SBI UPI: Money Transfer Using BHIM SBI Pay

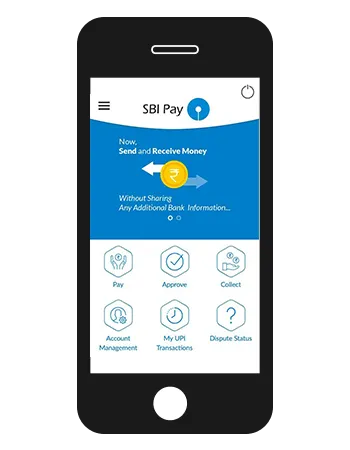

The State Bank of India (SBI) Unified Payments Interface (UPI) is a type of payment mechanism or solution through which funds can be received and sent through BHIM SBI Pay APP. This solution is available to all SBI customers and also for other people with accounts in other UPI-enabled banks.

The fund transfer process can be carried out with a Virtual Payment Address (VPA) or an account number and Indian Financial System Code (IFSC).

The VPA acts like a virtual identifier and is usually given out like a virtual id. UPI has been launched by the National Payments Corporation of India (NPCI) and the payments system is monitored by the Reserve Bank of India (RBI). NPCI monitors all retail payments in the country in an effort to allow the smooth and efficient flow of digital transactions using a mobile application. Users can easily assess this service by downloading the SBI Pay app on their respective mobile phones.

hat is an SBI UPI ID and How to Create It?

SBI UPI ID is a Virtual Payment Address (VPA) linked to your SBI bank account for seamless money transfers via the Unified Payments Interface (UPI). It acts as your digital address, eliminating the need to share account numbers or IFSC codes.

Example: username@sbi

How to create an SBI UPI ID:

- Download the BHIM SBI Pay app.

- Register using your mobile number linked to your SBI account.

- Verify using OTP.

- Set a 6-digit UPI PIN.

- Create your unique UPI ID (VPA), e.g., yourname@sbi.

How to Check Your SBI UPI ID?

To find your UPI ID in the SBI app:

- Open BHIM SBI Pay or YONO SBI app.

- Log in and go to the “Profile” or “My UPI ID” section.

- Your SBI UPI ID (e.g., yourname@sbi) will be displayed there.

You can also find your UPI ID under the "Manage Accounts" or "Bank Accounts" section.

How to Register for SBI UPI?

Step 1: Download the SBI UPI app on your smartphone from google play store

Step 2: After the download, verify the registered mobile number via SMS. This should be the same number registered with your respective bank

Step 3: Once the SMS is received, the app will automatically verify the mobile number

Step 4: To begin the registration process, enter a 'Virtual Address', 'First Name', 'Last Name', 'Email'. Answer the secret question and choose the respective bank

Step 5: Accept all terms and conditions and choose the 'Next' button

Step 6: Choose a bank account, click 'Register'. Choose a 6-digit password.

Step 7: Set up an m-PIN by submitting debit card details key in OPT to confirm m-PIN.

Step 8: A registration confirmation message will be sent to the respective mobile number

How to Transfer Money Using SBI UPI Pay App?

Step 1: Go to the SBI PAY app on your smartphone and enter the 6-digit pin

Step 2: Click 'Pay', select an account

Step 3: Key in the VPA of the recipient/payee. Write remarks, if any

Step 4: Key in the amount to be transferred and click 'Pay'

Step 5: Enter m-PIN and submit.

How to Collect or Receive Money Using SBI UPI Pay App?

Step 1: Go to the SBI PAY app on your smartphone and enter the 6-digit pin

Step 2: Click on 'Collect'

Step 3: Key in VPA of the person from whom you wish to collect money from

Step 4: Write remarks, if any

Step 5: Choose 'Initiate Request'. A confirmation will be sent.

Step 6: The funds will be credited after the payer approves the request.

Features of BHIM SBI Pay

- You can transfer funds using BHIM SBI Pay through various options like VPA, Aadhaar, scanning QR code, account number + IFSC etc.

- No charges are levied for BHIM SBI Pay transactions.

- Available rewards and offers can be availed.

- You can carry out a maximum of 20 transactions in a day within the Rs.1 lakh limit.

- You can transfer funds to a beneficiary without registering them.

Benefits of SBI Pay

- Cashless Payments: The main objective behind launching this app is to encourage the use of digital payment mechanisms. And the SBI PAY app allows customers to seamlessly send and receive funds through this app without any hassle.

- Safe and reliable: The risk element in this type of payment system is close to negligible. Hence, it is a very safe and secure way of transferring funds.

- Backed by RBI: The SBI Pay app is monitored by the RBI and hence it is a very trustworthy app to use. Since this is a government-backed service there is no chance of risk in terms of the funds that are being sent.

- No restriction: Fund transfer can be initiated on all 365 days of the year and at any time of the day or night. There is no time restriction when it comes to this type of payment unlike in NEFT, where transactions are only settled in a batchwise format.

- Speedy service: SBI Pay is a fast, economical and hassle free service that allows digital transactions in the country. It is much faster than other types of fund transfer methods.

SBI UPI Charges and Limits

Please note that as of now there will be no charges for carrying out transactions using this app.

Transaction Timings for SBI UPI Transfers

Transactions can be made at any time and there are no specific timings for this service.

SBI FUND Transfer Methods

Other UPI Related Article

How to Register for SBI UPI?

Register for SBI UPI in minutes. Download the app, verify your number, and set up your m-PIN to start using UPI services

Step 1

Download the SBI UPI app on your smartphone from google play store.

Step 2

After the download, verify the registered mobile number via SMS. This should be the same number registered with your respective bank

Step 3

Once the SMS is received, the app will automatically verify the mobile number

Step 4

To begin the registration process, enter a 'Virtual Address', 'First Name', 'Last Name', 'Email'. Answer the secret question and choose the respective bank

Step 5

Accept all terms and conditions and choose the 'Next' button

Step 6

Choose a bank account, click 'Register'. Choose a 6-digit password.

Step 7

Set up an m-PIN by submitting debit card details key in OPT to confirm m-PIN.

Step 8

A registration confirmation message will be sent to the respective mobile number.

FAQs on State Bank of India UPI

- What is the difference between IMPS and SBI UPI?

There are many additional features in the SBI UPI app. Unlike IMPS, one can use the SBI UPI app to also collect money. The VPA is also an additional feature.

- What is a VPA?

VPA expanded as Virtual Payment Address, is basically a virtual identification. It comes in the form of a unique ID. It is a title that can be chosen by the customer.

- How many VPAs can SBI customers have?

SBI Pay allows users to hold multiple VPAs for both receiving and making payments.

- Is it mandatory to register to avail the service

SBI Pay services cannot be availed without initiating the registration process.

- Can a user link multiple bank accounts with the VPA?

More than one bank account can be linked in the app to avail services.

- Can other e-wallets be linked with SBI Pay?

This will not be possible.

- How to get a VPA?

A VPA can be obtained during the registration process. All users are allowed to choose a preferred VPA.

- Is it necessary to register a beneficiary to carry out SBI Pay transfer? What details does a customer have to furnish to send funds?

No. The details required to initiate fund transfer is VPA or account number and IFSC code.

- What is the transaction limit?

The maximum amount of money one can send or receive through this app is Rs.10,000 per day. The maximum number of transactions one can carry out in a day is 5.

- What if I lose my cell phone?

In such a case, the customer must contact the customer care and block if/her number to avoid misuse.

- Is it possible to track a transaction status on SBI Pay?

Yes. A transaction can be tracked on the app through the 'My UPI Transactions' tab.

- How can a customer treat a Collect Pay request?

The customer will have to log into the app and click on 'Approve' or 'Reject'. If approved, the customer has to key in the respective m-PIN on the app.

- Is it possible to change the default account? If yes, how?

This process can be initiated through the app. Go to 'Account Management', choose 'Account' and click on the 'Preferred Account Button'.

- What if the mobile is used by another person? Can he/she make payments through the app?

No. This will not be possible without providing the m-PIN.

- What will be the consequences if a user changes his/her Sim or mobile number?

If a customer changes his/her sim, they can continue to use the app after updating the new mobile number.

News on SBI UPI

SBI services like Internet Banking, Yono, UPI down on 1 April 2024 due to Annual Closing

On 1 April 2024, the State Bank of India (SBI) underwent its Annual Closing, resulting in the unavailability of Internet Banking, Yono Lite, Yono Business Web & Mobile App, YONO, and UPI services. Throughout this duration, users could access UPI Lite and ATM services.

Annie Jangam is a financial writer with a unique background in biotechnology and eight years of genomics research experience, culminating in 6 international publications. Her three-year experience in SEO-based content writing spans diverse topics. She combines her analytical skills with a talent for clear communication to simplify complex financial concepts. She delivers informative, engaging content with scientific precision and creative flair in the fintech industry. She covers various financial products such as banking, insurance, credit cards, tax, commodities, and more. Her research background demonstrates her dedication, attention to detail, and problem-solving skills, making her a valuable asset in the data-centric world of fintech.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.