How to Check Your PF Status Online in 2026

The Employees' Provident Fund is a scheme that helps individuals save towards their retirement. Contribution (12% of the employee's basic salary) towards the scheme is made by the employer and employee each.

The EPF scheme is handled by the Employees' Provident Fund Organisation. Various benefits of the scheme can be availed by employees during the time of employment or after their retirement. The EPFO introduced the Universal Account Number (UAN) that is allotted to all the members of the scheme.

Under the Employees Provident Fund (EPF) scheme, individuals will be able to withdraw money by using the Employees' Provident Fund Organisation (EPFO) portal. The advantages of checking the claim status online are:

- Simple procedure

- Takes less time

- No documents required

With the introduction of the UAN, various details such as PF withdrawal, PF balance, transferring of PF from one account to another as well as updating 'Know Your Customer' details have become very simple.

Steps to Check Status of a Claim

Once individuals have requested the withdrawal of PF funds, it is very easy for them to check the status of their claims. This has become possible only after the introduction of the UAN portal by the EPFO. In order for employees to check their claims online, the below-mentioned information must be available to them:

- UAN

- Name and extension code (if needed) of the company

- Employer's EPF regional office

Once the individual has all the above information, the EPF claim status can be found by using the below mentioned procedures:

On EPFO Portal

Employees can check the claim status directly from the EPFO portal by following the below-mentioned procedure:

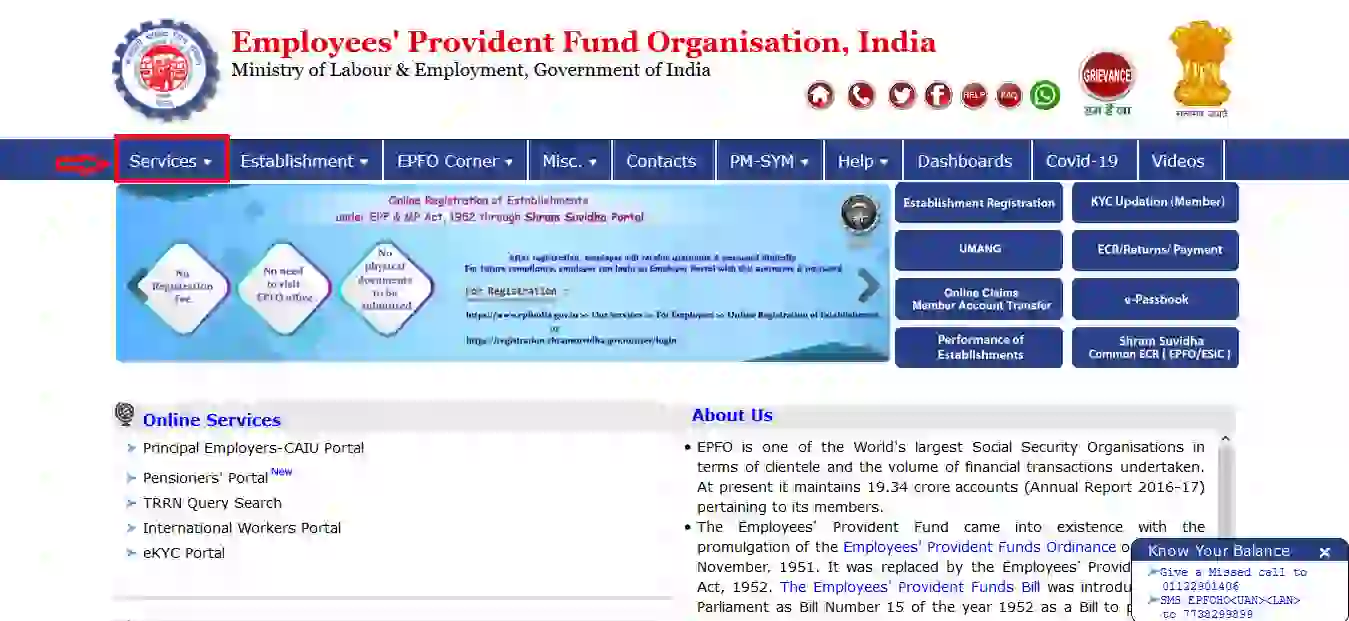

Step 1: First, employees must visit the portal of the EPFO (https://www.epfindia.gov.in/site_en/index.php).

Step 2: Next, employees must click on 'For Employees'. This option can be found under the 'Our Services' menu.

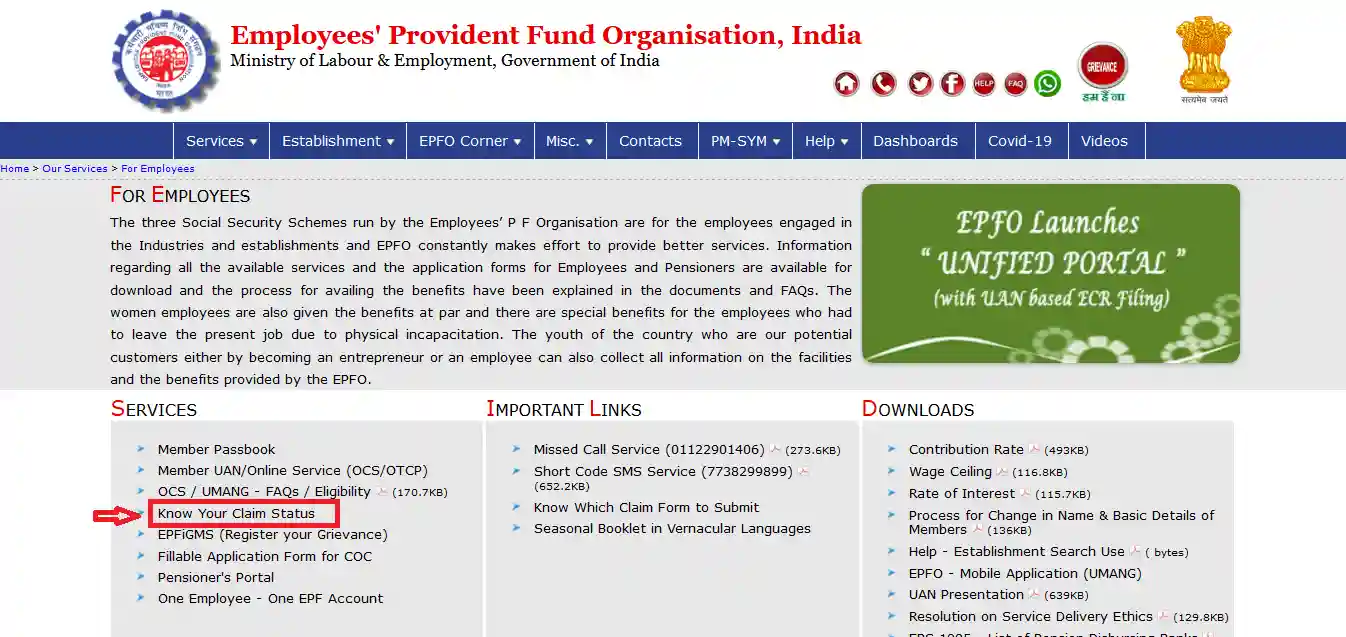

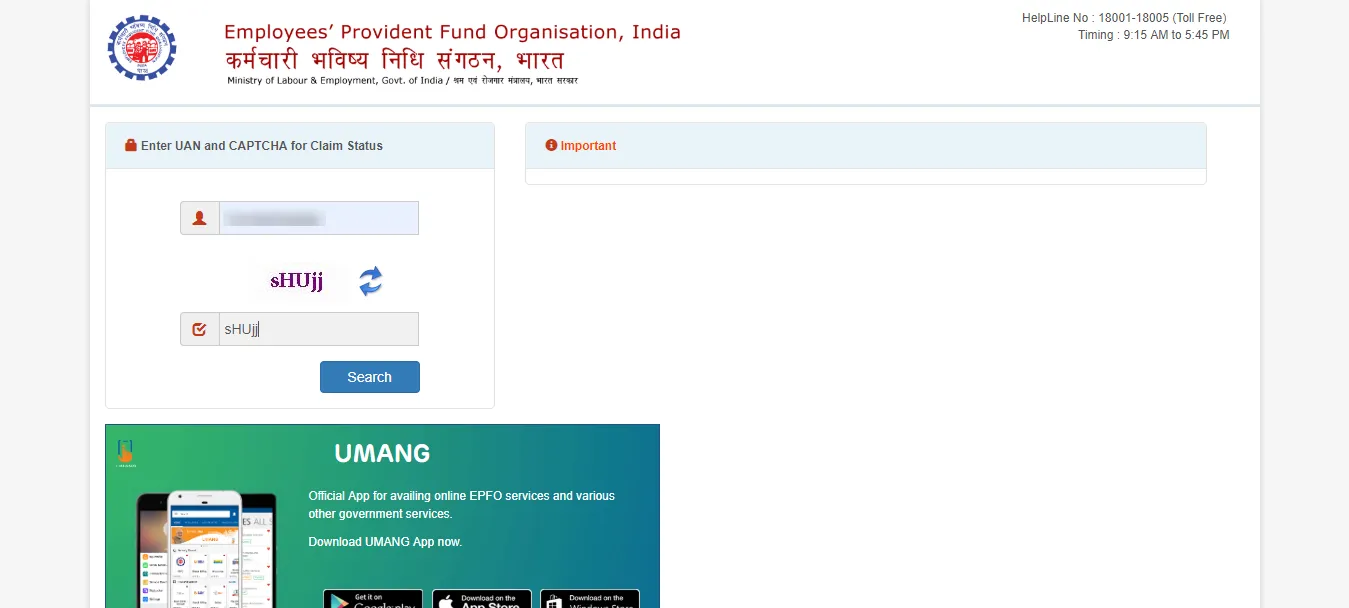

Step 3: On the next page, employees must click on 'Know Your Claim Status' which is present in the 'Services' menu. On the new tab, employees must enter their UAN and captcha details and click on 'Search'.

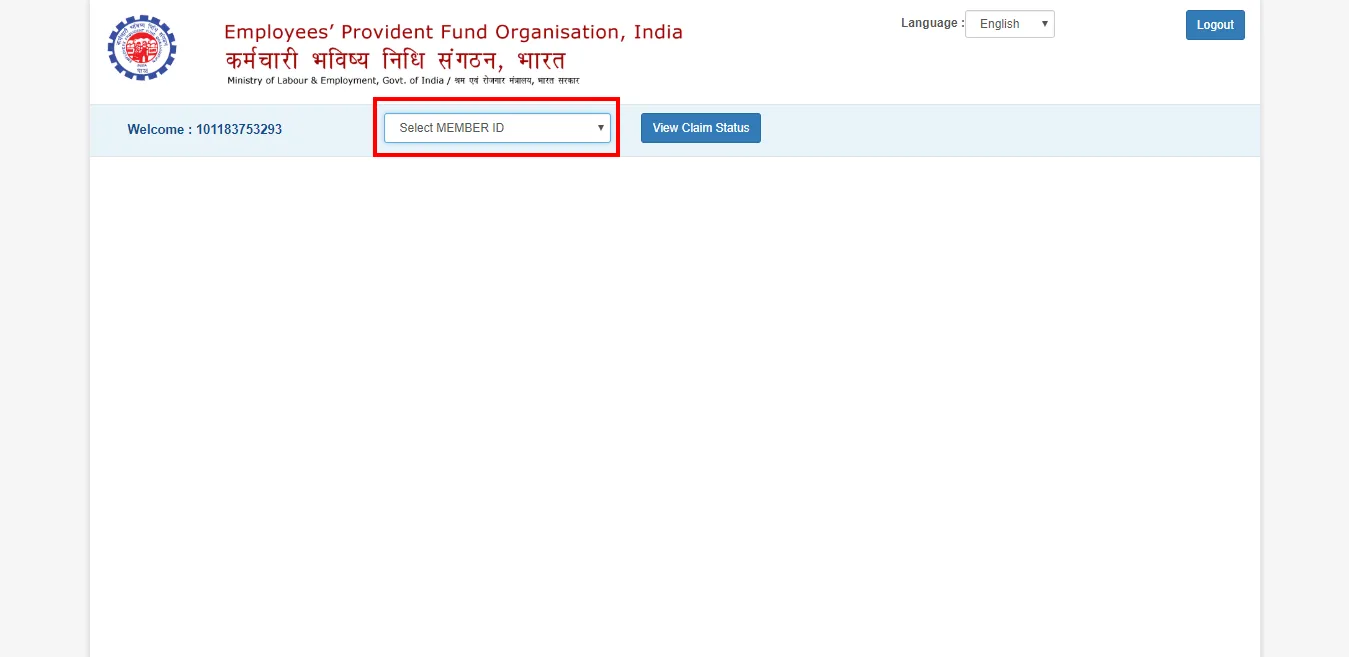

Step 4: On the next page, employees must select the Member ID from the drop-down menu. Once the Member ID is selected, click on 'View Claim Status'.

Step 4: The details of the claim status will be displayed on the screen.

Step 5: Regular updates are also provided by the EPFO via SMS regarding their claims. Details such claims application and the transfer of funds to the employee's bank account will be sent via SMS.

By Logging into UAN Portal

Employees can also check the status of their claim by logging in to their UAN portal. The procedure to check the status of the claim is mentioned below:

- Initially, employees must visit the official website of EPFO (https://www.epfindia.gov.in/site_en/index.php).

- Next, the employee must go to the 'For Employees' page. The link to the page can be found under 'Our Services'.

- Once on the 'For Employees' page, under 'Services', the employee will find 'Member UAN/Online Service (OCS/OTCP)'. The employee must click on it.

- On the new tab that has been opened, the employee must enter his/her UAN details and captcha.

- Once the employee has signed in to his/her UAN portal, he/she must click on 'Track Claim Status' which can be found under 'Online Services'.

- On the next page, the status of the claim will come up.

By Using PF Account Number

Employees can check their claim status using their PF account number by following the steps mentioned below:

Step 1: Visit the official website of EPFO.

Step 2: Go to the 'Know your Claim Status' page.

Step 3: From the drop-down list, choose your PF Office State.

Step 4: From the drop-down menu, choose your city.

Step 5: Enter your PF account number and click on the ‘Submit’ option.

Once the accurate information is entered, the PF claim status of the applicant will be displayed on the screen. The Umang App also allows users who have updated their UAN profile with their current mobile number to check the status of their claims.

By Using Umang App

The steps to check the PF claim status through the Umang app are as follows:

Step 1: Visit the official website of EPFO.

Step 2: On the home page, navigate to the ‘EPFO’ option.

Step 3: Click on the ‘Employee Centric Services’ option.

Step 4: Click on the ‘Track Claim’ option.

Step 5: Enter your UAN and select the ‘Get OTP’ option.

Step 6: For verification, enter the OTP.

Step 7: Click the ‘Login’ option.

Steps to Check PF Claim Status Offline

Employees can check their PF claim status offline with these two methods.

Via SMS

Applicants can send an SMS from the mobile number linked to the UAN portal to check the status of their claims. For precise tracking of the status of their claim, they should be careful about the SMS format before sending it. 'EPFOHO UAN LAN' is the most recent SMS format. The language code in which users prefer to obtain their claim details is indicated here by ‘LAN.’

Via Missed Call

To check the PF claim status via a missed call, employees need to call the toll-free number 011-22901406 from their registered mobile number. An SMS will be sent on their registered mobile number with information regarding the status of their PF claim after the call is automatically disconnected. Employees will have to update their Aadhaar, PAN, and bank account information on the UAN portal.

Eligibility to Make EPF Claim

In the following circumstances, an EPF accountholder will be considered qualified to receive the accumulated funds:

- Up to 90% of an employee's EPF corpus may be claimed prior to retirement if they are 54 years old and retire within a year.

- Individuals who are older than 55 years old are eligible to claim the full EPF corpus. However, those who chose early retirement will not receive the full value.

- If an account holder is unemployed for more than a month, they can be eligible to receive up to 75% of their EPF corpus. However, when they begin a new job, they must transfer 25% of their EPF corpus to their EPF account. An individual may claim the whole EPF corpus if they have been unemployed for more than two months.

- Furthermore, such a partial withdrawal can only be done when it is necessary to pay for higher education, a medical emergency, or the construction or acquisition of a residential property.

Steps to Initiate EPF Claim Process

Applicants must submit the appropriate claim form to the relevant authority before getting started with their PF claim. Factors such as an applicant's age, employment status, and reason for withdrawal are considered when determining which form is appropriate for the particular circumstance.

The acceptable claim form for each circumstance is highlighted below:

- Form 13: For transferring the accrued fund into a new EPF account, in the event of change of employment

- Form 31: To request a temporary or advance withdrawal of EPF

- Form 20: For claiming the PF of a deceased EPF member

- Form 14: To cover the cost of an LIC policy

- Form 10C: To obtain a Scheme Certificate or a Withdrawal Benefit under the Employees' Pension Scheme

- Form 10D: To make a pension fund claim if the account holder is under the age of 58 years and must leave a place of business due to a disability

FAQs on PF Status Online

- Where can individuals check the claim status online?

Individuals can check their claim status on https://passbook.epfindia.gov.in/MemClaimStatusUAN/. Individuals must use their Universal Account Number (UAN) and password to check the claim status.

- Is there any age restriction to become a member of the EPF?

No, there is no age restriction to become a member of the EPF. However, once individuals reach the age of 58 years, they cannot be a member of the Pension Fund.

- How do I cancel my PF claim?

There is no way to cancel the PF claim status online once it has been started. However, applicants may cancel their online request for EPF withdrawal by getting in touch with the EPFO-Regional Office.

- Will employees be able to directly join the EPF?

No, employees will not be able to directly join EPF. The only way employees can become members of the EPF is to work for an organisation that is a part of the EPF & MP Act, 1952.

- Is it possible for employees to contribute towards EPF after resignation?

No, employees will not be able to contribute towards EPF if they are not working. The employee's and employer's EPF contributions must be the same.

- For how long can EPF members retain their membership?

EPF members can retain their membership until they withdraw the PF amount. However, if no contributions are made for more than three years, no interest will be credited after the third year.

- Is it possible for individuals who are working in organisations but not receiving any pay to become a member of the EPF?

No, individuals will have to receive wages to become members of the EPF.

- In the case of PF withdrawal, is there any time limit?

Individuals must wait for 2 months before they withdraw their PF funds in case of resignation.

- In case individuals do not receive their PF within 20 days, who should they report the issue to?

Individuals can raise a complaint on the EPFO portal in case they do not receive their PF funds within 20 days.

- Can employers reduce the wages of the employees due to contributions made towards EPF?

The employer cannot reduce the wages of the employee because of payments made towards EPF. It is prohibited under Section 12 of the EPF & MP Act, 1952.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.