Govt Income Certificate

An income certificate is a government-issued document that confirms the monthly or annual income of an individual or family from all sources. It serves as official proof of income and is commonly used to access government benefits, subsidies, and welfare schemes.

This also serves as a vital document in various other official work that involves applying for loan, purchase of material, government benefits, and many more. Here are more details about the income certificate.

What is an Income Certificate?

The government issues the income certificate, a legal document that certifies the annual income of an individual or their family from every source. In each state, the actual authority issuing this certificate is different. Generally, the Village Tehsildars issue the income certificate. However, in several states and union territories, it is issued by the Deputy Commissioner, Revenue Circle Officers, District Magistrates, Sub Divisional Magistrates, as well as various District Authorities.

To obtain an income certificate, you have to submit an application online or offline; with an affidavit and other supporting documents. The government will review these documents and issue an income certificate.

Importance of an Income Certificate

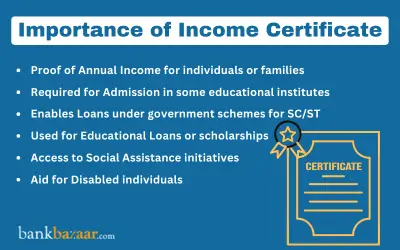

The following are some of the significances of the income certificate:

- It acts an individuals’ or family’s proof of annual income

- It can serve as financial document required in some education institute for admission

- This is also required for various government services, tax reduction, and purchase of residential property or house

- Can be used by the student to seek educational loan or scholarship for high education in institutes within or outside the country

- Loan can be availed by the Schedules Caste or Scheduled Tribe under various government schemes using this document

- Compensations are provided depending on income certificate during natural calamities, such as earthquake, cyclone, drought, Tsunami, landslide, flood, and others

- Assistance to Ex-Financial servicemen

- Financial assistance to handicapped individuals, such as hearing aids, prosthetic limbs, bicycles, etc.

- Also enables individuals to avail themselves of social assistance initiatives announced by the government

What are the Uses of an Income Certificate?

The following are some of the vital usages of the income certificate:

- Free ration

- Helps in securing admission in educational institutions either free of cost or at a concession for economically backward students

- Provides financial relief to families or individuals affected during natural calamities

- Helps in providing loans at concessional rates offered by the respective government employers

- Income certificate helps in availing various medical benefits, such as subsidised medicines, financial assistance to mothers who gave birth to girl children, free or concessional treatment, etc.

- Scholarships to meritorious student who belong to socially and economically backward class of the society

- Helps widows, senior citizens, farmers, etc., to avail themselves of government benefits, pensions, and other subsidies

- Helps in applying for government jobs that are reserved for specific categories

- Provides the Ex-Servicemen with financial aid

- Helps in claiming government accommodation in hostels, flats, etc.

How to Apply for an Income Certificate

The following are the steps to apply for an income certificate through online mode:

- To apply for income certificate, visit the respective state’s or district’s website

- Create an account on the website

- Generate unique username and password

- Log into the account and click on ‘Apply for income certificate’

- The online application form will open where you need to fill in the required details, such as:

- Name

- Age of the applicant

- Birthday

- Sex

Upload the following documents:

- ✔️Any one of Driving license, voter ID, ration card, or other identity proof

- ✔️Aadhar card

- ✔️Religion or sub-caste certificate, Caste certificate

- ✔️ITR (Income Tax Return), parent’s income certificate, salary certificate, Form 16, etc.

- ✔️Applicant also need to submit the affidavit that states that the details mentioned on the application are true

You can also submit the application through offline mode, by obtaining the form from the nearest Tahsildar office or download it online. Fill in the application form, attach all the documents, and submit it to the nearest Tahsildar office.

Documents Required for an Income Certificate

The documents required to apply for an income certificate are as follows:

Identity Proof |

|

Income Proof | Salary Certificate Statement (for government workers) OR IT Return or Form 16 (for non-government employees) OR IT Return or Affidavit (for self-employed or small company owners) |

Address Proof |

|

Other Documents (Optional) |

|

Once all required documents are collected, the application should be submitted at the local district authority's office or uploaded online, depending on the infrastructure available in each state. There is a nominal fee associated with the application, varying according to the state. The certificate is typically issued within a span of 10 days to 15 days.

How is Income Calculated for an Income Certificate

When issuing the income certificate, the person's or family's income must be determined. Income refers to a person's financial gain or recurring earnings while working for a company, as an employee, or as a self-employed individual. An individual or his or her family's income may be certified by an income certificate. For the calculation of a family's income, the earnings of all family members who work will be considered, such as unmarried daughters, unmarried sisters, and unmarried brothers who live together. The following are included in a family’s earnings:

- Salary of members employed in companies

- Labourer’s daily/weekly wages

- Consultancy charges

- Pension

- Profits obtained from business

- Commissions of agency work

- Regular monetary benefits such as:

- Employee bonus

- Dividends from the stock market and share markets

- Gains from selling assets

- Interest on deposits

- Gifts and inheritances

- Rent from property

The following formula can be used to calculate an individual's or family's total yearly income:

Salary Income: When calculating a salaried individual's income, the basic pay, special pay, Dearness Allowance (DA), and additional allowances, if any, are taken into account. House Rent Allowance (HRA), Honorarium, and Travelling Allowance (TA) for specialised work are not included in salary income.

Pension Income: The primary factor used to determine a family member's pension income is the Pension Payment Order (PPO). This does not include commutation amounts.

Real Estate Income: It will be regarded as income when a family member receives rent or brokerage fees from real estate. However, this income is considered after annual maintenance fees are subtracted.

Professional or Business Income: Income tax returns (ITRs) are utilised for calculating business income, income from any profession, and income from consulting or agency work performed by family members. Income will be considered depending on the assessee's declaration in case the member is not an assessee.

Daily Wage and Labour Income: To calculate the daily and monthly wage income, the daily labourer's declaration will be taken into account.

How to Track Status of an Income Certificate?

Here are the steps as to how to track status of income certificate:

- Log into the respective state’s website using your mobile number

- Click on ‘Get Status’ to track the status of your income certificate

- From the acknowledgment receipt, find the application number and enter it

- Click on ‘Status’

What is the Validity of The Income Certificate?

Here are some of the essential details regarding the income certificate:

- The income certificate is valid for the financial year only

- The certificate needs to be renewed every year to continue its validity

- You also need to provide the old certificate as a proof while updating the income certificate

FAQs on Income Certificate

- Who can apply for an income certificate?

All individuals such as salaried employees, non-salaried individuals, businessmen, labourers, agents, widows, consultancy owners, etc., can apply for an income certificate.

- Is an Aadhaar card necessary to apply for an income certificate?

You can submit any form of government-issued identification or proof of address to obtain an income certificate. However, currently, to apply for an income certificate, you must have an Aadhaar card.

- Is an income certificate the same as the Economically Weaker Section (EWS) certificate?

No, individuals belonging to the economically weaker category are given the EWS certificate, which is an income and asset certificate. The caste of an individual is not indicated on the income certificate. However, it indicates a family's income for the year in which it was issued. The EWS certificate cannot be obtained without an income certificate.

- Can an NRI apply for an income certificate?

No, only residents of the particular state/union territory are eligible to receive income certificates. To obtain an income certificate, you will have to submit residence proof of the state where you reside. Therefore, only state residents may submit an application for an income certificate.

- What is the difference between an income certificate and an agriculture income certificate?

An income certificate includes information about yearly earnings from all sources. An agriculture income certificate only lists the details of income derived from participation in agricultural activities.

- How long does it take to obtain an income certificate?

Typically, it takes 10 to 15 days to obtain an income certificate.

- How long is an income certificate valid?

An income certificate remains valid for the fiscal year specified in the certificate. Therefore, you need to renew your income certificate each financial year. Additionally, you may need your old certificate to obtain a new income certificate.

- Can I download my income certificate online?

Yes, most states provide the option of downloading an income certificate online.

- Can ITR be Proof of Income?

Yes, Income Tax Return (ITR) can be income proof and you must file ITR if your taxable income exceeds the maximum threshold amount which is not taxable.

- Who can give income certificate in India?

In India, the Village Tehsildars issue the income certificate. While this is also issued by the Revenue Circle Officers, Deputy Commissioner, District Magistrates, Sub Divisional Magistrates, as well as various District Authorities in many states and Union Territories.

- Is income certificate and income tax certificate the same?

No, the income certificate and income tax certificate are both different. The former is a government-issued financial document that proves the annual income of the individual or the family. While the latter is the form that the company or the individual files with the government to state their annual income, tax deduction, savings, and tax owed.

- What is the minimum income for income certificate in India?

The minimum income required to apply for income certificate in India is equal to or less than Rs.4.50 lakh.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.