How to Login EPFO Member Portal 2026

A statutory body that was introduced by the Indian Government is the Employees' Provident Fund Organisation (EPFO). The EPFO was launched in 1951 and all operations of the organisation are handled by the Ministry of Labour and Employment.

Steps to Login to EPFO Member Portal

The procedure to log in to the EPFO portal is very simple. You will need to enter the Universal Account Number (UAN), password, and captcha to complete the login procedure.

Process to Log in to EPFO Portal as Employees

To log in to the EPFO portal as an employer, follow the steps mentioned below:

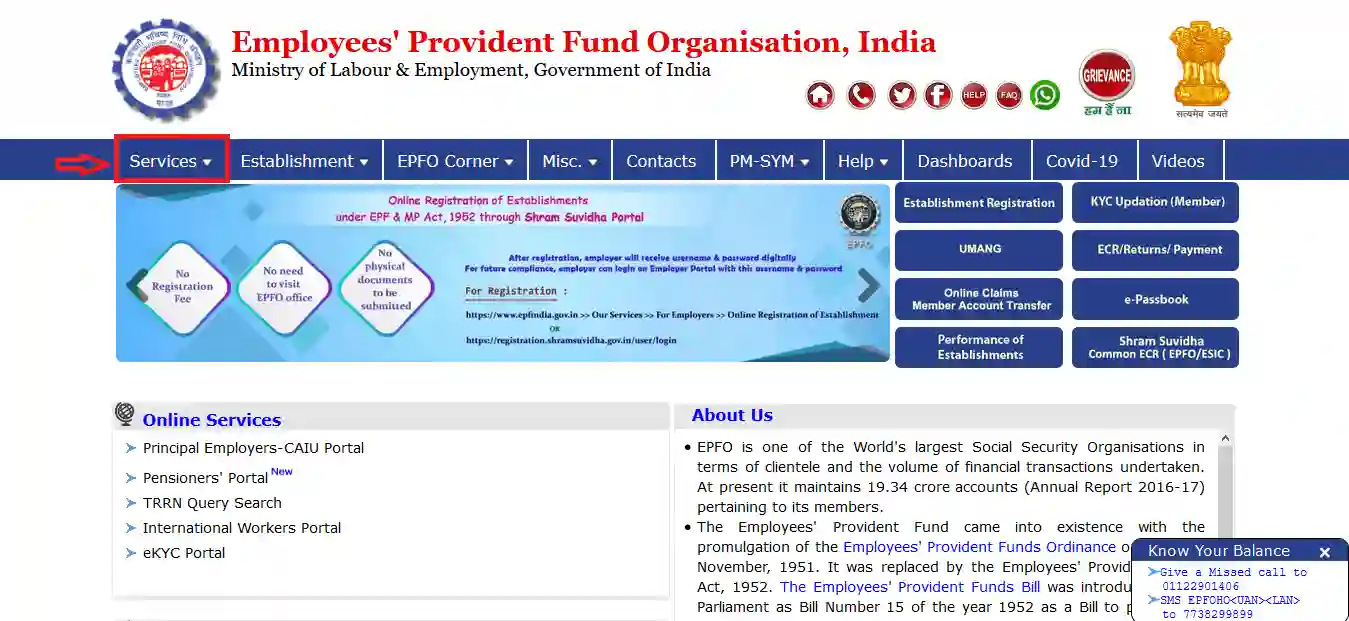

Step 1: Visit the official EPFO portal.

Step 2: Navigate to the ‘Services’ section and click on the ‘For Employees’ option.

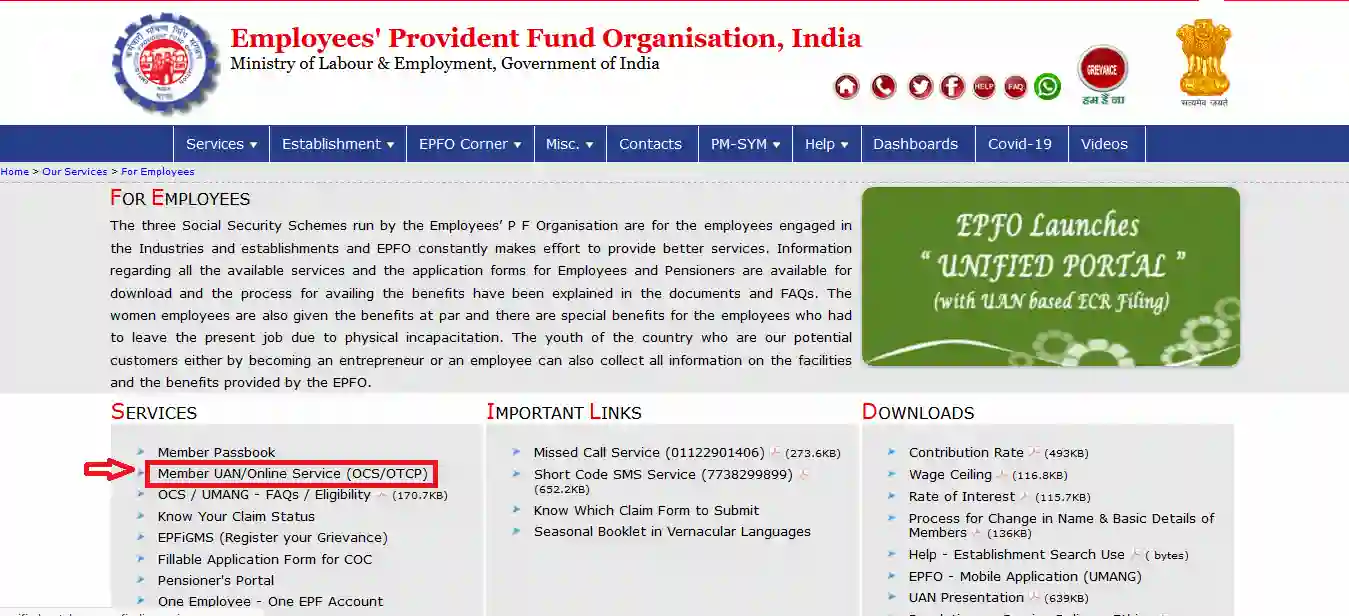

Step 3: A new dashboard will appear. Under the ‘Services’ section, click on the ‘Member UAN/Online Services’ section.

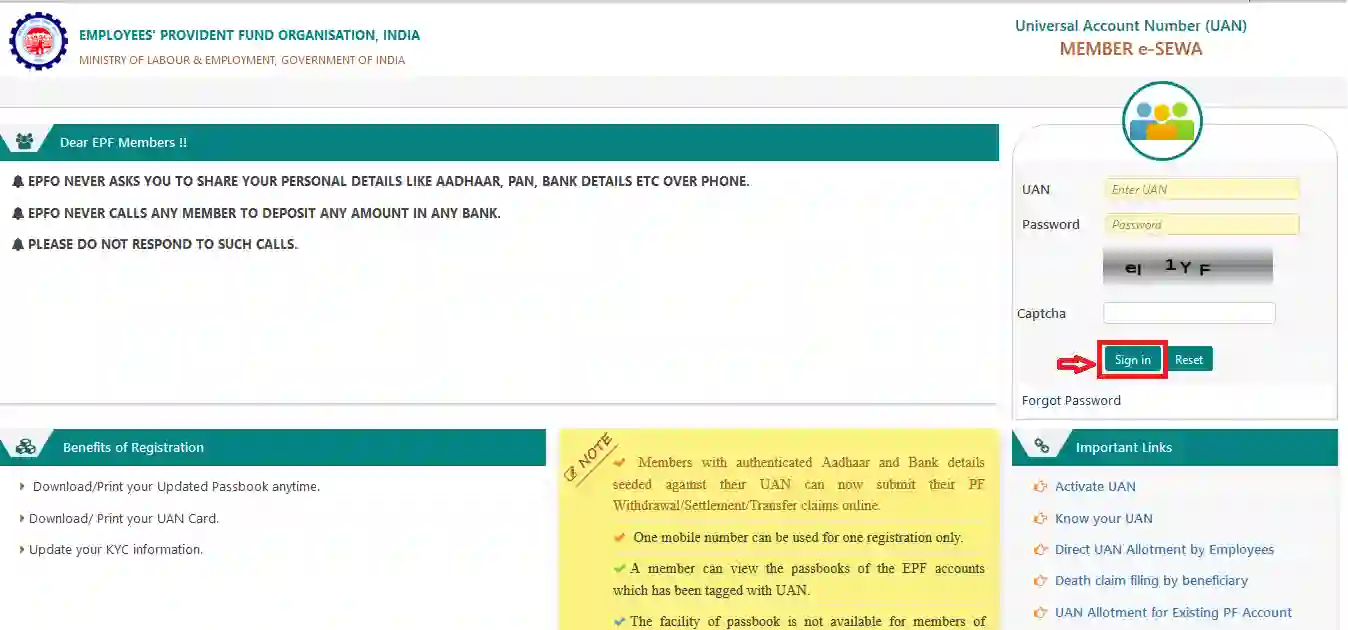

Step 4: Use your UAN to log in. If your UAN is not activated, click on the ‘Activate UAN’ option.

Step 5: After your UAN is activated, you will be able to log in to the EPFO member portal at any time to check the balance of your PF, and status of PF settlements or partial PF withdrawals.

The Process to Log in to the EPFO portal for Employees is mentioned below:

Step 1: First, employees must go to the EPFO website which is https://www.epfindia.gov.in/site_en/index.php

Step 2: Once the employee is on the EPFO website, he/she must go to 'Services' and click on 'For Employees'.

Step 3: On the next page, the employee must click on ‘Member UAN/Online Service (OCS/OTCP)’. The link can be found under ‘Services’.

Step 4: On the new page, the employee must enter his/her UAN and password. Along with those details, the employee must also enter the captcha details that have been provided.

Step 5: Next, the employee must click on ‘Sign In’.

Step 6: The next page will lead to the employee’s EPFO portal. Employees can update their Know Your Customer (KYC) details, claim their PF amount, check their PF balance, and transfer their PF amount on the EPFO portal.

Process to Log in to EPFO Portal as Employers

The process for employers to log in to the EPFO portal is mentioned below:

- First, the employer must visit the EPFO employer login page which is https://unifiedportal-emp.epfindia.gov.in/epfo/

- Next, the employer must enter the username and password, and click on ‘Sign In’.

In terms of financial transactions and the number of members present under it, the EPFO is one of the biggest Social Security Organisations in the world. The three schemes that come under EPFO are mentioned in the table below:

Employees Provident Fund (EPF) | Under the scheme, contributions are accumulated for the individuals to use at the time of retirement. Partial withdrawals are allowed in case of house construction, illness, and marriage. |

Employees' Pension Scheme (EPS) | Contributions are made towards the scheme on a monthly basis for the members to use at the time of retirement or for the nominees to receive in case the member passes away. |

Employees Deposit Linked Scheme (EDLI) | Benefits are provided to the member's family in case he/she passes away at the time of being a member of the EPFO. Up to 20 times the salary of the employee, subject to a maximum of Rs.6 lakh, is provided. |

How can I change my registered mobile number on EPFO?

Follow the steps given below to change your mobile number on EPFO:

Step 1: Visit the official EPFO website

Step 2: Login using your UAN number and password

Step 3: Click on the ‘Manage’ tab present on the screen

Step 4: Click on the ‘Contact Details’ option present below ‘Manage’ section

Step 5: You must verify your existing mobile number, currently linked to your EPF account. You will receive an OTP on your registered mobile number for verification.

Step 6: Once verified, you will get the option to change or update your mobile number.

Step 7: Fill in your new mobile number and submit the request

Step 8: You will receive an OTP on your new mobile number for verification. Once verified, your new mobile number will be linked to your EPF account.

How can I link Aadhaar card with EPFO?

There are two ways to link Aadhaar card with EPFO, through mobile app or through e-KYC portal:

- Follow the steps given below to link Aadhaar card with EPFO through mobile app:

Step 1: Download the UMANG app

Step 2: Select the eKYC services

Step 3: Select the option for Aadhar seeding

Step 4: Fill in your UAN number

Step 5: You will receive an OTP on your registered mobile number

Step 6: Fill in that OTP on that screen and submit it

Step 7: Fill in your Aadhar number

Step 8: You will receive another OTP on your registered mobile number

Step 9: Your Aadhar will be linked with UAN

- Follow the steps given below to link your Aadhaar card with EPFO through the e-KYC portal:

Step 1: Visit the official EPFO portal

Step 2: Login to your account with UAN and Password

Step 3: Click on the KYC option present on under the ‘Manage’ section

Step 4: You will be taken to a new page where you can choose to enter your Aadhar number to connect to your EPF account

Step 6: Click on the ‘Aadhar’ option

Step 7: Fill in your Aadhar number and names as displayed on the card

Step 8: Click on the ‘Save’ option

Step 7: Once you save your Aadhar details, UIDAI will verify it

Step 8: Once you have successfully completed the KYC process, you will have the option to connect your Aadhar with your EPF account, with the word "verified" next to your Aadhar.

Steps to Activate UAN

In order for employees and employers to epfo login, they must first activate their UAN. The UAN is allotted to every member of the EPF scheme by the EPFO. Employees can also find their UAN from their employers or on their salary slip. UAN can be activated through EPFO portal.

Follow the steps mentioned below to activate UAN through EPFO Member portal:

Step 1: Go to EPFO member portal and choose the option to ‘Activate UAN’

Step 2: Fill in your UAN/member ID and other details like name, DOB, Aadhaar number, mobile number, and captcha code

Step 3: Click on the ‘Get Authorization PIN’ option

Step 4: You will receive an authorization PIN on your registered mobile number

Step 5: Fill in this PIN and select ‘Validate OTP and Activate UAN’ option

Step 6: You will receive a password on your registered mobile number. Use this password to activate your UAN.

Services Offered at EPFO Portal

One Employee-One EPF Account

This is a facility where an EPF account holder can merge PF accounts under his/her UAN.

EPFO Member Passbook Download

The EPFO member passbook records transactions that are linked to contributions and withdrawals that are made to the EPF and EPS accounts.

Pensioner's Portal

This is where you can get answers to all pension-related queries. You can check your Pension Payment Order (PPO) number, pension credit, and passbook details.

Principal Employer

The facility interlinks the principal with the contract employer. The employer can upload details of the contract workers/work orders/outsourced job contracts.

TRRN Query

TRRN is Temporary Return Reference Number (TRRN) and a temporary number to check the status of your PF challan payment.

Helpdesk

EPFO has also set up a helpdesk for all employees and employers.

COC Application Form

The Certificate of Coverage (COC) application form can be filled in via the website.

Electronic Challan cum Return (ECR) portal

The employer can register with the e-Sewa portal and generate a user ID and a password. Then they can upload the Electronic Challan cum Return (ECR) with the digital signature.

How to Register on EPFO Portal

Step 1: Visit the EPFO member portal

Step 2: Click on 'Online Services'

Step 3: Choose 'For Employees'

Step 4: Select Member UAN/ Online Services

Step 5: You will be directed to the UAN member e-Sewa portal

Step 6: Register by clicking Activate UAN

Step 7: Enter details like Aadhaar card, UAN, date of birth, PAN, email ID, and mobile.

Step 8: You will get an authorisation PIN on your registered mobile number.

Step 9: Enter the PIN to validate details.

Steps for e-KYC for EPFO

Step 1: Log into the e-Sewa portal with your UAN and password

Step 2: Select 'Manage'

Step 3: Choose 'KYC'

Step 4: Fill in your KYC details like Aadhaar, PAN, Driving Licence, Passport, Election Card, Ration Card, bank details, and National Population Register.

Step 5: Select the box of the given KYC

Step 6: Choose 'Save'.

Step 7: Your data will be under 'Pending KYC'

Step 8: Details will be verified by the EPFO

Step 9: After it has been verified, the KYC will be updated

How to Reset your EPFO Login Password

You can easily reset your EPFO UAN login password by following the steps given below:

Step 1: Visit the official EPFO/UAN Member e-Sewa Portal. Look for and click on the 'Forgot Password' option.

Step 2: Enter your Universal Account Number (UAN) and validate it by entering the captcha provided to ensure accuracy.

Step 3: Fill in your personal details such as name, date of birth, and gender as registered with EPFO. Click on 'Verify' to confirm your identity.

Step 4: Now, you can enter your Aadhaar Details. Input the captcha code and your Aadhaar number. Provide consent by clicking on 'Verify.'

Step 5: Finally, confirm your identity by verifying the OTP sent to your registered mobile number. This step ensures the security of the password reset process.

Step 6: After successfully verifying your mobile number, you will be redirected to the password reset page.

Step 7: You can set a new password of your choice in the designated field. Ensure it meets the specified criteria for security purposes.

Step 8: Click on 'Confirm' to finalize the password reset process. Your EPFO UAN login password is now updated.

Steps to link EPF account with Aadhaar card:

Step 1: Go to EPFO member portal and login

Step 2: Choose the ‘menu’ option from the navigation bar

Step 3: Choose the ‘KYC’ option from the drop-down menu

Step 4: From the list of documents provided, choose 'Aadhaar card'

Step 5: Click on ‘Proceed’

Step 6: Once your Aadhaar details are verified with UIDAI’s data, your EPFO account will be linked with Aadhaar card.

How to Claim Forms at EPFO Portal?

If your Aadhaar and UAN are linked, you can raise a claim for partial or full withdrawal of EPF funds. This can be done when you are unemployed and at the time of retirement via claim settlement forms (Form 31, 19 & 10C).

The Government of India has signed a lot of agreements with many countries regarding the social security benefits that India and the corresponding country will provide.

Countries which have signed the agreement:

- Austria

- Germany

- Switzerland

- Belgium

- France

- Denmark

- Netherlands

- Luxembourg

- Finland

- Hungary

- Norway

- Sweden

- Czech Republic

- Republic of Korea

- Canada

Structure of EPFO

The Central Board of Trustees of the EPF has 3 schemes.

- The Employees' Provident Funds Scheme, 1952 (EPF)

- The Employees' Pension Scheme, 1995 (EPS)

- The Employees' Deposit Linked Insurance Scheme, 1976 (EDLI)

Functions Of EPFO

- Maintaining accounts

- Enforcement of the Act across India (except Jammu and Kashmir)

- Investment of various funds

- Settlement of all kinds of claims

- Making sure all records are updated

- Ensuring prompt payment of pension

UMANG

The Unified Mobile Application for New-age Governance (UMANG) is an all-in-one, secure, multi-channel, and multilingual e-governance app developed by the government. Local, state and central government bodies offer a wide range of citizen-centric services through this centralised platform. This app enables you to access EPFO services, apply for an Aadhaar card, locate CBSE centres, etc. Digital Services can also be accessed through the UMANG website/app.

EPF Balance Requests can be sent to 7738299899, which provides support 24/7 in 10 languages, such as Hindi and English. Members who have registered on the UAN Member Portal can get information about their most recent PF contribution and PF balance by giving a missed call to 9966044425 from their registered mobile numbers.

The EPF scheme aims to encourage saving among the country's working individuals. Both the employees and their employers may monitor their actions pertaining to this process through the EPFO member portal. The EPFO login to claim their PF balance, transfer or withdraw the PF amount, and update KYC details.

FAQs on EPFO Member Login

- What is the employer's and employee's contribution towards EPF?

The employer and employee each contribute 12% of the employee's salary towards EPF. While the entire contribution of the employee goes towards EPF, 8.33% of the employer's contribution goes towards pension, while the remaining goes towards EPF.

- What are the benefits of having a UAN?

Once the member activates his/her UAN, they will be able to print/download their passbook, and UAN card at any given time. All previous member IDs can be viewed by the member as well. KYC details can also be updated online by the member.

- Will my EPF number change if I change my job?

No, your EPF number will not change if you change your job.

- Can I withdraw my EPF funds if I am currently unemployed and in need of funds?

Yes, you are allowed to withdraw up to 75% of EPF funds if you are unemployed for more than a month. In case you withdraw the EPF amount before completing 5 years of service, then the withdrawn amount is taxable and should be mentioned under income from other sources while filing ITR.

- How is UAN number assigned to EPF members?

A UAN number is assigned when an individual joins a company. A UAN number is assigned only once and is unique for every EPF member.

- Who receives the pension in case the member dies?

In case the member dies, the pension will be received by his/her spouse. Also, till his/her children (maximum of 2 at a time) reach the age of 25 years, they are eligible to receive pension.

- In case the member wants to file a transfer claim, does he/she have to register on the member portal?

Yes, the member will have to register on the member portal in order to file for a transfer claim.

- Can the member edit details such as father's name, date of exit, date of joining, and relationship on the EPFO portal?

No, the member will not be able to make changes to the above-mentioned details on the EPFO portal.

- Can a member pay an excess of the mandatory 12% towards EPF?

Yes, the member can pay an excess of the 12% of the maximum of Rs.15,000 as a voluntary contribution.

- Why is it necessary to give a nomination for pension?

In case the member dies, and there is no eligible family member, the nominee will receive the pension.

News about EPFO Login

EPFO Suspends Gratuity Enhancement Amidst Rise in Dearness Allowance

The Employees Provident Fund Organisation (EPFO) has decided to suspend the increase in gratuity due to the rise in Dearness Allowance (DA) with immediate effect, as stated in a circular released on 7 May 2024. The circular dated 7 May 2024 has suspended the earlier circular dated 30 April 2024. This could result in beneficiaries being entitled to benefits from 1 January or another date, depending on any modifications to the effective date of 1 January. It's worth noting that the Union Cabinet had previously approved an increase in Dearness Allowance (DA) and Dearness Relief (DR) for central government employees and pensioners, effective 1 January 2024. The DA was raised from 46% to 50% of the basic pay or pension. With the increase in DA, other related allowances such as House Rent Allowance (HRA), gratuity ceiling, and hostel subsidy are also expected to rise, as they are linked to DA. Following the DA hike to 50%, the gratuity ceiling was also raised from Rs. 20 lakh to Rs. 25 lakh. This decision was made to mitigate the impact of inflation on government employees and pensioners, benefiting nearly 4.9 million government employees and 6.79 million pensioners, at an estimated total cost of around Rs. 12,868.72 crore.

As per new EPFO rules, change of employer will not require the subscribers to request for PF transfer 5 March 2024

Subscribers need not request for transfer of Provident Fund due to job change from 1 April 2024 according to the new EPFO (Employees’ Provident Fund Organisation) rule. On switching employer, the automatic transfer of Provident Fund (PF) balance will occur, which will happen only when the Know Your Customer (KYC) requirements are fulfilled, and the Universal Account Number (UAN) is linked. On making the first contribution by the employer, automatic transfer will be triggered.

EPFO: 1.6 million new members added in January 2024

The Employees' Provident Fund Organisation (EPFO) disclosed in its provisional payroll that, as of January 2024, the EPFO added a total of 1.602 million members on a net basis. As per a statement by the Labour Ministry, approximately 808,000 members registered for the first time in January 2024. The data emphasises the prevalence of the 18–25 age group, with a substantial 56.41% of all new members added in January 2024 falling into this age group.

This implies that the bulk of people entering the organised workforce are young people, primarily those looking for their first jobs. Roughly 1.217 million members left EPFO and later joined again, as per the payroll data.

EPFO provides SOP to correct employees' profiles

The Employees' Provident Fund Organisation (EPFO) released a standard operating procedure (SOP) to streamline the updating of employee profiles and prevent fraud. The measure is being taken in light of an increase in cases of fraud and impersonation brought on by changes made to the universal account number (UAN). The list of acceptable documents to make corrections and the deadline for processing applications is provided by the SOP.

Aadhaar card, driving licence, PAN card, and class 10 or class 12 marksheet are a few of the documents that applicants may submit in accordance with the new SOP to change their UAN profiles. Minor requests will be processed in seven days, whereas large requests will take 15 days to process. Requests that have been escalated to a higher level will require an additional three days to process.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.