How to Check the EPF Balance Online 2026

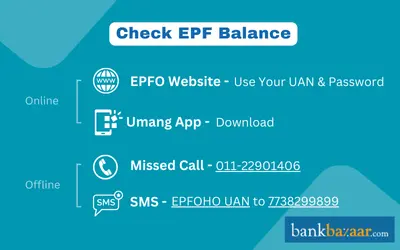

To check your EPF balance online, log in to the EPFO member portal with your UAN, or use the UMANG app. You can also check via SMS (by sending EPFOHO UAN to 7738299899) or give a missed call to 9966044425.

About EPF Balance

Checking your EPF balance is important to manage your retirement savings and plan your finances better. It helps you track your contributions, stay updated on your savings, and make informed financial decisions. If you're thinking about taking a loan against your EPF, knowing your balance is essential.

The EPF interest rate for the financial year 2025-26 is 8.25%. Checking your balance is now quick and easy through the EPFO portal, UMANG app, SMS, or missed call service.

EPFO Portal

Employees can use the EPFO portal to access their EPF passbook. Employees need to have an activated UAN to use these methods. Given below is the process that employees must follow to check the EPF balance using the EPFO portal:

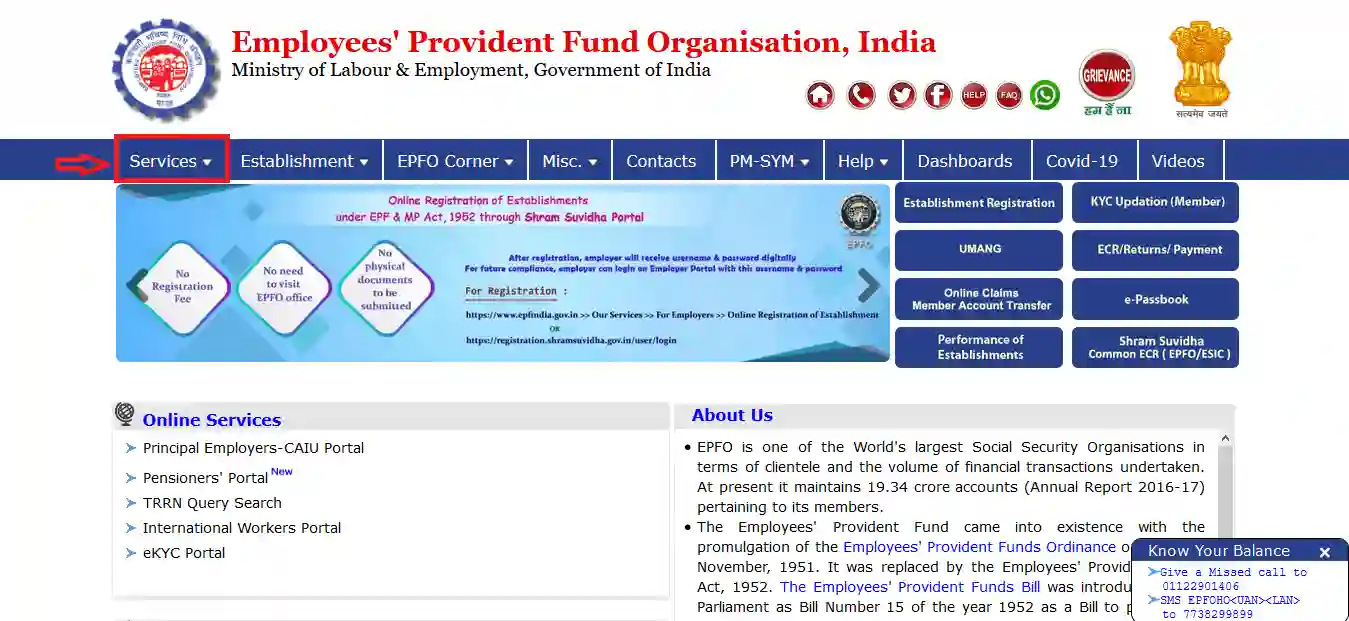

1. First, the employees must visit the EPFO portal (https://www.epfindia.gov.in/site_en/index.php).

2. On the next page, the member must click on ‘For Employees’ under the 'Services’ tab.

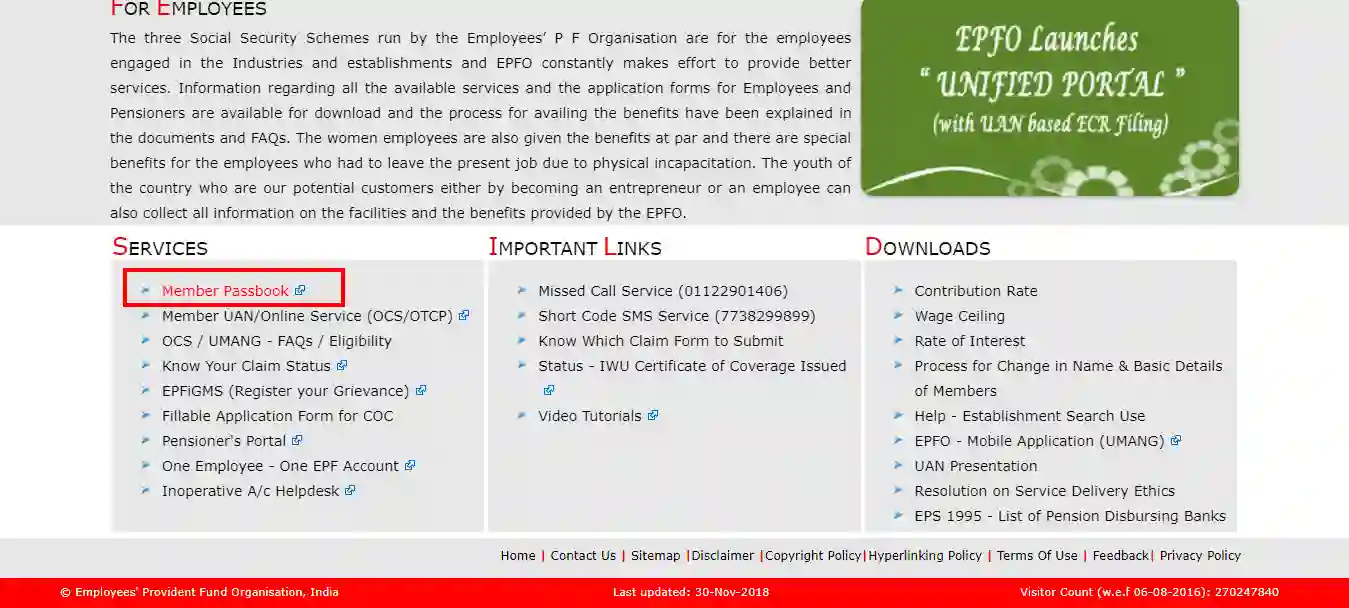

3. Next, click on ‘Member Passbook’ under the ‘Services’ section.

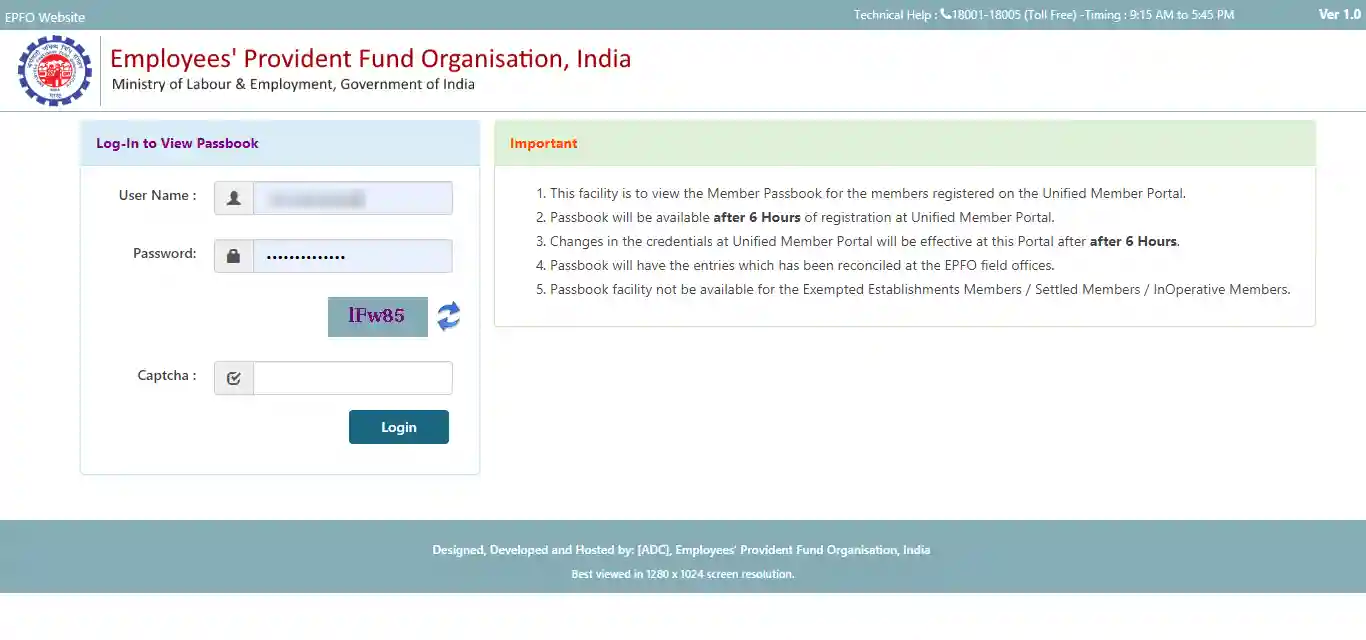

4. On the next page, the member must enter his/her UAN, password, and captcha details and click on ‘Sign In’.

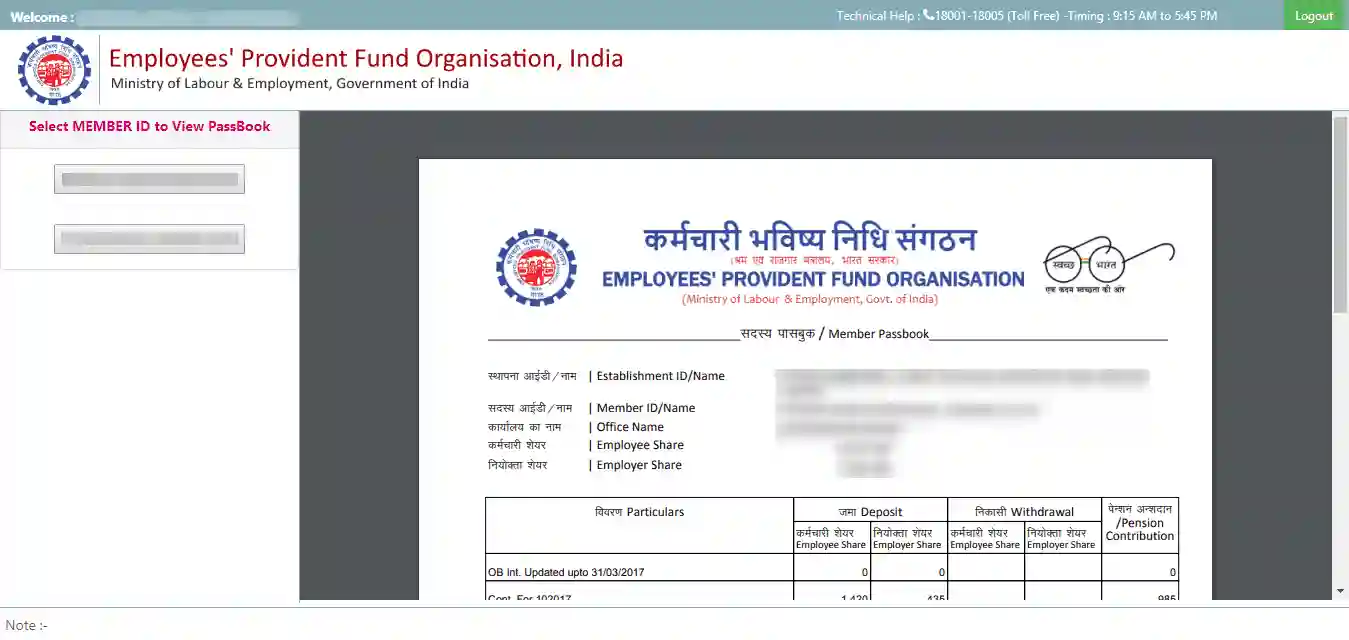

5. On the next page, the member will be able to check his/her EPF balance under the respective Member ID.

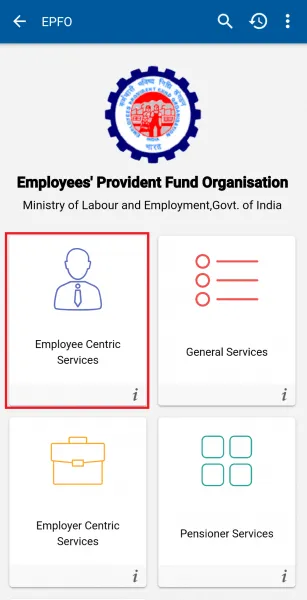

UMANG App

By downloading the Unified Mobile Application for New-age Governance (UMANG) app, employees will be able to check the EPF balance on a mobile phone.

You can raise and track EPF claims on the app, along with checking your balance..

To access the app, you must register once using the mobile number linked to your UAN.

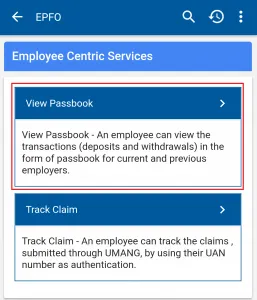

Let us take a look at how you can view your historical EPF transactions through the UMANG app:

- Install the app and open it on your mobile phone. Click on the EPFO option.

- Select 'Employee Centric Services'

- On the next screen, you will find the 'View Passbook' option.

- After clicking on it, you will have to provide your UAN number and enter the One-Time Password (OTP) sent to your registered mobile number. Click on ‘Login’ and you will be able to view your EPF transactions, including withdrawals and deposits from your current and previous employment.

Missed Call

EPF members can also check their balance by giving a missed call to 9966044425 from their registered mobile number.

You need to link your PAN, Aadhaar, and bank account number with your UAN to use this service.

Make sure your employer links your details to your UAN if they haven’t yet.

SMS Service

If you have activated your Universal Account Number (UAN), you can check your EPF balance and last contribution by sending an SMS to 7738299899.

The SMS format is: EPFOHO <UAN> <Language Code>

- Replace <UAN> with your 12-digit UAN.

- Replace <Language Code> with the last three letters of your preferred language (e.g., ENG for English, KAN for Kannada).

Available languages include Bengali, Malayalam, Tamil, Telugu, Kannada, Marathi, Gujarati, Punjabi, Hindi, and English.

For example, to get details in Kannada, send: EPFOHO 123456789012 KAN

Make sure your PAN, Aadhaar, and bank details are linked to your UAN to use this service.

How to Submit an e-Nomination in EPFO

- Step 1: Visit the UAN Member e-Sewa portal. Access the official UAN Member e-Sewa portal, which serves as the platform for managing various EPF-related activities.

- Step 2: Enter your UAN number, password, captcha code, and click on the 'Sign In' button to log into your account.

- Step 3: Once logged in, go to the 'Manage' tab and select the 'E-nomination' option.

- Step 4: You can cofirm your family declaration by clicking on 'Yes.'

- Step 5: Add your family members’ details in the e-nomination form by selecting ‘Add Family Details.’ You can add multiple nominees if needed.

- Step 6: Declare the total amount of share for each nominee by clicking on 'Nomination Details.'

- Step 7: After entering the required details, click on 'Save EPF Nomination' to save the information.

- Step 8: Click on 'E-sign' to generate an OTP. Submit the OTP received on the mobile number linked with Aadhaar to complete the e-nomination process.

How to Check Your PF Balance Without a Registered Mobile Number

You can easily check your PF balance without relying on your registered mobile number by following the steps outlined below:

- Step 1: Visit the official PF Passbook Portal Website by following this link: PF Passbook Portal

- Step 2: Log in with your UAN (Universal Account Number) and Password. You don’t need your registered mobile number to log in.

- Step 3: After successfully logging in, select the PF account you wish to examine. Proceed by clicking on the ‘View PF Passbook Old’ option.

- Step 4: You can now view comprehensive details of your PF balance, including the employee and employer balances. You can check your pension balance in the last column of the PF passbook.

- Step 5: If you want to review your yearly PF contributions, you have the option to click on ‘View Passbook (New: Yearly).’ This feature provides a detailed summary of your annual PF transactions.

How to Check EPF Balance of Exempted Establishments/Private Trusts

Some large companies like Godrej, HDFC, Nestle, Wipro, TCS, and Infosys manage their own EPF funds through company-managed trusts instead of the Employees’ Provident Fund Organisation (EPFO). These organizations are known as exempted establishments.

Because company trusts manage the EPF corpus, EPFO does not provide a passbook or a unified way for these employees to check their EPF balance.

Ways to Check EPF Balance in Exempted Establishments:

- PF Slip or Pay Slip: Many companies include EPF contribution details and balance in the monthly salary slips or provide separate EPF slips.

- Company Employee Portal: Some companies like Wipro and TCS offer online portals where employees can log in and check their EPF balance and download PF statements.

- Contact HR Department: Employees can reach out to their company’s HR team for EPF balance details and related information.

- Track Contributions Manually: Employees can track monthly contributions via their salary slips and calculate their approximate EPF balance using the EPFO’s interest rate. Your EPS account receives up to ₹1,250 per month as part of the Employees’ Pension Scheme contributions.

Interest on EPF Balance for Inoperative Accounts

EPF accounts stop earning interest once they become inoperative. An EPF account is classified as inoperative in these cases:

- When the employee retires at age 55.

- When the employee migrates abroad.

- When the employee passes away before withdrawing the EPF balance, within 36 months of it becoming payable.

Note: If an employee leaves their job before turning 55, the EPF account remains active and continues to earn interest until the employee reaches the age of 58.

FAQs on EPF Balance Enquiry

- How to check EPF balance using PF number?

Individuals must use their UAN details to check their EPF balance online. You don’t need your PF number to check your EPF balance online.

- Can I check my EPF balance by giving a missed call without registering my mobile number?

Missed call EPF balance check works with your registered mobile number. Therefore, it is mandatory to link your mobile number to the UAN in order to avail these services

- Can I withdraw my entire PF amount at once?

Yes, you can withdraw your full PF amount if you are unemployed for two months. If you have been unemployed for at least one month, you can withdraw up to 75% of your EPF balance. PF withdrawals are only tax-exempt after five consecutive years of EPF membership.

- Is it possible to check the EPF balance using Aadhaar number?

No, it is not possible to check the EPF balance using the Aadhaar number. EPF balance can be checked online only by using the UAN.

- Is it possible for individuals to check the EPF balance of their previous organisation?

Yes, it is possible for individuals to check their previous organisation's EPF balance. Once individuals log in to the EPFO portal using their Universal Account Number (UAN), they will be able to check the balance by clicking on the respective Member ID. All previous Member IDs that have been linked to the UAN will be visible on the portal.

- Is it possible to check the EPF balance via SMS without linking the mobile number to the UAN?

In case individuals want to check their EPF balance via SMS, they must link their mobile number to the UAN. The EPF balance will be sent via SMS only to the registered mobile number.

- Is it possible to use the PAN number to check the EPF balance?

To check the EPF balance, the PAN is not required. However, to avail a variety of online services, it is important that the UAN and EPF are linked.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.