Guide on How to Register and Login to the Income Tax Portal

The Income tax login process and the filing of tax returns have become easier. It is now compulsory on the part of the taxpayers to register themselves with the IT department and file their income tax online. However, the e-filing of income tax has been made compulsory now, and a taxpayer is required to be registered under the Income Tax Department website for the same.

Note: You can now file your taxes through the New income tax portal. The New portal comes with many features and is designed to ease the tax filing process.

Documents Required for Registration Process on Income Tax Portal

The following Prerequisites are required for the registration process:

- Permanent Account Number (PAN)

- Mobile Number

- Email Address

- Proof of Address

In order to be able to file your income tax returns (ITR) on the Income Tax Department Portal, before login you will be required to register yourself on the official website.

Step-by-Step Guide to Registering on the Income Tax Portal

Follow the steps to create Income Tax Account with incometax.gov.in site:

- Step 1: Visit the official Income Tax Department Portal and click on the 'Register Yourself' option.

- Step 2: Enter your PAN number and click on 'Validate'.

- Step 3: Then select 'Yes' and Click on 'Continue' button.

- Step 4: Enter your basic details such as your name, surname, date of birth, etc

- Step 5: Provide your Email ID, Mobile Number, complete postal address and then click on 'Continue'.

- Step 6: After the Registration Form is filled up, the individual will be required to verify the registration.

- Step 7: Now, Enter 6-digit One Time Password (OTP) that is sent to the registered mobile number and email ID.

- Step 8: Upon completion of this entire process, the registration process will be completed.

- Step 9: Once you have verified the OTP, a new window will open where you will have to verify the details and ensure they are correct.

- Step 10: Once all the details have been verified, you will have to set up a password and secure login message.

- Step 11: Click on 'Register', following which you will receive an acknowledgment message stating that your registration is successful.

How to Log In to the Income Tax Portal for E-Filing

Once an individual is successfully registered on the Income Tax Department Portal, he/she can use the Income tax login credentials to log in to the Income tax portal.

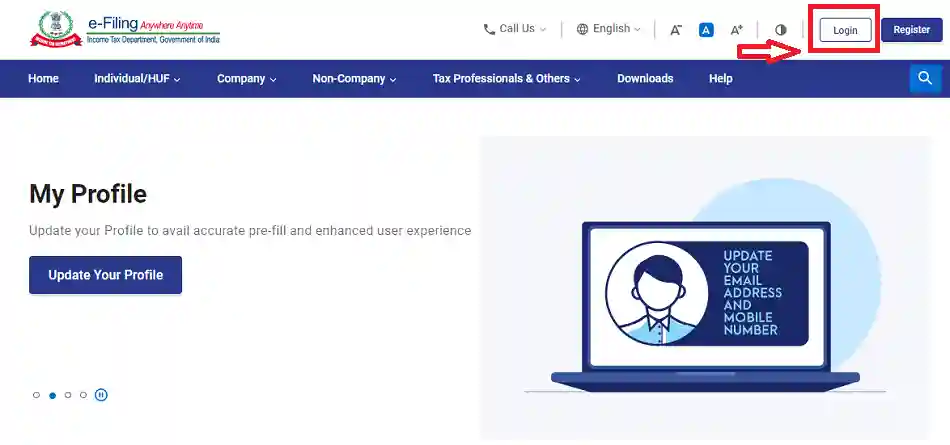

- Step 1: Visit the official Income Tax Department Portal

- Step 2: Click on the 'Login Here' option on the homepage.

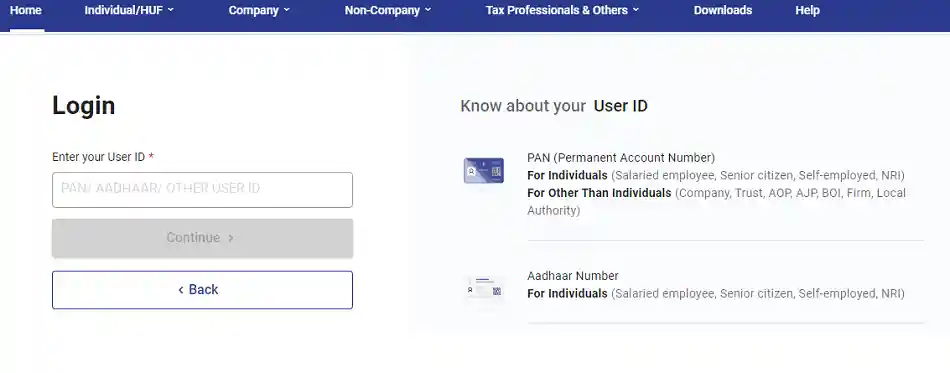

- Step 3: The user will be redirected to a new webpage. On this page, the user will be required to fill up his/her User ID.

- Step 4: Click on 'Continue', and proceed to Enter your password and confirm your secure access message.

How to Reset the password for income tax e-filing

Follow the steps given below to reset the password:

Step 1: Visit the income tax e-filing's home page and choose the option to reset the password.

Step 2: Enter your PAN number.

Step 3: Reset your password by choosing one of the below-mentioned passwords:

- Aadhaar OTP

- Upload DSC

- OTP

- Answer secret question

Step 4: Once you complete the chosen procedure, your password will be reset.

How do I Activate my Income Tax Login?

Step 1: Visit the income tax e-filing portal

Step 2: Click on the ‘Register’ tab.

Step 3: Choose the ‘Others’ option.

Step 4: Choose ‘Tax Deductor and Collector’ from the dropdown menu present under ‘Category’ tab.

Step 5: Fill in the TAN number and click on ‘Validate’ tab.

Step 6: Choose the scenario as per your requirements.

Step 7: Click on ‘Continue’ tab.

Step 8: Fill in all the required details.

Step 9: Fill in the OTPs received on your registered Email ID and mobile number.

Step 10: Check all your details and confirm the same.

Step 11: Set the password.

How to Disable Secure Login on the Income Tax Portal?

Follow the steps mentioned below to turn off secure login:

Step 1: Login on the e-filing portal

Step 2: Below the ‘Profile-setting’ tab, choose the ‘e-filing vault – Higher Security’ option.

Step 3: Unselect the previously chosen security option.

Step 4: Select the ‘Proceed’ option

Step 5: Select the ‘Disable’ option.

How to Change Your Name on the Income Tax Portal?

- Step 1: Visit the e-filing portal and log in using your user ID and Password.

- Step 2: Now, Go to My Profile option and click on it.

- Step 3: Select Update my profile option.

- Step 4: Click on the Edit option and update your personal information.

FAQs on Income Tax Login Portal

- After how many attempts will my income tax login get locked?

The income tax login account will get locked after five failed attempts. The account can be unlocked using ‘Unlock your account’ option or it will automatically get unlocked after 30 minutes.

- What is the username for income tax login?

Your PAN number is your username for income tax login.

- Can I e-verify ITR without logging in on income tax portal?

Yes, you can use the e-verify facility to verify ITR without logging in on income tax portal.

- Can I login to my income tax account without password?

No, you cannot login to your income tax account without password.

- Can I use my Aadhaar Card to login to my income tax account?

Yes, you can use your Aadhaar Card to login to your income tax account provided it is linked to your PAN.

- Can I login to my income tax account through net banking?

Yes, you can login to your income tax account through net banking provided your bank provides the facility. Most of the top banks in India offer this facility to their customers.

- How to login with DSC in income tax website?

You can either login through net banking or by directly logging in to your income tax e-filling portal on www.https://www.incometax.gov.in/iec/foportal/.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.