MCD Property Tax in Delhi - How to Pay MCD House Tax Online

If you own a residential property in Delhi, then you will have to pay property tax to the Municipal Corporation of Delhi. All the properties including the vacant ones which comes under the purview of the body will be charged with the MCD property tax.

The Delhi municipal corporation replaced by three new bodies in 2012. Residents of the respective municipal corporations need to pay their property tax within a fixed deadline and payment can be made through the online portal.

List of Municipal Corporations in Delhi

Here are the three types of municipal corporation in Delhi are as follows:

- East Delhi Municipal Corporation (EDMC)

- South Delhi Municipal Corporation (SDMC)

- North Delhi Municipal Corporation (NDMC)

East Delhi Municipal Corporation (EDMC)

People possessing a property in East Delhi Municipal need to pay property tax by visiting official website. EDMC is divided into two zones which are Shahdara North and South, which is further categorised into six wards and five colonies each.

North Delhi Municipal Corporation (NDMC)

Property owners residing in North Delhi must pay property tax under specified deadlines to the North Delhi Municipal Corporation. Individuals residing in North Delhi in any of the six zones such as City-SP Zone, Civil Lines, Karol Bagh, Narela, Rohini, and Keshav Puram.

South Delhi Municipal Corporation (SDMC)

South Delhi Municipal Corporation is divided into five zones, which are Central, South, West, and Najafgarh. Individuals possessing properties in any of these four zones in South Delhi will have to pay tax to the SDMC. The property owners can pay their property taxes through offline and online mode. Individuals need to visit the official portal to pay property tax online.

How to Pay MCD Property Tax?

How to Pay MCD Property Tax Online 2026?

Given below are the steps you will have to follow in order to pay the MCD Property Tax online:

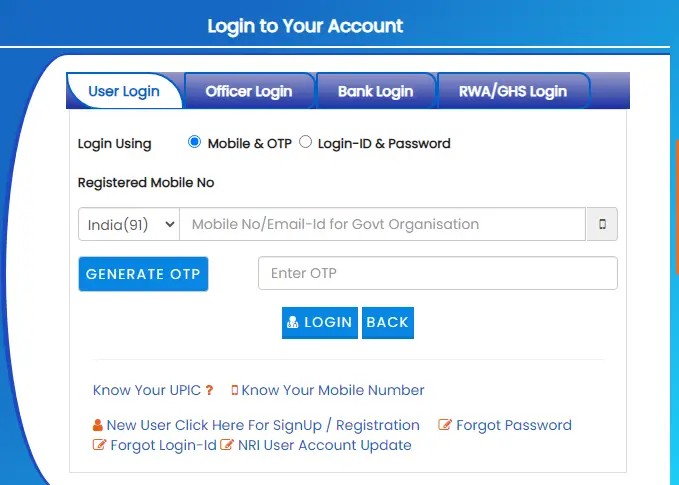

Step 1: Visit the official MCD Property tax website

Step 2: Provide your 'Registered Mobile Number' and click on 'Generate OTP'

Step 3: Now, enter 'OTP' and click on 'Login'

Note: If you are a new user, click on the 'SignUp / Registration' option.

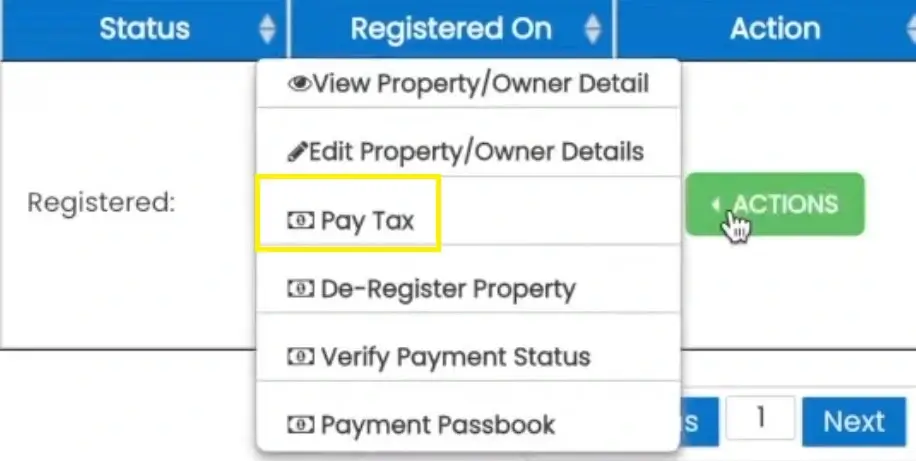

Step 4: Next, complete property details will be shown on screen, like UPIC, Property Type, Owner Type, Name, Address, Status and Registration Details.

Step 5: Click on 'Actions' button and click on the ''Pay Tax" option.

Step 6: Choose the 'Financial Year' for which property tax is to be paid and click on 'Submit'

Step 7: Next, the pop up is shown as 'Is there any Modification/Change in the Property/Owner Details from Last Tax Paid'.

Step 8: If you wish to change, then click on 'Yes, I want to Edit before I Pay' or click on 'No, I want to Pay'.

Step 9: Now, It redirected to the Tax Calculator page with complete Property details. also, shows the rebate percentage as well.

Step 10: Cross check all the details and click on 'Download PDF' and then select 'Pay Tax' button at the end.

Step 11: Now, Select your preferred payment mode- Credit card, debit card, or net banking and click on 'Pay now'

Step 14: Once payment is done, It shows the status as 'Success'

Note: Download the Receipt for your future reference.

Offline Method of Paying Delhi House Tax

You also have the option to pay your tax at any of the 800 ITZ cash counters conveniently located throughout Delhi. Upon completion of payment, you'll receive an instant MCD property tax receipt. This receipt includes a property tax ID, which proves useful for future tax payments.

Moreover, the entire property tax in Delhi must be paid in a single lump sum before the first quarter of the financial year ends. Therefore, ensure to settle your MCD property tax dues online or offline by the payment deadline, which is 30 June.

How to Pay MCD Property Tax through App?

You can pay your property tax conveniently through the official MCD App. Follow these steps:

Step 1: Open the Play Store or App Store on your mobile device and search for the MCD App.

Step 2: Install the app by clicking on the "Install" button.

Step 3: Create an account on the app using your mobile number and verify it with the OTP received.

Step 4: Navigate to the 'Registered Property Details' section and select 'Pay Tax.'

Step 5: Choose the applicable financial year for which you want to make the payment.

Step 6: Proceed to complete the payment using options like credit/debit card or net banking.

Step 7: Ensure to download the receipt for your records after making the payment.

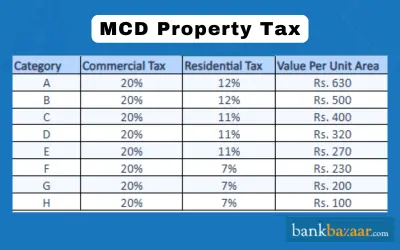

MCD Property Tax Rates in Delhi 2026

Property tax rates in Delhi are set by local authorities like the Municipal Corporation or the local Panchayat. Delhi is divided into 8 sectors from A to H, each with its own tax rates for residential and commercial properties:

Sector | House Tax Rate | Commercial Tax Rate |

A | 12% | 20% |

B | 12% | 20% |

C | 11% | 20% |

D | 11% | 20% |

E | 11% | 20% |

F | 7% | 20% |

G | 7% | 20% |

H | 7% | 20% |

How to Calculate Property Tax in Delhi?

The Municipal Corporation of Delhi uses the 'Unit Area System' for calculation of property tax all over the city. The formula used for how to calculate of house Tax is given below:

- House Tax = Annual Value * Rate of Tax

- Annual Value = Unit area value per square meter x unit area of property x age factor x use factor x structure factor x occupancy factor

- Rate of Tax = MCD publishes the rate of tax for A-H categories every year. You can find the applicable rate of tax on the official website of MCD Property Tax.

Where

Unit area value - This is the value per square meter assigned for the built-up area of the property.

Unite area of property - The built-up area not in the carpet area per square meter.

Age factor - Newer properties are levied higher tax as compared to old ones. The age factor is based on the age of the property, where the value of this factor ranges between 0.5 to 1.

Use factor - Residential properties are levied lower tax as compared to the non-residential properties. The value of factor assigned is 1.

Structure factor - RCC constructions are levied higher tax in comparison to low value constructions.

Occupancy factor - Properties that are rented out are levied higher tax as compared to the self-occupied ones.

Exemption for MCD Property Tax

Given below are the bodies/individual who are exempted from the payment of property tax:

- Vacant land or buildings used as place of worship, public burial, heritage land, or used for charitable purposed by any body or individual.

- Agricultural land or building.

- Land or building vested in corporation.

- Property owned by an ex-servicemen or widow of a person martyred in war. The property should only be used as a self-residence and no portion of it is let out.

- Properties martyred on paramilitary or police duty.

- Property owned by a South MCD employee who is handicapped but fully on duty.

- Any sportsperson who has won awards for any international games.

Rebates on Property Tax in Delhi

In India, property tax rebates serve as incentives offered by local authorities to foster adherence to property tax regulations and to stimulate specific activities. Below are the types of rebates available:

Type | Percentage of Rebate |

DDA/CGHS flats | 10% of the annual value, up to 100 sq meters of covered area |

Group Housing Flats | 20% up to 30th June of the FY |

Senior citizens, Women, Physically challenged individuals, Ex-servicemen | 30% on one property and up to 200 sq meters |

Conditions for availing the rebate

- Rebate is offered for up to a maximum of 200 square metres except for DDA/CGHS flats which have a limit of up to 100 square meters.

- The Occupancy factor should be residential.

- Use factor should be self-occupied.

- In the case of joint owners, concession will be offered based on the property share of the owners who qualify for concession on property tax.

How to Raise Complaints in Municipal Corporation of Delhi?

- In case of any queries related to the payment of your property tax, you can lodge a complaint by visiting the official website of MCD property tax.

- Under the 'grievance' section click on 'Lodge grievance reg tax receipt'.

- You will be directed to a separate page where you will have to enter the property id, name of the taxpayer, contact number, and the mode of payment through which the tax was paid.

- Click on 'Submit'. An official from MCD property tax office will get in touch with you and will help you with your query.

Toll-free Number of the Municipal Corporation of Delhi

Email Id: mcd-ithelpdesk@mcd.nic.in

MCD Toll-free number: 155305

Address: 24th Floor, Dr. S.P.M. Civic Centre, Minto Road, New Delhi, 100002.

Related Articles on Property Tax

Penalty for Delay Payment of MCD Tax

- In case you delay the payment of property tax, a fine of 1% will be levied each month by the MCD on the tax amount payable.

- The deadline for the payment of tax is announced by Delhi Municipal Corporation (DMC).

What Is the MCD Property Tax Deadline?

Property owners in Delhi often inquire about the deadline for paying their property taxes to the Municipal Corporation of Delhi (MCD). These taxes play a crucial role in funding essential services such as sanitation, roads, and public health provided by the MCD.

The deadline for MCD house tax payments may vary based on the location and specific regulations of the municipal corporation. Generally, property tax payments are due annually and can be made either in installments or as a lump sum.

How to Find Your Jurisdiction for Paying Property Tax in Delhi?

To determine your jurisdiction for property tax payment in Delhi, follow these steps:

- Visit the official website of the Municipal Corporation of Delhi (MCD) at http://mcdonline.gov.in.

- Click on the 'Property Tax' option on the homepage.

- Select the 'Know Your Property Tax Jurisdiction' option from the list of services on the next page.

- Enter your property ID or unique identification number, which is typically found on your property tax bill or receipt. If you don't have this information, you can search for your property by entering the complete address.

- Click on 'Search' to retrieve your property details and jurisdiction information.

- Once you have identified your jurisdiction, you can proceed to pay your property tax online or visit the designated MCD office in your area.

- Alternatively, you can visit the MCD office in your locality and request assistance in determining your property tax jurisdiction. The officials there will help you process and facilitate payment of your property tax.

What to do if you can't find your Property ID?

If you're unable to find your property ID in Delhi, consider the following steps to locate it:

- Search online for property details: Utilize the MCD website to search for your property details. Enter your property's address in the property tax search section. If multiple properties with the same address appear in the search results, compare details such as property type, size, and owner's name to identify your property.

- Review old property tax bills or receipts: Check any previous property tax bills or receipts you may have. The property ID is typically printed on these documents.

- Seek assistance from a property consultant: If you're still unable to locate your property ID, consider hiring a property consultant or lawyer specializing in property matters. They can help you find your property ID and provide guidance on the property tax payment process.

- Paying property tax on time is crucial to avoid penalties or legal issues. If you're having difficulty locating your property ID, it's advisable to seek assistance from the MCD or a property consultant promptly.

- Keep in mind that MCD house tax payment is calculated based on factors such as the size and location of your property. Therefore, ensure to enter accurate details when making the payment and retain a copy of the payment receipt for future reference.

FAQs on MCD Property Tax

- What is the last date to pay Delhi property tax?

The last date to pay Delhi property tax is 31 July on every year.

- In Delhi, who is in charge of property taxes?

Property taxes in Delhi are due from real estate owners in accordance with Section 66 of the NDMC Act. The estate under consideration may be either a residential or commercial building. Furthermore, whether a home is occupied or rented out, the owner is still required to pay this tax.

- How is the MCD property tax calculated?

The property tax is calculated based on the formula 'Property Tax = Annual Value x Rate of tax'.

- Is municipal tax and property tax the same?

No, municipal tax and property tax are two different tax that you will pay. However, property tax is a type of municipal tax charged by the municipal corporation.

- Can I pay the MCD property tax offline?

Yes, you can pay the MCD property tax offline by visiting any of 800 ITZ cash counters which are located strategically all over Delhi. It is recommended that you pay the tax either by cheque or by demand draft. Once the payment is made, you will receive a receipt which will contain the property tax id and could be used for future reference.

- I don't remember my property tax ID. What should I do?

It is highly recommended that you do not forget your property tax ID as a new one will not be provided. In case you forget your ID, get in touch with an MCD official who will help you with the process. You will also be penalised for the allotment of a new property tax ID.

- What are the consequences of not paying Delhi property tax?

The authority has the right to recover the tax under Sections 155 and 156 of the Delhi Municipal Corporation Act, 1957, by way of attachment of property, bank account, rent and all moveable properties, in case someone fails to pay property tax.

- What are the contact details of EDMC?

The EDMC has two zones Shahdara North and Shahdara South. For Shahdara North the contact details are 011-22824294 and 011-22501117. People can reach out the Shahdara South by sending email to dyancsnz@mcd.org.in and dyancssz@mcd.org.in.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.