EPF Form 31

The Employees' Provident Fund Organisation offers an online facility where employees can apply for EPF advance.

The form required for claiming an EPF advance is Form 31. The form is available once the employee logs in to the UAN Portal.

However, to apply for EPF advance online, the employee must have his/her bank details, Aadhaar Card, and PAN card details updated on the portal.

Form Name | EPF Form 31 |

Known as | PF Advance Form |

Provided by | |

Submitted for | Application for advance or loam from the provident fund. |

Allowed Reasons | House repair, Medical treatment, Wedding, Education |

Benefits for | Employees |

The advances or loans taken from the EPF scheme can cater to his or her different financial requirements such as weddings, medical exigencies and constructing a house among others.

The list of reasons for which advanced may be taken by an employee are listed below:

- Housing loan repayment

- Education

- House repair

- Wedding

- Medical treatment

- Construction of a dwelling

- Plot purchase

- Lockout

- House alteration

- Physically handicapped

- Abnormal conditions such as natural calamities

- Cut in supply of electricity

For more information, Check out related articles: UAN registration, UAN Login, PF Balance Check & EPF Claim Status

When Can You Use Form 31

Given below are the times when you can use Form 31:

Purpose of withdrawal | Withdrawal limit | Minimum service required to be served before withdrawal | Other conditions to keep in mind |

Marriage | Up to 50% of the contribution by the employee to the EPF | 7 years | For covering marriage expenses of self, children, or siblings |

Education | Up to 50% of the contribution by the employee to the EPF | 7 years | To cover the cost of education your children post their completion of 10th standard |

Renovation of home | Up to 12 times of the employee's monthly salary along with the dearness allowance, or the employee share including the addition of interest or cost whichever is lower | 5 years |

|

Purchasing of land or property |

| 5 years | The property must either be in the name of the member, or their spouse. It can be owned jointly too |

Before retirement | Up to 90% of the accumulated corpus along with interest accrued | Once the member turns 54 years old and within a year of superannuation or retirement whichever is earlier | The amount should be for the member to cover their financial expenses |

Repayment of loan | Up to 24 times of the employee's monthly salary along with the dearness allowance, or the employee share including the addition of interest, or total principal amount outstanding including the interest | 10 years | You will have to avail a loan from an agency who must clearly specify the principal amount outstanding and the interest charged on it |

If the employee has not received salary for more than 2 months or are unemployed without compensation | Share of the employee with interest | NA | The reason for not receiving your compensation can be anything except for strike |

How to Download EPF Form 31 Online

Form 31 is available on the EPF website. The procedure is mentioned below:

- The member must log in using his/her UAN and password on the EPFO member portal.

- The member will have to go to the 'Online Services' tab and then select 'Claim' for generating an online request.

- On clicking claim, a new page will open with all the details of the member, such as name, date of birth, father's name, PAN number, Aadhaar number, date of joining the company, and mobile number.

- On checking if all the information is correct, the member can click on 'Proceed for Online Claim'.

- The next page will be the type of claim the member would like to apply for. Select 'PF ADVANCE (FORM 31)' in the drop-down menu.

- The member will need to select the purpose for the advance. There will be various options available in the drop-down box such as illness, natural calamities, power cut, non-receipt of wages, and purchase of handicap equipment. The amount and his or her current address must be filled in the next field.

- On completing this, the member will have to sign the disclosure. On checking the box, the 'Get Aadhaar OTP' will be visible. On clicking that, he or she will receive the OTP, and this must be authenticated.

- On entering the OTP and clicking on 'Validate OTP and Submit Claim Form', the member will complete the process for online EPF advance application.

Documents Required to EPF Form 31

The documentation which has to be produced by an employee for various purposes in EPF Form 31 is listed is the table below:

Reason/Purpose | Documents |

Equipment for physically handicapped | Certificate from a doctor |

Adversely affected due to lack of power supply | Statement from state government |

Adversely affected by the occurrence of natural calamities | Certificate from the concerned authority |

Lockout of an establishment | Declaration |

House repair (only once) | Proof of need for repair |

House alternation (only once) | Proof of need for alteration |

Plot purchase | Declaration form, a copy of the purchase agreement |

Housing loan repayment | Signed declaration |

Construction of a dwelling | Signed declaration |

Medical treatment | Certificate from a registered medical physician, a certificate from the employer about lack of ESI facility, a certificate from a specialist (leprosy, tuberculosis) |

Wedding | |

Education | Bonafide certificate from the concerned educational institution |

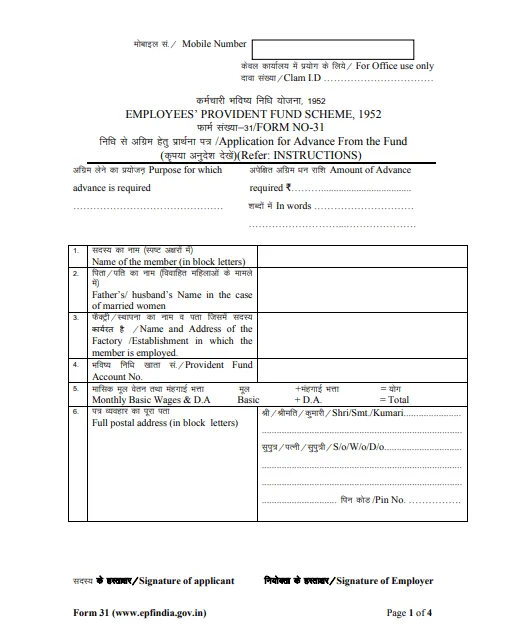

EPF Form 31 Format

You can visit the following URL: https://epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form31.pdf to download the EPF Form 31. You can take a print out of the form and fill it up. Here is how the EPF Form 31 looks:

What does EPF Form 31 Contain?

An employee has to fill out the following information in Form 31 under the Employee Provident Fund Scheme 1952:

- Mobile number

- Purpose for which advance is required

- Advance amount required

- Name of the member

- Husband's name (married women)

- Employee PF Account Number

- Monthly basic wages plus dearness allowance

- Full postal address

- Signature of applicant

- Signature of employer

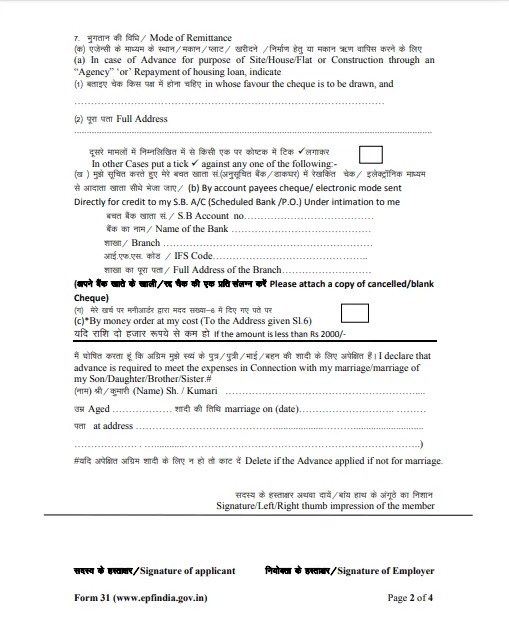

- Mode of remittance

- If an advance is being taken for housing loan repayment or construction of a flat or site via an agency, an employee has to mention the name of the recipient on whose name the cheque has to be drawn in addition to the complete address of the recipient

- Savings Bank account number

- Name of the bank

- Branch name and complete address

- IFSC code

- Copy of a cancelled cheque

- If the advance is being taken for wedding expenses, the employee has to mention the details of his daughter/sister/son/brother who is getting married including his or her age, wedding date and address (if the advanced applied for is not meant for marriage purposes, an employee need not fill in any details in the section)

- Signature of the employer

- Signature of the applicant

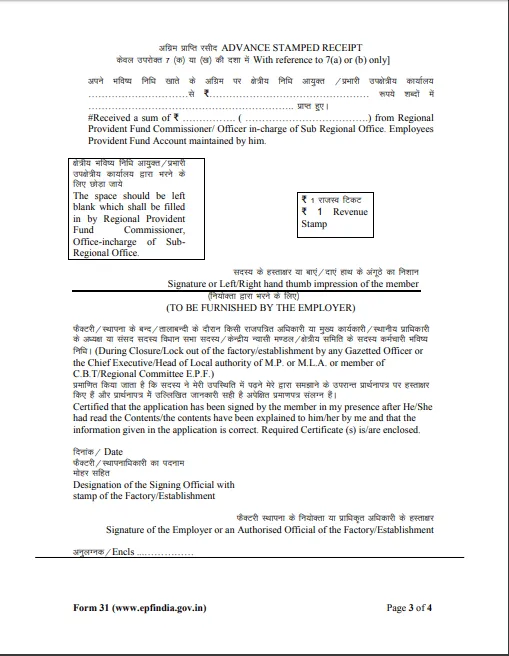

- Details related to advanced stamped received

- Signing official's designation (along with establishment's stamp)

How To Download Form 31

You can click on the link https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form31.pdf and download and print the Form 31. You will then have to fill it ensuring all the details mentioned are correct.

How To Submit Form 31 Offline

Given below are the steps you will have to follow to submit your Form 31 offline:

- Download the Form 31 and duly fill it with all the correct details and sign it.

- Contact your employer and get your certificate validated. Make sure your employer fills in all the correct details as required and provide all the relevant enclosures attested.

- Submit the form to your respective judicial EPFO office.

How To Submit Form 31 Online

Given below are the steps you will have to follow to submit your Form 31 online:

- Click on the link https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Log in to the portal by entering your UAN number and password and then click on 'Sign In'.

- Under 'Online Services', select the option ''Form-31, 19, 10C & 10D'.

- An auto-filled form will be displayed on your screen. Enter the last 4 digits of your bank account and verify it.

- A 'Certificate of Undertaking' pop-up window will appear on your screen where you will be asked if you agree with all the terms and conditions. Click on 'Yes'.

- Select the 'Proceed for Online Claim' option, and then from the drop-down menu proceed to choose the 'PF Withdrawal' option.

- Choose the option 'PF Advance Form' and enter details such as the amount you wish to withdraw, purpose behind the withdrawal, etc.

- Click on 'Submit'. Your online application process is completed.

How To Check The Status Of Form 31 Claim

Given below are the steps you will have to follow to check the status of your Form 31 claim:

- Click on the link https://unifiedportal-mem.epfindia.gov.in/memberinterface/.

- Log in to the portal by entering your UAN number and password and then click on 'Sign In'.

- Under 'Online Services', select the option 'Track Claim Status'.

- From the drop-down menu select the location of your respective PF office. Once you do that, on your screen you will be able to see the code of your PF office and the region code.

- Enter the establishment code which you can find on your pay slip.

- Enter your 7-digit account number and click on 'Submit'.

- You will be able to view the status of your Form 31 claim.

FAQs on EPF Form 31

- Which document is mandatory to be submitted which getting my bank account details verified?

You will have to submit a cancelled cheque while getting your bank account details verified. Submission of cancelled cheque is mandatory.

- Will I have to pay anything to download the Form 31 application form?

No, you will not be required to pay anything to download the Form 31 application.

- How long will it take to get my application verified and the funds be transferred to my bank account?

It will take at least two weeks for your application to be verified and the funds be transferred to your bank account.

- Is it mandatory to link my PAN with UAN if I wish to submit my Form 31 online?

Yes, it is mandatory for you to link your PAN with your UAN if you wish to submit your Form 31 online.

- I am planning to submit my Form 31 application offline. Will it be mandatory to submit the certification from my previous employer?

Yes, you will require certification from your previous employer if you are looking to submit your Form 31 application offline.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.