two manners mentioned below:

- CIN based view: An assessee can provide the details like Challan Identification Number (CIN), Challan tender date, the BSR code of the branch of the bank where the payment has been made, and the serial number of the challan to track the status of the challans. The assessee can also check whether the amount of tax paid is correct by specifying the actual amount which they have paid.

- TAN-based view : An assessee can provide the details about the Tax Deduction and Collection Number or TAN and the challan tender date to view the details of his/her Challan Identification Number (CIN). In addition to this, the assessee can also specify the amount against a particular CIN which will validate the amount uploaded by the bank.

Correction of details in Challans

An assessee can make a request to make changes in the challan payment information in case he/she feels the need to rectify some information which is wrong. While correcting, the following fields can be changed:

- Assessment Year

- Tax Deduction and Collection Number (TAN) or Permanent Account Number (PAN)

- Nature of the payment

- Major Head Code and Minor Head Code

- The total amount

These changes can be made by the concerned banks. The banks get 7 days from the day of deposit of the challan to make the changes related to the TAN and PAN, the assessment year, and the total amount. On the other hand, they get 3 months to make changes in the other fields such as the challan deposit date, the Major Head Code, the Minor Head Code, and the nature of the payment.

Correction of Wrong Assessment Year When Making Income Tax Payments

Assessment year is the year in which your taxes are assessed. So, it will be the year that follows the year for which you are paying your taxes.

Follow the steps given below if you have made a mistake in selecting the correct assessment year:

- When you file your IT returns, mention the payment details even if you have chosen the wrong assessment year

- Request the error in the challan to be corrected by the office of the jurisdictional assessing officer. This can be found on the Income Tax Department's e-filing website.

- You can request the correction to be made in the challan by the bank itself if you have detected the mistake within 7 days of making the deposit.

- A notice will be sent by the Assessing Officer (AO) after processing your returns since the payment details will not match the records.

- Respond to the notice with details of the error

- Under Section 154, you can submit a rectification of the error.

- The AO can make the required corrections in your challan if your rectification request has been verified as accurate and genuine. This will then be closed.

Challan 280 for Advance Tax

If your dues on annual tax are Rs.10,000 and above, then you can pay the Advance Tax. If you are a salaried employee, then your employer will take care of the payment of advance tax via TDS deductions.

When to pay Advance Tax

- If you are a freelancer then you will have to pay advance tax.

- If you run a business of your own.

- If you are a salaried employee but have a higher income from capital or interest gains, or rental income.

How to compute and pay Advance Tax

- Add all the capital and interest gains including the income salary, similar to the process followed at the time of filing income tax return.

- If you are a freelancer, then provide the estimate of the income you earn annually and deduct the expenses incurred.

- For expenses, you can provide the details of the rent you pay, internet bills, mobile bills, travel expenses, etc.

Due Dates of Payment of Advance Tax

- You have to pay up to 15% of the advance tax if you pay on or before 15th June

- You have to pay up to 45% of the advance tax less than the advance tax already paid if you pay on or before 15th September

- You have to pay up to 75% of the advance tax less than the advance tax already paid if you pay on or before 15th December

- You have to pay up to 100% of the advance tax less than the advance tax already paid if you pay on or before 15th March

Self-Assessment Tax

Unless you have paid all your tax dues completely, you cannot submit your income tax returns. During the time of filing your return, you may come across tax payable. This amount is called the Self-Assessment Tax which on completion of the payment will allow you to successfully file your income tax returns. You will also be required to pay the interest accrued under Section 234B and 234C if the payment is done after 31 March.

Outstanding Demand Payment

Sometimes, you might be required to pay an income tax to comply with the demand of an income tax notice. If you are in agreement with the assessing officer with regards to the payment of the tax payment, you can complete the payment online. This tax amount that you will pay is called Outstanding Demand Payment.

Things to keep in mind when filing taxes

It has been noted that mistakes are frequently made when paying taxes. So, remember the following when filing your taxes:

- Pick the right assessment year (AY): When choosing the assessment year, many people make mistakes. The financial year and the assessment year are frequently mixed up. Keep in mind that the assessment year is the year following the financial year.

- Keep track of form 26AS: You can also check your Form 26 AS to confirm the amount of taxes paid. Keep in mind that the data updates in Form 26 AS typically take 10 to 15 days.

- Select the appropriate tax code: People frequently select the incorrect code for the ‘tax applicable’ and ‘type of payment’ fields. Tax payment will not be represented in your account with the income tax department if you choose the incorrect code.

- Save the tax receipt: Make sure you keep all the tax receipts in a safe and secure place. It is recommended to have both online and offline copies.

What is the Difference Between Challan 280 and 281?

Challans 280 and 281 are fundamentally different from one another in that they can be used to pay different kinds of taxes. You can use challan 280 in order to pay self-assessment taxes, regular assessment taxes, advance taxes, surtaxes, taxes on profits distributed by domestic companies, and taxes on income distributed to unit holders while challan 281 is used to make payments to the Income Tax department for Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

FAQs on Challan 280 Online Payment

- What kind of income tax payments can Challan 280 be used?

Challan 280 can be used for income tax payments like advance tax, self-assessment tax, surcharge, regular assessment tax, and tax on distributed profits or distributed income.

- What are the ways through which I can make income tax payments?

Income tax payments can be made either online or offline. To pay income tax online, you will have to visit the TIN NSDL website. To pay income tax online, you will have to deposit it into a designated bank branch through demand draft, cheque or cash.

- What do I do if I have any problems with making income tax payments?

In case you have any issues on the NSDL website when entering non-financial information, you will have to get in touch with the call centre at 1800-222-080.

- How can I check my challan 280 status online?

You will have to enter details like Challan Identification Number, challan serial number, challan tender date and the bank's BSR code to track your challan's status online. In case you enter the tax amount you have paid, you can also get to know if you have entered the correct amount or not.

- Which taxes can be paid online?

You can pay most of the taxes online such as corporate tax, Tax Deducted at Source (TDS), income tax, Tax Collected at Source (TCS), and Securities Transaction Tax (STT).

- Is online tax payment for challan 280 compulsory?

No, the online payment of the Section 44AB Challan is only mandatory for all the businesses and all the non-corporate taxpayers. The other taxes can be paid offline by downloading Challan 280.

- Can I pay taxes if my bank does not have e-tax authorization?

No, you cannot pay your taxes from an unauthorized bank. You can use a different bank account (self or otherwise) provided it is authorized to make e-payments.

- Can I verify my challan 280 online?

Yes, you can verify your challan 280 online by clicking on the 'Challan Status Enquiry' page and selecting 'Verify'.

- Can I pay my challan 280 using a debit card?

Yes. You can pay taxes online with a debit card or another online banking method. Once the payment has been made, the receipt will appear on the screen flashing with information like the amount of tax paid, the BSR code for the bank branch, the date the challan was deposited, and the challan serial number.

- What is challan 280 counterfoil?

A challan 280 counterfoil is a proof that you made the payment. It contains payment information, CIN, and bank name used to make the e-payment after a successful transaction.

- What is a Challan ID number or CIN?

Challan Identification Number (CIN) is a unique number assigned to confirm tax payments. It contains the challan's serial number, the date the tax was deposited (in the format DD/MM/YY), and the bank branch's seven-digit BSR codes.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.