How to Download Form 26AS from TRACES Online

What is Form 26AS?

Form 26AS is an annual statement that includes all the details about the TDS or TCS issued on a taxpayer's income. It includes details of self-assessment tax payments, advance tax, and high-value transactions undertaken by the taxpayer.

Certain documents are essential to verify your tax obligations when filing your Income Tax Returns (ITRs), and one of those documents is Form 26AS, or tax credit statement. To ensure that tax filing is done correctly, taxpayers must understand Form 26AS, its objective, and its significance in the process.

How to View and Download Form 26AS?

Here are the Steps to Download Form 26AS::

Step 1: Visit official Income Tax e-filing website

Step 2: Click on 'Login' and enter the 'User ID' and click on 'Continue'.

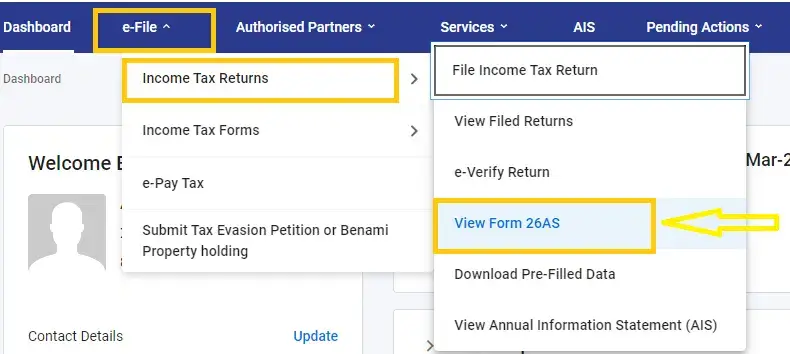

Step 3: Now, Go to e-file > Income Tax Returns > View form 26AS as shown in below screenshot.

Step 4: Then, click on 'View Form 26AS' and Select 'Confirm' next.

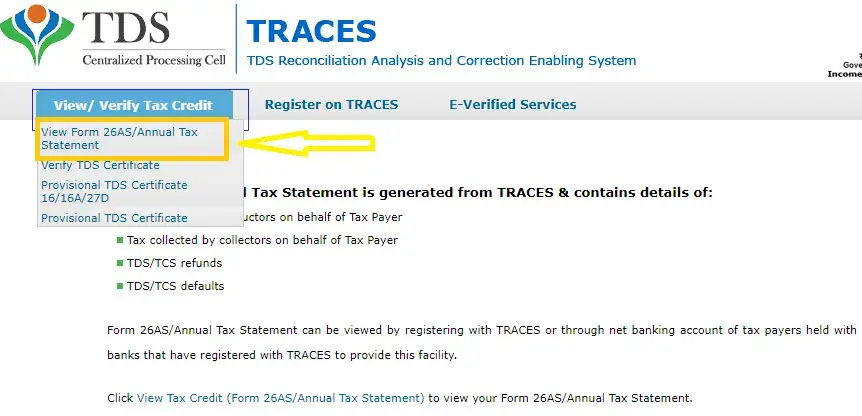

Step 5: Now, Its Pop up with 'Disclaimer' Click on 'confirm'. You will be redirected to TDS-CPC portal.

Step 6: Next, click on 'View Tax Credit (Form 26AS)'.

Step 7: Select the 'Assessment Year' and format you need to view Form 26AS.

Step 8: Click on the ‘View/ Download’ button and then ‘Export as PDF’

Information that can be Interpreted from Form 26AS

- Amount of tax deducted on your income

- Details regarding the tax collected

- Details of any tax paid in advance

- Self-assessment of the tax payment

- Regular assessment of the deposited tax

- Details regarding shares, mutual funds, high value transactions, etc.

- Tax deducted on selling immoveable property

- Details regarding yearly turnover

- Details regarding received income tax refund.

Different Parts of Form 26AS

Part | Details |

PART I: Details on Tax Deducted at Source (TDS) | This section records TDS deducted on various income sources such as salary, professional fees, business earnings, and interest. |

PART II: TDS Details for Form 15G/15H Submissions | It includes information about the cases where TDS was not deducted by submitting Form 15G or Form 15H, this applies to the senior citizens with income below the taxable limit. |

PART III: TDS on Non-cash Transactions (Section 194B, 194R, 194S) | Covers TDS on benefits received in kind, such as gifts, incentive-based foreign trips, or prizes like cars won in lottery. |

PART IV: TDS on Rent, Property, Professional Fees & Virtual Digital Assets | Displays TDS deducted under Sections 194IA, 194IB, 194M, and 194S for:

|

PART V: TDS on Virtual Digital Assets (Form 26QE) | Includes TDS details for virtual digital asset sellers under specific tax provisions. |

PART VI: Tax Collected at Source (TCS) Details | Details on the TCS collected under Section 206C for various transactions. |

PART VII: Tax Refund Details | Provides information on refunds issued by the CPC-TDS. Additional details can be checked in the AIS (Annual Information Statement) on the e-filing portal. |

PART VIII: TDS Details for Buyers/Tenants/Contractors | Records of TDS deductions for property buyers, tenants paying rent over Rs.50,000 per month, those making professional or contractor payments exceeding Rs.50 lakh, and buyers of virtual digital assets. |

PART IX: Transactions & Demand Payments under Section 194S (Form 26QE) | Covers tax-related transactions and demand payments linked to virtual digital assets. |

PART X: TDS or TCS Defaults & Processing | Highlights defaults detected during TDS return processing, excluding those raised by the assessing officer. |

How to View Form 26AS from Net Banking Facility?

A PAN holder who has a net banking account with any authorised bank is eligible to access Form 26AS. Only if your PAN number is connected to that particular account may you read your Form 26AS. This service is provided for free.

The banks that have registered with NSDL to enable users to view Form 26AS include the following:

Axis Bank | Corporation Bank | IDBI Bank |

Citibank | Bank of Maharashtra | Indian Bank |

Bank of India | City Union Bank Limited | Oriental Bank of Commerce |

ICICI Bank | Indian Overseas Bank | State Bank of Mysore |

Bank of Baroda | Kotak Mahindra Bank | Indian Bank |

State Bank of India | Saraswat Co-operative Bank | State Bank of Patiala |

Federal Bank | Union Bank of India | UCO Bank |

State Bank of Travancore | - | - |

Why is Form 26AS Important?

Some of the reasons why Form 26AS is important are given below:

- You can check whether the deductor has correctly filled the TDS statement or if the collector has accurately filled the details of Tax Collected at Source (TCS). The form contains all the details of the tax deducted and collected on behalf of

- You can also check whether the tax deducted and collected on behalf of you has been deposited in the government account on time.

- You can verify the tax credits and calculation of income tax before filing your income tax return.

What are the Benefits of Form 26AS?

The benefits of Form 26AS are given below:

- Form 26AS provides vital details about tax deducted/collected and deposited with government tax authorities by authorized deductors/collectors.

- It allows taxpayers to review all financial transactions involving TDS/TCS for the relevant financial year.

- Form 26AS aids in income computation and facilitates claiming tax credits when filing an Income Tax Return (ITR).

- It also serves as a confirmation for verifying refunds during the applicable financial or assessment year.

TDS Certificate vs. Form 26AS

Some of the things you must verify in your TDS certificate with Form 26AS are given below:

- Do not forget to check whether certain details mentioned in your form are correct or not. Make sure your name, Permanent Account Number(PAN), Deductor's TAN, refund amount paid to you, and TDS amount on Form 26AS are correctly mentioned. These details are extremely important and in case any of the details are found to be incorrect, you will find difficulties in filing your income tax returns.

- You will have to verify that your TDS as shown in the certificate has been received by the Central Government of India. You can do this by comparing the TDS data on the Form AS data with your payslips data.

- Check whether the TDS shown in Form 16/16A is also reflecting on your Form 26AS correctly. If the TDS is not reflecting in your Form, then it means that the deductor has deducted the TDS but is yet to submit it to the IT department. In such a case, get in touch with your deductor immediately and get the issue resolved at the earliest.

Top Pages on Tax

- Comprehensive Guide on Income Tax in India 2023

- Income Tax Slabs for FY 2023-24

- E-Filing Income Tax Returns in India 2023

- Income Tax Returns (ITR) - Comprehensive Guide

- Income Tax Refund

- How to File Income Tax Return (ITR) Online in 2023

- Goods and Services Tax - GST Full Form, Meaning & Details

- Advance Tax Payment - How to Calculate and Pay Tax Online?

- House Rent Allowance (HRA)

How AIS Complements Form 26AS for Taxpayers

The Income Tax Department has come up with Annual Information Statement, also known as AIS with an aim to incorporate new information such as off market transactions, foreign remittances, mutual fund purchases, interest received on income tax refunds, break up details of salary and ITR information of another person.

The income tax department was already availing these details from the authorized bodies.

For example, banks submit Form 15CC for payment done to NRIs, transfer agents, and depositors report off market. Furthermore, salary break up details are present in Form 16 from the information uploaded by employers on the TRACES portal.

FAQs on Form 26AS

- How to download Form 26AS in excel format?

First, you have to log in to the e-filing account, then go to the ‘e-File’ option, click’Income Tax Returns’ and choose ‘View Form 26AS’. Now, read the disclaimers and click on ‘Confirm’. Now, click on ‘View tax credit’, select the ‘Assessment Year’, View Type’ as ‘Excel’, and click the View/Download button.

- How to rectify errors in Form 26AS?

One of the effective ways to correct the errors in Form 26AS is to inform the deductor and tell him to file a rectified TDS return.

- What comes under Form 26AS?

This form contains all information on the tax deducted from your income. It includes the details of the tax collected by collectors, self-assessment tax payments, advance tax paid by you, assessment tax deposited by you, and refund details.

- What are the TDS related forms that I need to submit?

In Part A1 of this form, you will have information about your income where TDS has not been deducted when you have submitted Form 15G/Form 15H.

- What is the importance of Form 26AS?

This form is an annual credit statement (consolidated) that is issued about your PAN. You must compare Form 16, which is received from your employer, with Form 26AS.

- What do I do if the amount of advance tax paid in the bank is wrongly reflected in my Form 26AS?

This may be because the bank has made an error in its data entry. You must take up this issue with your bank and rectify the amount.

- Can I make changes to the address and name of the PAN holder which is there in Form 26AS?

Yes, if the details of the PAN holder are incorrect, you can constantly update this. You should apply the 'Request for new PAN card or/and changes or correction in PAN data' option on the official website.

- When does Form 26AS get updated?

Form 26AS gets updated when the income tax department processes the TDS return filed by the taxpayer.

- What is the password of Form 26AS in PDF format?

The password of Form 26AS in PDF format is the taxpayer’s date of birth/incorporation in DDMMYYYY format.

- How to view Form 26AS through net banking?

Taxpayers can view or download Form 26AS through the net banking of any authorized bodies. You can view Form26AS via net banking of any bank. Form 26AS can be seen if your PAN is linked to the bank account.

- Why is Form 26AS needed?

Form 26AS is needed as it offers proof of tax deducted and collected at source on behalf of taxpayers. In addition, it confirms that banks and employers have deducted specific taxes on your behalf and deposited them in the government’s account.

- When will TDS reflect in Form 26AS?

TDS will get reflected in Form 26AS after you file a TDS return, and it will be processed by the CPC. The entire process will take around seven days.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.