LIC’s Bima Shree and Jeevan Shiromani Plan

Life Insurance Corporation of India is one of the most reputed state-owned insurance providers operating in India, in today's date. LIC is famous for providing a horde of insurance products to its customers along with other services and facilities.

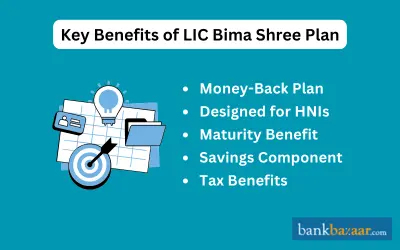

Features of LIC's Bima Shree Plan

It is essentially a non-linked, limited premium payment money back policy that offers its customers a combined package of both savings and protection. LIC's Bima Shree Plan is suitable for individuals having a high net worth. The plan was designed specifically for people falling in the 'High Net Worth' category. This plan provides a lump-sum payment to the family of the policyholder in case of his/her untimely demise during the term of the policy. Additionally, the policyholder also receives a maturity benefit when the policy matures. Moreover, if the policyholder survives the term of the policy, he/she will receive payments from LIC at regular intervals for a certain period of time. Policyholders can also avail the loan facility against their policies.

Mentioned below are some of the benefits offered under LIC's Bima Shree Policy:

Death benefit:

If the policyholder passes away during the initial five years of the policy, his/her family members will receive the death benefit or 'Sum Assured on Death' along with accrued Guaranteed Additions. If the policyholder passes away after completion of five years but before the maturity date, his/her family members will receive the death benefit along with accrued Guaranteed Addition and Loyalty Addition.

Survival benefit:

If the insured survives each of the specific durations in the policy, a fixed percentage of the Basic Sum Assured amount is paid out by the insurer. The various percentages for multiple policy terms are:

- 14 years - 30% of the Basic Sum Assured on the policy's 10th and 12th anniversary.

- 16 years - 30% of the Basic Sum Assured on the policy's 12th and 14th anniversary.

- 18 years - 40% of the Basic Sum Assured on the policy's 14th and 16th anniversary.

- 20 years - 45% of the Basic Sum Assured on the policy's 16th and 18th anniversary.

Maturity benefit:

If the insured individual survives the whole term of the policy, after having paid all of his/her premiums diligently, the insurer gives out a maturity benefit or 'Sum Assured on Maturity' alongside accrued Guaranteed Additions and Loyalty Additions.

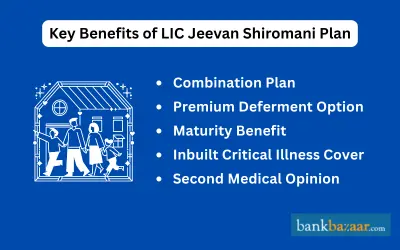

Features of LIC's Jeevan Shiromani Plan

Offering a mix of both the elements of savings and protection, LIC's Jeevan Shiromani Plan has specifically been made for individuals having a high net worth. The plan provides a lump-sum payment to the family members of the insured in case of his/her untimely demise during the policy term. Additionally, the policyholder also receives periodic payments from the insurer during specific durations of the policy, known as survival benefit. The policyholder also receives a lump-sum maturity benefit at the end of the policy term.

Mentioned below are some of the benefits offered under LIC Jeevan Shiromani Plan:

Death benefit:

If the policyholder passes away within the initial five years of the policy, the insurer gives out a death benefit payment along with accrued Guaranteed Additions. In case the policyholder passes away after a period of five policy years but before the arrival of the maturity date, then death benefit along with accrued Guaranteed Additions and Loyalty Additions are paid out by the insurer.

Survival benefit:

A fixed portion of the Basic Sum Assured is paid out by the insurer at specific durations of the policy in case of survival of the policyholder, provided the premiums have been paid diligently.

Maturity benefit:

If the policyholder survives the whole term of the policy till the end, while having paid all the premiums diligently, the insurer will provide a maturity benefit or 'Sum Assured on Maturity' alongside accrued Guaranteed Additions and Loyalty Additions.

Inbuilt critical illness benefit:

If the policyholder is diagnosed with any one of the specified 15 critical illnesses in the policy, he/she will receive the following benefits:

- 10% of the Basic Sum Assured or Inbuilt Critical Illness benefit

- Option of deferring the premium payment

- Second opinion from other healthcare providers (international or national)Applicants are recommended to read the terms and conditions of the policies carefully before making a purchase.undefined

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.