PNB MetLife India Insurance

PNB Metlife India Insurance Company is one of the most reputed insurance companies that has declared profits for the past five financial years. It offers various types of plans ranging from simple protection plans to pension plans as per its customer's needs.

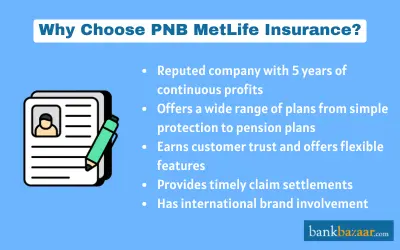

Why Choose PNB MetLife Insurance?

PNB and MetLife have been in the business together for the last 15 years and do not seem to be slowing down in the industry with so much growth and potential. However, that may not be a sufficient reason for an ordinary human to want to opt for their insurance products. Here are some reasons more well-defined than simply what you already know:

- One of the most important things with the companies involved in this insurance providing group is the trust they have earned from their customers.

- The company has reported continuous profits for the last 5 years, and considering their volumes.

- All the products have highly flexible salient features, such as policy terms or sum assurance amounts. But that is not all, there are products that are already bespoke to the needs of an ordinary man to a multi-billion dollar organization with group insurance requirements.

- It is essential that a company provides the finances required when the actual claim is made. This statistic breaks or makes an insurance company and PNB MetLife is no exception.

- An international brand involvement somehow guarantees excellent services. MetLife is however, more than just a regular insurance company.

Types of Insurance Available from PNB MetLife:

Following are the plans offered by the PNB Metlife insurance company:

PNB MetLife Protection Plans:

PNB MetLife protection plans provide financial security to your family in the form of assured monthly income or lump sum payments.

PNB MetLife Mera Term Plan Plus :

PNB MetLife Mera Term Plan Plus get a simple solution to provide your loved ones with financial security and protection

Entry Age |

|

Maturity Age | Without Return of Premium (RoP):

With RoP:

|

Policy Term |

Without RoP:

With RoP:

|

Riders |

|

Sum Assured |

|

Premium Payment Mode |

|

Premium Payment Term |

|

PNB MetLife Saral Jeevan Bima:

Entry Age |

|

Maturity Age |

|

Premium Payment Mode |

|

Sum Assured |

|

PNB MetLife - POS Suraksha

Entry Age |

|

Maturity Age | 65 years |

Policy Term |

|

Sum Assured |

|

Premium Payment Term |

|

Income Payout Period | 10 years |

Premium Payment Mode |

|

PNB MetLife Mera Jeevan Suraksha Plan

Entry Age |

|

Maturity Age |

|

Benefit Options |

|

Policy Term |

|

Premium Payment Mode |

|

Sum Assured |

|

Premium Payment Term | Regular pay |

Annualised Premium |

|

PNB MetLife Income Protection Plan

Entry Age |

|

Maturity Age | 75 years |

Plan Options |

|

Policy Term |

|

Premium Payment Term | Limited pay: ·

|

Premium Payment Mode |

|

Sum Assured | Maximum: Rs.10 lakh |

PNB MetLife Dental Care Plan

Entry Age |

|

Sum Assured | Rs.50,000 |

Total Premium | Rs.3,250 |

Online Savings | 7.50% |

Premium after Savings | Rs.3,006 |

Premium Payment Frequency | Single |

Policy Term | 6 months |

PNB MetLife Aajeevan Suraksha Plan

Coverage Options |

|

Entry Age |

|

Maturity Age |

|

Benefit Options |

|

Sum Assured |

|

Premium Payment Term |

|

Rider Options |

|

Premium Payment Mode |

|

Mera Mediclaim Plan

Entry Age | Protection:

Health:

|

Maturity Age | Protection:

Health:

|

Premium Payment Mode | Monthly, quarterly, half yearly, yearly |

Policy Term | Protection:

Health: 1/2/3 years |

PNB MetLife Income Protector Plus

Entry Age |

|

Maturity Age | 75 years |

Plan Options |

|

Benefit Payout Period |

|

Premium Payment Mode |

|

Monthly Income Options |

|

Policy Term |

|

PNB MetLife Savings Plans:

PNB MetLife Savings Plans provide you with life insurance coverage while also assisting you to invest methodically, therefore producing long-term wealth to help you achieve your goals.

PNB MetLife Guaranteed Future Plan

Entry Age | Minimum:

Maximum: 60 years |

Maturity Age | Single pay: 80 years Limited pay: 75 years |

Sum Assured | Minimum:

Maximum:

|

Premium Payment Mode |

|

Annualised Premium |

|

PNB MetLife Smart Platinum Plus

Entry Age | Wealth Option:

Wealth + Care Option

|

Maturity Age |

|

Minimum Sum Assured |

|

Policy Term |

|

Premium Payment Mode |

|

PNB MetLife Super Saver Plan

Maximum Entry Age | Annual Mode:

|

Minimum Maturity Age |

|

Maximum Maturity Age |

|

Sum Assured |

|

Premium Payment Term | 5, 7, 10, 12, 15 years and Regular pay |

PNB MetLife Bachat Yojana

Entry Age |

|

Maturity Age | 75 years |

Policy Term | 15 years |

Premium Payment Mode |

|

Premium Payment Term | 10 years Limited Pay |

Sum Assured |

|

PNB MetLife Guaranteed Goal Plan

Benefit Payout Options | Option 1: Lumpsum Option Option 2: Income + Lumpsum Option |

Income Payout Mode |

|

Minimum Entry Age | Single Premium:

|

Maximum Entry Age | Single Premium:

|

Premium Payment Mode |

|

Rider Options |

|

PNB MetLife Pension Plans:

PNB MetLife pension plans enable you to set aside a portion of your assets to build over a defined length of time to earn a regular stream of income post retirement.

PNB MetLife Immediate Annuity Plan

Minimum Entry Age | Standalone Annuity:

Tied Annuity"

|

Maximum Entry Age |

|

Annuity Payout Mode |

|

Minimum Annuity Payout | Rs.1,000 per month |

Maximum Annuity Payout | Subject to Annuitant’s entry age and purchase price |

PNB MetLife Grand Assured Income Plan

Entry Age | Minimum: 40 years Maximum:

|

Purchase Price |

|

Premium Payment Mode |

|

Minimum Annuity |

|

PNB MetLife Retirement Savings Plan

Entry Age |

|

Vesting Age |

|

Premium Payment Term |

|

Sum Assured | Minimum:

Maximum:

|

PNB MetLife Group Plans

PNB MetLife group plans offer life insurance to a group of individuals. In the event of the insured's death, these plans provide financial support for the beneficiary of the employee covered under the plan.

PNB MetLife Group Flexi Term Plus

Entry Age |

|

Maturity Age |

|

Policy Term |

|

Pay Out Options |

|

Premium Payment Mode |

|

PNB MetLife Group Term Life Plus

Entry Age |

|

Maximum Maturity Age | 66 years |

Premium |

|

Group/Scheme size |

|

Group / Scheme size |

|

PNB MetLife Group Secured Gain

Entry Age |

|

Maximum Maturity Age | According the Employer's Scheme Rules for each group insurance, with a maximum age of 99 years. |

Sum Assured |

|

Minimum Contribution | Rs.1 lakh |

Minimum Policy Term | 1 year |

Group size |

|

PNB MetLife Complete Loan Protection Plan

Entry Age | Minimum:

Maximum:

|

Maximum Maturity Age |

|

Sum Assured per Member |

|

Premium Payment Mode |

|

Group size |

|

PNB MetLife Loan and Life Suraksha

Entry Age |

|

Maximum Maturity Age | 70 years |

Sum Assured per Member |

|

Policy Term |

|

Group Size |

|

PNB MetLife Bima Yojana – (Group Micro-Insurance)

Entry Age |

|

Maximum Maturity Age | 70 years |

Premium Payment Term |

|

Cover Options |

|

Group Size |

|

Premium Payment Modes for Limited and Regular pay |

|

Sum Assured per Member |

|

PNB MetLife Complete Care Plus

Entry Age |

|

Maximum Maturity Age | 81 years |

Minimum Premium | Rs.2,915 per life |

Maximum Premium |

|

Minimum Group/Scheme Size | 10 |

Maximum Group/Scheme Size | 9,00,00,000 |

Minimum Sum Assured per Member | Rs.5,000 |

Maximum Sum Assured per Member | Rs.100 crore per life |

PNB MetLife Superannuation

Entry Age |

|

Maximum Maturity Age | According to the scheme rules |

Minimum Group Size | 10 |

Maximum Group Size | No limit |

Minimum Policy Term | Yearly renewable basis |

PNB MetLife Traditional Employee Benefits Plan

Entry Age |

|

Maximum Maturity Age | According to individual employer’s scheme |

In-built Life Cover Benefit upon Death | Rs.1,000 |

Minimum Initial Annual Contribution | Rs.1 lakh |

Maximum Initial Contribution | Rs.500 crore |

Policy Term | 1 year (renewable) |

PNB MetLife Unit Linked Employee Benefit Plan

Entry Age |

|

Maximum Maturity Age | According to individual employer’s scheme |

In-built Life Cover Benefit upon Death | Rs.1,000 |

Minimum Initial Annual Contribution | Rs.1 lakh |

Minimum Initial Annual Contribution | Rs.500 crore |

Policy Term | 1 year (renewable) |

How to Place Claims for Your PNB MetLife Insurance Policy?

Different insurance products may have different claim procedures. But generally life insurance has differences in more of documentation required based on the cause of the event. To give more clarity to the claim process, here is a general step by step process that the rightful claimant can follow to make it easier for all parties at MetLife:

Step 1: Collect all the documentation in one place. More clarity will be provided on what documentation may be necessary, but it generally involves or relates to the type of claim that is being made.

Step 2: You have to make sure that you have copies of the documentation in your system, and easily accessible for reference. The company will investigate the claim, which is why the claim process takes time.

Step 3: Get a copy of a claim form and submit it along with the documents, based on the requirements of your policy. Different types of policies require different types of documents.

Step 4: Once the submission is made, based on the acceptance or rejection of your policy, you will be notified through phone or email.

Step 5: The claim amount will be then transferred to the claimant's bank account.

Documentation for PNB MetLife Policy Application:

The following are the minimal documentation required for PNB Metlife policy application (not exhaustive list):

- Identity proof of policyholder and nominated

- Address proof

- Income Proofs and bank statements

- Application form

- Other documentation requested by the bank

How to Check Policy Status for PNB MetLife Insurance?

PNB MetLife has over 150 branch offices across the nation where customers can visit with their policy number, present it along with at most a form of identification, and learn more. You can, however, access information on the status of your insurance at your convenience from both your home and place of employment. Simply enter your policy information when registering on their website. From now on, all you have to do is go online, enter your login information and password to access your account, and you'll have access to all the information you require regarding your policy. Email and phone can also be used for this. The phone may be a more convenient means to access information for folks who are unfamiliar with digital media.

PNB MetLife Insurance Online Payments:

PNB MetLife insurance online payments are simpler than you think. The website has a page Billdesk - PNB MetLife Payment Gateway, which is dedicated to people with the requirement of paying premiums online. It also makes sense due to its convenience factors with people, allowing them to not only make regular premium payments but also do it at home or office. The other details that may be required of you, are payment related. It is also a safe mode of payment since you get an instant receipt for the same.

PNB MetLife Insurance Premium Calculator:

The first consideration when purchasing insurance is the level of protection needed for a certain individual. Both of these online calculators and the PNB MetLife Insurance Premium Calculator are accessible. Simply enter the information requested here, such as the sum assured and the term of the insurance product, and you will be given the monthly price. You must also be aware of the type of calculating technique being applied or the basis on which the premiums are computed. Since additional fees may also apply, you may not have a precise notion of the amount that will be your premium, but you will undoubtedly receive an estimate so that you can plan your monthly spending.

PNB MetLife Life Insurance Customer Care:

You can call the support team by calling on their toll free helpline number 1800-425-6969, via email, or by fax. Customer can also request for help by sending an SMS on the designated number provided by PNB MetLife for policy related queries.There is also a special section called 'Write TO Us', using which customers can register their concern/query with the customer support team.

FAQs on PNB MetLife Insurance:

- What are the life insurance policies that PNB MetLife offers?

MetLife offers protection plans, retirement plans, monthly income plans money back plans, investment plans, child plans, savings plan, rural plans, health plans and rider plans. Visit MetLife website to know more about the various products under each plan.

- What are the documents that are to be submitted while applying for the insurance?

You will have to submit your identity proof, age proof, address proof, income proof and PAN card documents while applying for the insurance.

- What are the modes of premium payment available?

The payments can be made through cheque, cash or through an online payment. You can also give a standing order for the bank to deduct the amount from your debit card or savings account to meet the payment of the policy.

- How can I make life insurance more affordable?

You can buy the life insurance when you are young as the premium payment will be lower. If you have the option to take a life insurance cover through a group insurance plan offered by your employer, take it.

- How much life insurance do I need?

You must consider how much your dependents will need to live comfortably and to be able to pay all the bills and meet other expenses while taking a life insurance. You can use the life insurance calculator that PNB MetLife is offering to determine how much insurance is right for you.

- Can I change my beneficiary or nominee?

Yes, you can change your beneficiary at any time till the maturity date of the policy. You will have to inform PNB MetLife and fill up the beneficiary change request form.

- What is the free look period offered by PNB MetLife?

You will get a 15-day free look period within which you can return the policy and you will get a full refund.

- Can I surrender my policy?

Yes, you are allowed to surrender the policy.

- Can I take a loan on my life insurance policy?

Yes, you can take a loan against a PNB MetLife Life insurance policy. You will have to submit a loan request form along with the assignment request form to the nearest branch.

- What is PNB MetLife insurance public disclosure?

The insurance company has to ensure that all the policies are transparent and all the information about the policy is shared with the people except the information of their customers and policyholders. The public disclosure from the insurance company advises and warns people of the fraudulent activities that take place, where people are asked for random information about their insurance. Neither is the information supposed to be shared, nor are they supposed to be asked by the insurance company just like that. Hence, the public disclosure states to stay aloof from such activities especially telecallers.

- Can we make insurance online payments for PNB MetLife?

Yes, the website allows you to pay online, through their online payment gateway for all the necessary payments needed to made, such as premiums or plan renewals.

- Where can I find the PNB MetLife insurance application forms?

Almost all applications are downloadable from the company website but one can also go to the 150 offices, nearest to his home. The branch locator online, will help to find the office nearest to you.

- Where can I find the PNB Metlife Insurance forms such as surrender/ cancellation form, etc?

All the claim forms are available online from the PNB MetLife website.

- How can I change the nomination details in my policy?

Download the beneficiary change request form online and submit it at a branch or mail it to the insurance company office nearest to you.

- What are the minimum eligibility criteria for PNB MetLife policies?

Like any other company, they need to ensure legitimacy in your requirement for insurance and assurance that you will pay the premiums whenever due. Hence the following are the most common eligibility criteria: Age between 18 years and 60 years (generally) and citizenship. Some also look for the minimum income requirement and an individual's credit score as well.

- How to cancel PNB MetLife policy online?

Simply download and fill in a Surrender Request Form sign it along with the original policy document and send it to a PNB MetLife branch.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.