Dearness Allowance (DA)

Dearness Allowance can be understood as a component of salary which is some fixed percentage of the basic salary, aimed at hedging the impact of inflation.

The government of India provides the Dearness Allowance (DA) to both the government employees and pensioners. This component of salary is a variable and is used as a hedge against inflation. The value of DA varies depending on location and is revised by the government twice a year.

What is Dearness Allowance?

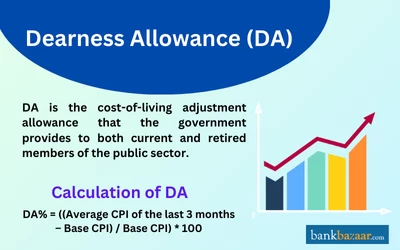

Dearness Allowance (DA) is the cost-of-living adjustment allowance that the government provides to both current and retired members of the public sector.

It is determined using the government employee basic salary percentage. Since DA is directly related to the cost of living, the DA component is different for different employees based on their location. This means DA is different for employees in the urban sector, semi-urban sector, or the rural sector.

Increase in Dearness Allowance, effective 1 January 2025 from 53% to 55%

Recently, the Dearness Allowance (DA) for central government employees underwent a 2% increase, raising it to 55%. Similarly, the Dearness Relief (DR) for central government pensioners has also experienced a 2% hike, reaching 55%. These adjustments came into effect from 1 January 2025.

Latest Changes in Dearness Allowance

- The Dearness Allowance (DA) for central government employees has recently been raised by 2%, increasing it from the previous rate of 53% to 55%. This adjustment became effective from January 1, 2025.

- Similarly, Dearness Relief (DR) for central government pensioners has also seen a 2% hike, reaching 55%.

- Consider a central government employee with a basic salary of Rs.40,000 per month. With the new DA rate of 55%, their employee will get Rs.22,000.

- These adjustments aim to help central government employees cope with the increasing cost of living. In summary, central government employees can anticipate a notable increase in their take-home salary due to the recent DA hike.

Calculation of Dearness Allowance

After the Second World War, the DA component was introduced by the government. After 2006, the formula for calculating dearness allowance has changed and currently, DA is calculated as follows:

For Central Government employees:

Dearness Allowance % = ((Average of AICPI (Base Year - 2001=100) for the past 12 months -115.76)/115.76) *100 |

For Central public sector employees:

Dearness Allowance % = ((Average of AICPI (Base Year - 2001=100) for the past 3 months -126.33)/126.33) *100 |

Where, AICPI stands for All-India Consumer Price Index.

For example, consider that your base income is Rs.33,000 and that, with the most recent 4% increase, your DA percentage is 38%, meaning that your dearness allowance is Rs.12540.

The Indian Pay Commission re-evaluates the salaries of government employees before submitting its report which contains detail review and analysis of all salary component. The multiplication factor used for DA calculation is calculated by the Pay Commission. The hike in DA also benefits the pensioners to tackle the rising inflation.

Factors Affecting Calculation of DA

The following is the list of factors that affect the DA calculation:

- Consumer Price Index (CPI): This is a vital factor considered in determining the DA and it is adjusted based on the CPI fluctuations that signifies the change in cost of commodities and services.

- Base Index: This factor is a predefined year’s index which is used as a reference to compare the cost of living.

- Inflation: This influences the DA rate directly and hence the purchasing power decreases with an increase in inflation to compensate for the higher cost of living. Inflation is the key factor used in determining the periodic revision of DA which is measured through CPI or WPI (Wholesale Price Index).

- Cost of living: To cope with the cost-of-living DA is designed which is based on location as cost of living is higher for urban areas than rural areas or semi-urban regions. The factors included in DA calculation are housing cost, transportation cost along with basic necessities.

- Industrial average: Tracking overall performance of various industries plays a vital role in DA calculation. DA rates experience upward revision in case of rise in industrial wage to keep the employee wages aligned with industry standards.

- Policies set by the employer: Different employers set have distinct rules for DA calculations, such as guidelines for Public Sector Undertakings (PSUs) are different from that of central government companies.

- Frequency of revision: DA is revised twice a year in January and July based on economic conditions to compensate for the inflationary pressure.

Types of Dearness Allowance

Dearness Allowance (DA) is a vital component of an employee's salary, particularly in government sectors, designed to protect workers from the effects of inflation. The Indian government offers different types of DA based on the nature of employment. The primary categories are Variable Dearness Allowance (VDA) and Industrial Dearness Allowance (IDA). Let’s explore these types in detail:

Industrial Dearness Allowance (IDA)

Industrial Dearness Allowance (IDA) is given to employees working in public sector enterprises (PSUs). Unlike VDA, which is revised biannually, IDA is adjusted quarterly to address inflation. The CPI is used as the basis for these adjustments, ensuring the allowance remains relevant to the prevailing economic conditions.

The government recently increased the IDA by 5%, benefiting employees in public sector undertakings. IDA is designed to provide financial relief to employees facing the rising cost of living. The quarterly updates help PSUs employees keep pace with inflation, ensuring that their salary doesn't lose its purchasing power over time.

Variable Dearness Allowance (VDA)

Variable Dearness Allowance (VDA) is provided to central government employees to offset inflationary pressures on their income. It is reviewed and adjusted every six months to reflect changes in the Consumer Price Index (CPI), which is an indicator of inflation.

Key Components of VDA

- Variable DA: This portion remains constant until the government revises the basic minimum wages.

- Base Index: Fixed for a specific period and doesn't change until a revision is made.

- Consumer Price Index (CPI): The CPI changes every month, and these fluctuations directly impact the VDA amount.

Each of these components plays a crucial role in determining the total VDA paid to employees. The government revises the VDA by factoring in changes in the CPI, which affects the overall purchasing power of employees. Hence, employees' DA is regularly updated to ensure it aligns with inflation rates and maintains their financial stability.

Criteria | Variable Dearness Allowance (VDA) | Industrial Dearness Allowance (IDA) |

Sector | Central Government Employees | Public Sector Enterprises (PSUs) Employees |

Revision Frequency | Revised every six months | Revised every quarter |

Adjustment Based on | Changes in the Consumer Price Index (CPI) | Changes in the Consumer Price Index (CPI) |

Components | 1. Variable DA (Fixed until minimum wages are revised) 2. Base Index (Fixed for a specific period) 3. CPI (Changes monthly) | 1. Fixed DA based on CPI 2. Quarterly revision |

Applicability | Central government employees only | Employees of public sector enterprises (PSUs) |

Recent Updates | Adjusted twice a year based on CPI | Recently increased by 5% for PSU employees |

How is DA Treated Under Income Tax?

Here are the details about how DA is determined under income tax:

- For salaried employees, DA (Dearness Allowance) is fully taxable.

- DA is considered part of the salary for retirement benefits, if an employee is given unfurnished rent-free accommodation, provided all conditions are met.

- The DA component to be listed separately in filed tax returns as per the requirements of Income Tax rules in India.

Role of Pay Commissions in DA Calculation

Role of Pay Commissions in Dearness Allowance (DA) Calculation:

Pay Commissions play a significant role in determining the salary structure for government employees in India, including the calculation and revision of Dearness Allowance (DA). The primary function of these commissions is to assess the salary components for public sector employees and make recommendations for any necessary revisions to ensure fairness and alignment with inflation.

Key Roles of Pay Commissions in DA Calculation

- Assessment of Salary Components: Pay Commissions review all the salary components, including Basic Pay, Allowances, and Dearness Allowance (DA). These components are then revised to reflect the prevailing economic conditions. As a part of the salary structure, DA is carefully evaluated for appropriate adjustment to offset inflation.

- Multiplication Factor for DA: One of the crucial tasks of the Pay Commission is to review and update the multiplication factor used in calculating DA. This factor determines how much DA an employee will receive based on changes in the Consumer Price Index (CPI). The multiplication factor ensures that DA remains relevant to the changing cost of living.

- Reviewing the DA Structure: The Pay Commission periodically assesses and revises the DA formula, including its structure and applicable rates. The purpose is to ensure that the DA provides adequate relief to employees against inflation, which is an external factor that the government cannot control.

- Impact on Employee Salaries: The revision of DA by the Pay Commission significantly impacts the salaries of public sector employees. A DA increase can result in a notable rise in an employee’s monthly income, helping them cope with inflationary pressures and maintain their standard of living.

- Pensioners’ Benefits: DA revisions are not limited to active employees. Pensioners also benefit from these revisions, as the DA is considered when adjusting pension amounts. This is especially important for retired government employees, ensuring they receive an income that keeps pace with inflation.

- Implementation by the 7th Pay Commission: The 7th Pay Commission is responsible for evaluating and revising salaries for government employees, including DA. This Commission plays a crucial role in determining the allowances and increments, ensuring that the salary structure is adjusted appropriately.

Dearness Allowance for Pensioners

The following are the details of DA for pensioners:

- DA for pensioners refers to retired central government employees and is eligible for both individual and family pensions.

- The pension of retired employees is impacted due to the changes in the salary structure by the Pay Commission.

- Based on changes in the Dearness Allowance (DA), pension amounts are adjusted.

- DA is granted on a time scale or fixed pay and pensioners do not receive DA if re-employed.

- In some cases, re-employed pensioners may receive DA, which is limited to their last drawn salary.

- Pensioners residing abroad while re-employed will not receive DA.

- Pensioners living abroad are eligible to receive DA on their pension if they are not re-employed.

Difference Between DA and HRA

The overall salary of a government employee is determined by adding the basic income, other components like HRA (House Rent Allowance), and the dearness allowance, which is computed as a specified proportion of the base wage.

HRA or House Rent Allowance is the salary component given by an employer to an employee to meet expenses related to the renting of accommodation which the employee takes for residential purposes. HRA applies to both employees from the private sector as well as the public sector whereas DA is majorly applicable to employees working in the public sector.

Dearness Allowance (DA) and House Rent Allowance (HRA) are two distinct components of an employee’s salary structure, which must not be confused with each other. Here are some of the key differences between DA and HRA:

Eligibility: DA is only available to public sector employees and pensioners, while both public and private sector employees are eligible for HRA.

Tax Exemptions: There are no tax exemptions available in the case of DA. However, certain exemptions apply to HRA, as per the provisions of the Income Tax Act.

Calculation: DA is calculated as a percentage of the basic salary of a public sector employee. On the other hand, HRA is not calculated as a percentage of the basic salary. It is a component of an employee’s salary that helps to fulfil the requirements for renting accommodation.

Purpose: DA is a cost-of-living adjustment offered to public sector employees by the Government to curb inflation. In contrast, HRA is meant to help employees fulfill their housing requirements by providing a part of their salary to pay for rental accommodation.

The difference between DA and HRA are given in the table below:

Category | DA | HRA |

Eligibility | Only available to public sector employees and pensioners. | Both public and private sector employees are eligible. |

Tax Exemptions | There are no tax exemptions available. | Certain exemptions apply to HRA, as per the provisions of the Income Tax Act. |

Calculation | DA is calculated as a percentage of the basic salary of a public sector employee. | HRA is meant to help employees fulfill their housing requirements by providing a part of their salary to pay for rental accommodation. |

Purpose | DA is a cost-of-living adjustment offered to public sector employees by the Government to curb inflation. | HRA is meant to help employees fulfill their housing requirements by providing a part of their salary to pay for rental accommodation. |

In summary, while both DA and HRA are components of an employee’s salary, they serve different purposes and have distinct eligibility criteria, tax implications, and calculation methods.

Dearness Allowance Merger

The following is the list of details regarding DA merger:

- Since the revision of the calculation formula, the DA (Dearness Allowance) for public sector and central government employees has been steadily increasing.

- DA is at 50% of the basic salary as per the current rate.

- To counter the effects of inflation, the DA is increased annually.

- As per the rules, DA is merged with basic salary if it exceeds 50%.

- Salary increases significantly on merging DA with the basic salary, as other salary components are based on the basic salary.

- Employees have raised this demand with the Government, and a decision is expected soon.

- If the government approves, this decision will lead to a substantial salary boost for the employees.

FAQs on Dearness Allowance

- What is the Full Form of DA in Salary?

The full form of DA in salary is Dearness Allowance.

- When is Dearness Allowance (DA) revised for employees?

DA is reviewed biannually, once in every 6 months on the basis of the cost-of-living index.

- Which rule grants Dearness Allowance to pensioners and the family pensioners?

The Pension Rule 50A grants public sector pensioners and family pensioners DA in order to compensate for inflation or price rise.

- Is Dearness Allowance applicable to the employees and pensioners of private sector?

No, the employees and pensioners of private sector employees in India are not entitled to receive Dearness Allowance as a part of their salary.

- How is Dearness Allowance or DA computed on pension?

Pensioner's Dearness Allowance is computed on the basic pension of an employee without commutation. This means, an employee receives a specific percentage of his/her original pension as DA.

- Does Dearness Allowance differ on the basis of work location of an employee?

Yes, DA differs for the employees depending on their work location. Since DA is directly connected to the cost of living, it is not the same for all employees and varies for employees working in rural, urban, and semi-urban areas.

- When is Dearness Allowance merged with the basic salary of an employee?

DA is merged with the basic salary of an employee when it exceeds the limit of 50%. This merging results in a significant hike in the salary of the employees. Currently, DA stands at 50% of the basic salary of an employee.

- Does an employee need to pay tax for Dearness Allowance?

Yes, a salaried employee has to pay tax for Dearness Allowance since it is taxable for employees having a regular salary according to the latest tax updates. Also, under the Income Tax Act, 1961, it is mandatory to declare one's tax liability for DA during Income Tax Return (ITR) Filing.

- Do pensioners have the eligibility to draw Dearness Allowance during reemployment?

Pensioners who are reemployed under the State government, Central government, an Autonomous or local body, or government undertakings, don't have the eligibility to draw Dearness Allowance in cases where DA is granted along with fixed pay or time scale. Except for this, in all other cases of reemployment, DA is granted to a re-employed pensioner depending on the limit of the last drawn emoluments.

- Is Dearness Allowance granted to pensioners who stay abroad?

DA is not granted to pensioners while they are staying in any place outside India during reemployment. Pensioners who are staying abroad without reemployment are allowed to receive DA on pension.

News about Dearness Allowance

Madhya Pradesh government has announced an increase in Dearness Allowance for state government employees

Madhya Pradesh state government employees will see a rise in their Dearness Allowance (DA) to 55% under the 7th Pay Commission norms. Currently the state government employees of MP receive 50% DA, which will increase by 3% effective from 1 July 2024, followed by an additional 2% from 1 January 2025. The arrears for the revised DA will be disbursed in five installments from June to October 2025.

Gujarat Govt Announces 3% DA Hike for Employees and Pensioners

In a significant decision, the Gujarat government has approved a 3% increase in dearness allowance (DA), raising it to 53% of the basic pay for approximately nine lakh employees and pensioners. The revised DA, effective retrospectively from 1 July 2024, was announced on Wednesday through a resolution by the state finance department. Employees and pensioners will receive arrears for the July-November period along with their December salaries and pensions, disbursed in January 2025. Beneficiaries include state and panchayat employees, secondary and higher secondary school staff, and personnel in aided non-government schools under the 7th Pay Commission.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.